- / HOME

In its “World Economic Outlook” (January 2024), the IMF forecasts global economic growth of 3.1% for 2024. Given the expected continued decline in inflation, the IMF sees the risks to global growth as broadly balanced. Global inflation is expected to decline to 5.8% in 2024 (2023: 6.8%), still above pre-pandemic (2017-19) levels of around 3.5%. AIXTRON does not currently expect any significant influence on business development from the general global economic environment. The industry and sector-specific framework conditions for demand for AIXTRON systems remain intact, although an influence from negative macroeconomic developments cannot be ruled out.

Market observers continue to see positive developments for production equipment in the semiconductor industry in the coming years. According to a study published by the leading global industry association SEMI in December 2023, the overall market for investments in wafer fab equipment, which includes AIXTRON's deposition equipment, will decline from an all-time high of around USD 107.4 billion in 2022 to around USD 100 billion in 2023 and grow by 3% in 2024. In 2025, SEMI expects a significant increase in the markets to a sales level of USD 124 billion, still mostly driven by the Korean, Taiwanese and Chinese markets. According to SEMI, the market for wafer fab equipment is currently burdened by difficult macroeconomic conditions and conditions in the semiconductor industry. However, emerging applications in numerous markets are expected to drive significant growth in the semiconductor industry again this decade, which should necessitate further investment to expand production capacity.

Regardless of the market development of the entire semiconductor industry, the market segments on which AIXTRON focuses are determined by a number of megatrends, including electrification, digitalization and energy efficiency, the development of which will be decisive for the future development and size of AIXTRON's sales markets.

Sales of GaN power semiconductors will be driven by the need to increase energy efficiency in the global IT infrastructure and data centers in order to slow down the rapid increase in energy consumption. The electromobility of the future is expected to lead to an increased use of SiC components in the powertrain and in the charging infrastructure in order to better meet the requirements for range and efficiency.

The increasing demand for lasers manufactured on AIXTRON systems is due to the rapidly growing need for fast and energy-efficient optical data communication (cloud computing, video streaming, etc.). Likewise, 3D sensor technology in consumer electronics (smartphones, TVs) and access control, as well as the progress of industrial digitization and a growing number of vehicles that use 3D sensor technology, are contributing to an increased demand for lasers.

AIXTRON is deepening its collaboration with many customers on research and pilot projects for the technological advancement of the next generation of displays in smartwatches, TVs, smartphones and notebooks: Micro LED displays, whose self- luminous LED pixels can be produced on AIXTRON's MOCVD systems, aim to replace today's LCD or OLED display technology with innovative, energy-saving alternatives with better luminosity, contrast, color fidelity and resolution. The commercialization of these novel display technologies will determine the size of these additional new markets for AIXTRON.

For the financial year 2024 , the Group once again expects sales growth compared to the previous year. Customer demand continues to extend across all technology areas. The Executive Board is optimistic about both the short and long-term positive outlook for demand for MOCVD systems for optoelectronics (Laser, LED and micro LED-based display applications) and also power electronics (GaN and SiC-based power electronics).

Based on the current Group structure, the assessment of the order development and a budget exchange rate of USD 1.15/EUR (2023: USD 1.15/EUR), the Executive Board expects revenues in 2024 in the range of EUR 630 million and EUR 720 million, at a corresponding gross margin of around 43% – 45% and an EBIT margin of around 24% - 26% in the financial year 2024. For the first quarter of 2024, the Executive Board expects revenues in a range between EUR 100 million and EUR 120 million.

As in previous years, the Executive Board assumes that AIXTRON will not require external bank financing in the financial year 2024. Furthermore, it is assumed that the Group will be able to maintain a solid equity base for the foreseeable future.

AIXTRON's systems enable the production of power semiconductors for highly efficient energy conversion in the area of power supply for data centers or consumer electronics or electric vehicles and their charging infrastructure (GaN and SiC components). Lasers manufactured with the help of AIXTRON systems are key components in fast optical data transmission (cloud computing, Internet of Things), in 3D sensors and increasingly in complex vehicle assistance systems. AIXTRON technology also enables the production of high-frequency chips for 5G mobile networks and key components for the production of the latest generation of displays (fine pitch displays, mini and micro LED displays).

Due to AIXTRON's proven ability to develop, manufacture and market innovative deposition systems in a flexible number for several customer markets, the Executive Board is convinced of the positive future prospects for the group and its target markets.

As of December 31, 2023, AIXTRON did not have any legally binding agreements on financial investments or the acquisition or sale of parts of the company.

AIXTRON's risk management system is controlled centrally and includes all of AIXTRON's key organizational units in the process. The Corporate Governance & Compliance department, headed by the responsible CFO of AIXTRON SE, is responsible for setting up a risk management system and informs the entire Executive Board and the Supervisory Board of AIXTRON SE at regular intervals or ad hoc if necessary.

The primary goals of the risk management system support the achievement of strategic business goals and early detection of potential risks compared to the applicable corporate planning that could negatively affect the achievement of strategic business goals and business activities. The risk management system supports the Executive Board in the systematic, effective and efficient management of identified risks by defining, prioritizing and tracking risk-reducing measures. In order to meet the extended requirements of IDW PS 340, the conformity and meaningfulness of AIXTRON's risk management system were examined and essential instruments were further optimized in terms of presentation and meaningfulness. The subject of this consideration was the further development of the framework specifications for the risk management system, the risk assessment scheme, the risk-bearing capacity and the resulting overall risk position in the AIXTRON Group. The results and resulting adjustments were integrated into the risk management process and risk reporting, used in the quarterly risk inventory and documented in the Group-wide risk management system manual. In order to further optimize the risk management system, new software for the risk management system was introduced in the fourth quarter of 2022.

All risk owners have been trained in the use of the new risk management software and have ongoing access to it. This ensures that abrupt changes in the risk situation or newly identified risks are reported by those responsible for risk and integrated into the risk portfolio and reported in a timely manner.

The regular, quarterly risk inventory is initiated, carried out and monitored by the central risk management department. All risk owners from the operational and administrative areas, all general managers of the AIXTRON subsidiaries and the Executive Board of AIXTRON SE are asked about the current developments in already documented risks and measures to reduce them, as well as possible new risks. The results are collated at central level and discussed in a risk committee before the Supervisory Board is informed.

AIXTRON uses a risk management software to support the risk management process. All risk owners have access to the software. This ensures that abrupt changes in the risk situation or newly identified risks are reported by the risk owners and integrated into the risk portfolio and reported promptly.

At AIXTRON, all individual risks and risk aggregates are evaluated and classified according to a defined scheme. The assessment of the probability of occurrence can be specified in four levels or as a fixed value. The possible extent of damage if the risk occurs can also be recorded in four stages or as a three-point analysis (Best Case, Most likely Case and Worst Case). The amount of damage relates to the measured degree of impact on the operating result (EBIT) of the AIXTRON Group. If the risk is significant for relevant risks, a possible outflow of cash is also used as the amount of damage.

The four levels for the probability of occurrence of the risks, in addition to the possibility of a fixed value, are divided into:

The potential net loss (measured as a percentage of equity) is used as a criterion for evaluating the possible financial impact of a risk on the earnings (EBIT) of the AIXTRON Group. The four possible levels in addition to the three-point view were calculated as follows:

The risk effects are presented both in terms of possible gross/net effects and in different observation periods (up to 12 months, 13 – 24 months and longer than 24 months). The gross loss represents the loss potential in the event of a risk occurring without taking into account other effects such as risk reduction measures. The net loss describes the loss potential in the event of a risk occurring taking into account the effects resulting from the risk reduction measures such as insurance, provisions, budget- and forecast recording of risks. A risk matrix is derived from this assessment, which divides the risks of the AIXTRON Group into the following four risk classes (see chart for color scale):

Substantial risks that are classified as “critical” in terms of the amount of damage and with a probability of occurrence in the “likely” category are to be viewed as material risks for the AIXTRON Group within the meaning of the German Accounting Standard (DRS 20).

Similar substantial and significant risks are also considered material within the meaning of DRS 20 if they have an aggregated net expected value (combination of the amount of damage and probability of occurrence) that can be viewed as “critical” according to the system described above.

Risks that are considered to threaten the continued existence of the company within the meaning of DRS 20 would be listed separately.

The organizational responsibility for the internal control system (ICS) lies with the Corporate Governance & Compliance department. The aim of the ICS is to ensure the proper conduct of business activities, reliable financial reporting and compliance with legal, regulatory and internal requirements. To achieve this goal, potential operational, financial and compliance risks are identified, assessed and internal controls are implemented when deemed necessary. The effectiveness of the control measures is checked at regular intervals by the Corporate Governance & Compliance department. In order to ensure functional and disciplinary independence, the Corporate Governance & Compliance area reports to the Chief Compliance Officer, who regularly informs the Management Board and the Audit Committee about the results of the audits. The Corporate Governance & Compliance area has neither direct operational responsibility nor authority for the processes within the ICS.

The internal control system in the accounting process of the AIXTRON Group includes both the accounting process of AIXTRON SE and the group accounting process. It defines controls and monitoring activities, which are measures aimed at ensuring the proper handling of business activities, reliable financial reporting and compliance with laws and regulations. A control system that is appropriate for the size of the group and business activities is the prerequisite for effectively controlling operational, financial and other risks.

In the accounting process, controls are defined at risk points that help ensure that the annual financial statements and the consolidated financial statements are prepared in accordance with the regulations. A separation of functions that is adequate for the size of the group and the application of the four-eyes principle reduce the risk of fraudulent activities.

A global IT system is used to prepare the annual financial statements, the consolidated financial statements and the consolidation, which ensures a uniform and consistent approach and data security. Central system backups are regularly carried out for the relevant IT systems in order to avoid data loss. In addition, defined authorizations and access restrictions are part of the security concept.

The corporate function Finance of the AIXTRON Group is technically and organizationally responsible for the preparation of the annual financial statements and the consolidated financial statements. In the decentralized units, local employees are responsible for preparing the local financial statements. Uniform group accounting is ensured by group- wide specifications in terms of content and deadlines, as well as accounting guidelines and valuation principles. The Corporate Governance & Compliance department regularly checks compliance and effectiveness of the controls and is therefore involved in the overall process.

In the opinion of the Executive Board, these coordinated processes, systems and controls ensure that the Group accounting process is in accordance with IFRS and the annual financial statements are in accordance with HGB and other accounting-related regulations and laws and are reliable.

The internal audit is part of the corporate governance organization and is set up by the audit committee of AIXTRON SE on behalf of the Supervisory Board of AIXTRON SE. Internal Auditing reports directly to the Audit Committee and the Executive Board. Internal Audit's annual plan is discussed with and approved by the Audit Committee and the Executive Board. Internal Audit aims to provide independent and objective auditing and consulting services to improve the organization and add value. Internal Audit follows a systematic and disciplined approach to assessing the effectiveness and efficiency of organizational processes and tools. The follow-up to internal audit findings and progress is regularly discussed with the Audit Committee and the Board.

In addition, the annual internal audit plans are prepared on the basis of a risk-based methodology, which takes into account findings and risks in the area of compliance risk management and the internal control systems. Based on the risks and findings, a recommendation for the annual internal audit plan is submitted to the Audit Committee for review and approval. In addition, the findings and risks are reviewed on an ongoing basis and, if necessary, ad hoc reviews are recommended to the Audit Committee.

The design of the risk management and internal control system described is based on the legal framework and international standards – such as the German Stock Corporation Act, the German Corporate Governance Code or the auditing standard "IDW PS 340 n.F." issued by the Institute of Public Auditors. Based on the information made available to the Executive Board of AIXTRON SE, it is not aware of any circumstances that could impair the appropriateness and effectiveness of the risk management system (RMS) or the internal control system (ICS).1

1 The information in this paragraph (overall statement on the effectiveness of the risk management and internal control system) was made in accordance with the requirements of the German Corporate Governance Code 2022. They are to be classified as "not related to the management report" because they go beyond the legal requirements and are therefore not part of the substantive audit by the auditor.

The following risks could possibly have a significant negative impact on AIXTRON's results of operations, net assets and financial position, net assets, liquidity and the stock market price of the shares as well as on the actual outcome of matters to which the forward- looking statements contained in this combined management report are based relate. The risks explained below are not the only ones faced by the AIXTRON Group. There may be other risks that AIXTRON is currently unaware of, as well as general corporate risks such as political risks, the risk of force majeure and other unforeseeable events. In addition, there may be risks that AIXTRON currently considers immaterial, but which ultimately could also have a material negative impact on the AIXTRON Group. Please refer to the Forward-Looking Statement section for more information on forward-looking statements.

In accordance with the requirements of the German Accounting Standard (DRS 20), the following material risks exist as at December 31, 2023, considered on an aggregated basis:

AIXTRON's target markets are distributed worldwide, with a regional focus on Asia, Europe and the USA. AIXTRON is therefore subject to global economic cycles and geopolitical risks such as the conflict between the USA and China, which could adversely affect the business of the AIXTRON Group. Such risks cannot be influenced by AIXTRON.

The markets addressed by AIXTRON are cyclical and can therefore be volatile. The timing, length and intensity of these industry cycles are difficult to predict and influence through AIXTRON. In order to spread market-related risks, AIXTRON therefore diversifies and offers products in different target markets.

In each of these markets, AIXTRON competes with other companies. It is possible that new competitors will appear on the market or that established competitors will adopt strategies or launch products that may negatively impact market expectations overall or of individual key customers of AIXTRON.

Market developments are continuously observed and assessed by AIXTRON. In order to reduce the risk of dependence on individual markets and their fluctuations, AIXTRON has implemented a management system designed to ensure that market developments are identified early and used optimally.

AIXTRON's market and competition risks can have a critical impact on the Group's medium to long-term high sales and profit expectations if the risks materialize.

In addition to the requirements of the German Accounting Standard (DRS 20), there are industry-specific, unique technological risks as of December 31, 2023:

Some of the technologies that AIXTRON offers enable new, disruptive application options. This often means long development and qualification cycles for AIXTRON products, since demanding technical and/or other customer specifications have to be met (sometimes for the first time) before a business deal is concluded.

Due to the predominantly long-term development and qualification cycles of AIXTRON's products, there is a possibility that AIXTRON's technologies and products are developed for markets or application areas in which the framework conditions of the end markets or the strategic planning of potential customers change fundamentally in the course of the development cycle.

The ongoing focus on research and development activities in the past fiscal year and the intensive involvement of external technology partners are still considered by AIXTRON SE’s Executive Board to be suitable measures to reduce this risk.

AIXTRON's technology risks could have a significant impact on the Group's medium to long-term high sales and profit expectations if the risks materialize.

If it turns out that a technology risk has materialized and the introduction of a new technology cannot be implemented as planned, this can result in the planned and forecasted revenues being exposed to the risk of being postponed or omitted, and thus development activities being refinanced later than planned or not at all.

In AIXTRON's risk management system, the following risks are not considered significant for the Group:

AIXTRON defines IT and information security risks as breaches of integrity, confidentiality and liability.

The Group has invested in extensive technical and organizational measures to increase information security and protect information from unauthorized access, unwanted modification or deletion. The information security measures taken are subject to regular monitoring and continuous improvement and are supported by targeted awareness and training concepts.

Compared to the 2022 fiscal year, the overall risk situation remains unchanged for the 2023 fiscal year, with the exception of the changes described above in the AIXTRON Group. The continuous focus of research and development activities with a emphasis on renewing and expanding the product portfolio streamlines the risk portfolio and thus improves the exploitation of opportunities and the avoidance of risks in AIXTRON's target markets.

Neither in the 2023 fiscal year nor at the time of writing of this management report has the Executive Board of AIXTRON SE identified any risks for the company that could threaten its continued existence as of December 31, 2023.

AIXTRON's core competence is the development of the latest technologies for the precise deposition of complex semiconductor structures and other functional materials. Here the group has developed a leading competitive position worldwide. In order to maintain or expand these positions, AIXTRON continuously invests in corresponding research and development projects, e.g. for MOCVD systems for the production of semiconductors for applications such as micro LEDs, lasers or power electronics. The Executive Board will maintain the focus on AIXTRON's core competence in order to successfully work on existing as well as to successfully open up new markets.

Important market segments for power electronics based on wide-band gap materials such as gallium nitride (GaN) and silicon carbide (SiC) are the automotive industry, energy industry, telecommunications and consumer electronics. Energy-efficient solutions are increasingly in demand for AC/DC converters and inverters as well as high-frequency power amplifiers. The electrification of vehicles and their charging infrastructure with SiC- based components is an important trend. GaN-based components, which enable fast charging of mobile devices, are also becoming increasingly popular. The IT industry, such as data centers or servers, also has a high need for energy-saving GaN-based power supplies, which are expected to see even greater demand from other market segments in the next few years. In addition, GaAs or GaN-based high-frequency components contribute to sales, which are used, among other things, for signal transmission in 5G networks or for the WLAN 6 standard.

Important market segments for optoelectronics are consumer electronics, data communication and display technology. The rapid developments in the field of artificial intelligence will lead to an accelerated increase in data volume in the coming years and thus the demand for faster and more optical data communication. The use of optical data transmission is also increasingly penetrating shorter distances, e.g. within data centers and even servers or for connecting households to the fiber optic network. The global expansion of fiber optic networks for high-speed data transmission is leading to increasing demand for systems for the production of edge and surface emitting lasers (EEL and VCSEL). Although these markets are always subject to certain cyclical and technical fluctuations, AIXTRON expects demand to increase in the coming years, especially if demand for 3D sensing increases due to virtual reality applications or LiDAR for autonomous driving. Demand for systems for the production of red, orange and yellow (ROY) LEDs is currently showing signs of recovery. Further growth potential is expected from the increasing commercialization of Micro LED displays, which may lead to additional significant demand for equipment for these demanding applications. These display technologies have high potential in various consumer electronics end applications.

AIXTRON expects that the following market trends and opportunities in the relevant end- user markets can have a positive impact on further business development:

As part of the assessment of our business opportunities, investment opportunities or development projects are reviewed and prioritized in terms of their potential value proposition to ensure an effective allocation of resources. We focus specifically on growth markets that are positively influenced by global megatrends such as increasing electromobility, electrification, energy efficiency, digitization and networking, in order to make the best possible use of the opportunities that arise for the Group's economically and ecologically sustainable business development.

If identified opportunities are deemed likely to materialize, they are incorporated into business plans and short-term forecasts. Trends or events going beyond this, which could lead to a positive development for the net assets, financial position and results of operations, are observed and can have a positive effect on our medium to long-term prospects.

The Declaration of Corporate Governance pursuant to Section 289f HGB has been combined with the Group Declaration of Corporate Governance pursuant to Section 315d HGB. This combined declaration including a Corporate Governance Report is available on the homepage of AIXTRON SE at Declaration of Corporate Governance and is part of this annual report.1

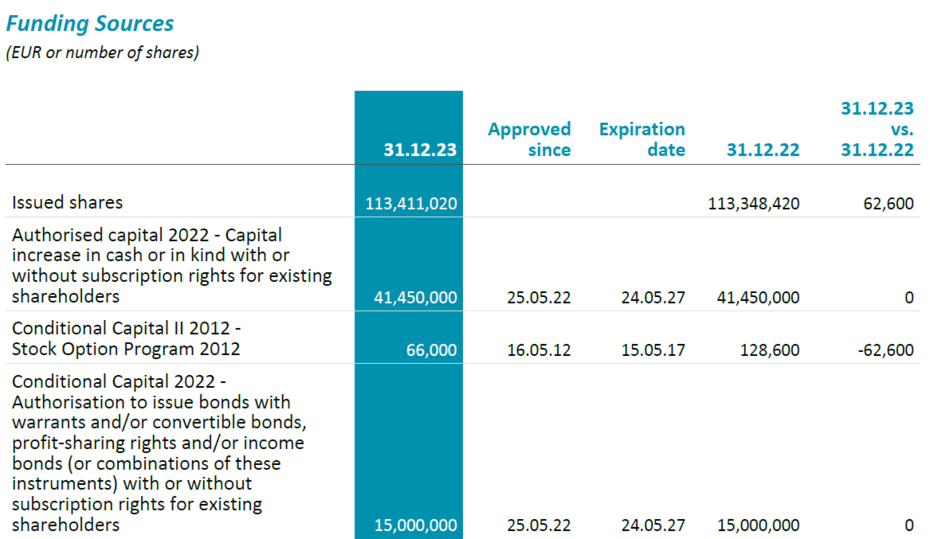

The share capital of AIXTRON SE as of December 31, 2023, amounted to EUR 113,411,020 (December 31, 2022: EUR 113,348,420) divided into 113,411,020 registered shares with a proportional interest in the share capital of EUR 1.00 per no-par value registered share. Each no-par value share represents the proportionate share in AIXTRON’s stated share capital and carries one vote at the Company’s annual shareholders’ meeting. All registered shares are fully paid in.

As of December 31, 2023, AIXTRON SE held 876,402 treasury shares, which accounted for a share capital in the amount of EUR 876,402 (2022: 965,224). The treasury shares correspond to 0.8% of the share capital (previous year: 0.9%).

AIXTRON SE has issued a share certificate representing multiples of shares (global share). Shareholders do not have the right to the issue of a share certificate representing their share(s). There are no voting or transfer restrictions on AIXTRON’s registered shares that are related to the Company’s Articles of Association. There are no classes of securities endowed with special control rights, nor are there any provisions for control of voting rights, if employees participate in the share capital without directly exercising their voting rights.

1 The information in the Corporate Governance Declaration was made in accordance with the requirements of the German Corporate Governance Code 2022. They are to be classified as "not related to the Management Report" because they go beyond the legal requirements and are therefore not part of the substantive audit by the auditor.

Additional funding needs could be covered by the following additional capital as authorized by the annual shareholders’ meeting:

In accordance with Section 71 (1) no. 8 German Corporations Act, AktG, the Company is authorized until May 24, 2027, with the approval of the Supervisory Board, to purchase its own shares representing an amount of up to 10% of the share capital existing at the time of the resolution or – if this value is lower – at the time of the exercise of the authorization. This authorization may not be used by the Company for the purpose of trading in own shares. The authorization may be exercised in full, or in part, once, or on several occasions by the Company, by companies dependent on the Company or in which the Company directly or indirectly holds a majority interest, or by third parties appointed by the Company. The shares may be purchased (1) on the stock market or (2) by way of a public offer to all shareholders made by the Company or (3) by way of a public invitation to submit offers for sale.

Changes to the Articles of Association regarding capital measures require a resolution of the general meeting, which is passed by a three-quarters majority of the share capital represented at the general meeting (Art. 59 SE-VO, § 179 AktG). Other changes to the Articles of Association require a majority of two-thirds of the votes cast or, if at least half of the share capital is represented, a simple majority of the votes cast.

As of December 31, 2023, approximately 16% of AIXTRON's shares were held by private individuals (2022: 18%), most of whom are based in Germany. Approximately 83% of the outstanding AIXTRON shares were held by institutional investors (2022: 82%). At the end of 2023, the four largest shareholders each held more than 3% of AIXTRON shares in their portfolios. According to the most recently received voting rights notifications, Blackrock, Inc. was at 5.7%, Bank of America Corp. at 4.8%, Norges Bank at 4.3% and Perpetual Limited at 3.6%. According to the definition of the German stock exchange, 99% of the shares were in free float and around 1% of the AIXTRON shares were held by the company itself.

Members of the Executive Board are appointed and dismissed by the Company's Supervisory Board. The individual members of the Executive Board are appointed for a maximum period of six years and can then be re-appointed.

In the event of a “change of control”, the individual members of the Executive Board are entitled to terminate their employment with three months’ notice to the end of the month and to resign from office with effect from the date of termination. Upon termination of employment due to a so-called “change of control” event, all members of the Executive Board receive a severance payment in the amount of the fixed and variable remuneration expected to be owed by the Company for the remaining term of the employment contract, up to a maximum of two years’ remuneration. A “change of control” as defined above exists if a third party or a group of third parties, who contractually combine their shares to act as a third party, directly or indirectly holds more than 50% of the Company’s share capital. Apart from the aforementioned, there are no other “change of control” clauses.

The AIXTRON Group's Sustainability Report is available on our website under Publications. The Group's non-financial report in accordance with sections 315b ff. HGB is integrated into this Sustainability Report and all text sections, tables and graphs, and all text sections, tables and graphics that are assigned to the non-financial report are marked accordingly.

Alan Tai

Taiwan/Singapore

Christof Sommerhalter

USA

Christian Geng

Europe

Hisatoshi Hagiwara

Japan

Nam Kyu Lee

South Korea

Wei (William) Song

China

AIXTRON SE (Headquarters)

AIXTRON 24/7 Technical Support Line

AIXTRON Europe

AIXTRON Ltd (UK)

AIXTRON K.K. (Japan)

AIXTRON Korea Co., Ltd.

AIXTRON Taiwan Co., Ltd. (Main Office)

AIXTRON Inc. (USA)

Christoph Pütz

Senior Manager ESG & Sustainability

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Ralf Penner

Senior IR Manager

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Prof. Dr. Michael Heuken

Vice President Advanced Technologies