- / HOME

AIXTRON develops, produces and installs equipment for the deposition of complex semiconductor materials, and also offers deposition processes, consulting, training, customer support and service for these systems. AIXTRON also provides peripheral devices and services for the operation of its systems.

AIXTRON supplies deposition equipment for volume production as well as for research and development (R&D) and pre-series production.

AIXTRON system demand continues to be high as our tools are an enabling technology for higher energy efficiency in power electronics, the transformation towards electromobility, for the increasing bandwidth of data, as well as the use of 3D sensor technology in consumer electronics and in the automotive sector. Last but not least, they enable the use of innovative technologies like micro LEDs in displays. With deposition technology, AIXTRON helps its customers increase the performance and quality of modern power and optoelectronics components and reduce production costs.

AIXTRON falls within the scope of the EU Dual-Use Regulation and supplies systems and spare parts based on the correspondingly required export permits.

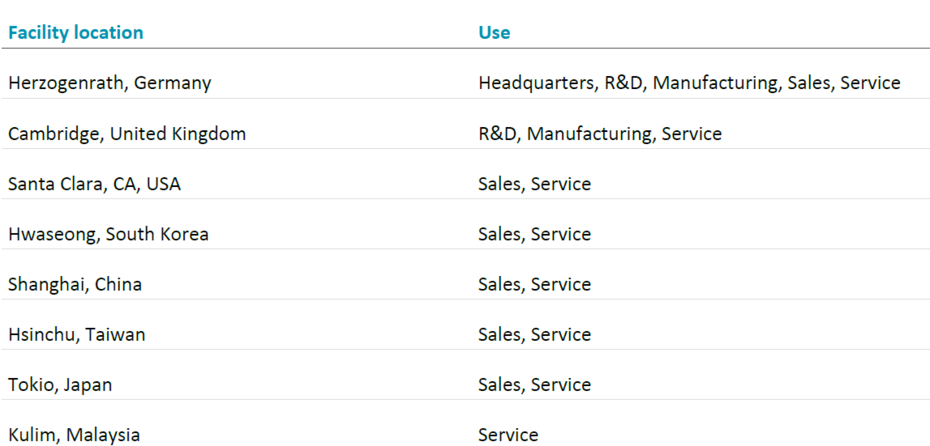

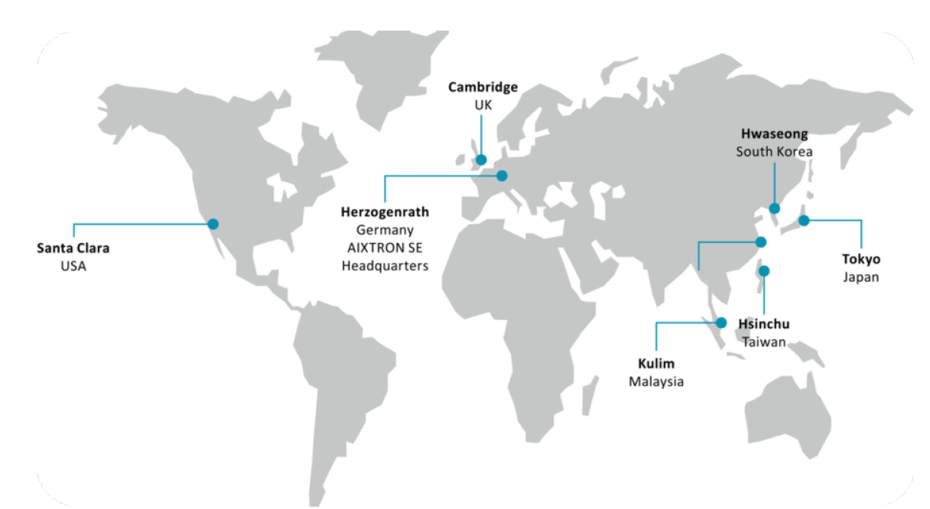

The AIXTRON Group comprises the parent company AIXTRON SE with its registered office in Herzogenrath, Germany, and its subsidiaries. As of December 31, 2023, AIXTRON SE held direct and indirect stakes in 13 companies which are part of the AIXTRON Group, and which are fully consolidated. In the 2023 financial year, AIXTRON operated at the following locations:

As a European stock company (Societas Europaea) the AIXTRON SE has a dual management and control structure consisting of an Executive Board and a Supervisory Board. The Executive Board is responsible for managing the Company at its own responsibility while being advised and monitored by the Supervisory Board. In 2023, there were the following personnel changes in the Company’s management and supervisory bodies:

Dr. Jochen Linck left the Executive Board on September 30, 2023. Since October 1, 2023, the Executive Board has consisted of Dr. Felix Grawert (Chairman of the Board) and Dr. Christian Danninger (CFO).

Detailed information on the composition of the Executive Board and the Supervisory Board, the allocation of responsibilities between them, the operating procedures of the Supervisory Board committees and the Company‘s diversity concept can be found in the Corporate Governance Declaration, which is part of the annual report and also available on the AIXTRON website at Declaration of Corporate Governance.1

The AIXTRON product range includes customer-specific systems for the deposition of complex semiconductor materials. Here, substrates of different materials and sizes can be coated.

The MOCVD process (Metal-Organic Chemical Vapor Deposition) is used to manufacture components for power electronics or for optoelectronics from compound semiconductor materials.

Our systems in the field of power electronics are used for the production of gallium nitride (GaN) semiconductor components, which, for example, increase the performance of chargers in consumer electronics, enable energy-saving power supply for servers and data centers and efficient power conversion in the field of renewable energy. A second major field of application for power electronics are silicon carbide (SiC) components, which are used, for example, in the main inverters for electric vehicles, in their charging infrastructure, and also in inverters for renewable energies (solar and wind). These components are also manufactured by our customers using our CVD systems. Both GaN and SiC are material systems with a wide band gap (WBG) that are beginning to be increasingly used in various areas of power electronics. Through their use, they contribute to the decarbonization of our modern society and make an important contribution to climate protection.

On our systems in the field of optoelectronics, customers manufacture lasers for fast optical data transmission and for 3D sensors. The latter are increasingly used in applications that require recognition of the spatial context, e.g. in the environment detection of robots or in autonomous vehicles. Another area of application is the production of LED picture elements (pixels) for display applications of the next generation, so-called micro LED displays. Other applications of our systems include the production of special LEDs, such as red, orange and yellow LEDs (ROY) for automotive lighting and indoor farming, among others.

AIXTRON is continuously working to improve its existing technologies and products. After AIXTRON presented the first system of the newly developed generations with the G10-SiC in 2022, the G10 product family was completed last year by the G10-GaN and the G10- AsP. The G10-GaN is a fully automated, compact MOCVD cluster tool for high-production power electronics factories and can be used to produce GaN devices on both 150mm and 200mm wafers. The G10-AsP is designed for the production of optoelectronic components e.g. for optical data communication or micro LED and can also be used for 150mm and 200mm wafers. In addition to continuously improving material performance, the focus of the entire G10 product family is particularly on further optimizing the systems for large-scale production through more automation with industry-standard interfaces, for example through the efficient use of limited clean room areas in semiconductor factories.

1 The information in the Corporate Governance Declaration was made in accordance with the requirements of the German Corporate Governance Code 2022. They are to be classified as "not related to the Management Report" because they go beyond the legal requirements and are therefore not part of the substantive audit by the auditor.

Manufacturing and Procurement

AIXTRON produces its prototype and customer systems at its production sites in Herzogenrath and Cambridge. Production focuses on assembly, testing and qualification as well as commissioning of the systems according to standardized specifications.

The group sources the components required to manufacture the systems and the majority of the pre-assembled assemblies from external suppliers and service providers. We optimize the performance of our supply chains in order to cover the increased overall demand and to compensate for fluctuations in delivery ability. Based on a rolling forecast, necessary measures are taken to ensure material availability in close coordination between sales, purchasing and production. This also includes the early detection of bottlenecks in raw materials and components. In collaboration with our partners in the supply chain, we use appropriate strategies to ensure the availability of inventory.

The assembly of the systems is carried out with the help of external service providers in our own or, if necessary, in rented nearby production facilities. The subsequent commissioning, testing and qualification of the systems is carried out by AIXTRON specialists. The planning, control and monitoring of production is the sole responsibility of AIXTRON employees, thus enabling quality requirements to be met throughout the entire production process.

In 2022 and during 2023, AIXTRON successfully completed the market launch of the products G10-SiC, G10-AsP and G10-GaN series production.

AIXTRON's production sites have a process-oriented quality management system certified according to ISO 9001:2015. In 2023, external auditors have certified the quality management systems of both AIXTRON SE and AIXTRON Ltd. confirmed without any deviation.

AIXTRON’s leading position in the global market and ability to continually innovate are the result of the commitment and knowledge of our employees. Therefore, our human resources department is designed to create a safe and supportive working environment and to promote a culture of appreciation and collaboration.

Attracting and retaining highly qualified and committed specialists and managers is a key success factor. Competing for the best talent, we are continuously enhancing our attractiveness as an employer brand. In addition to a comprehensive, informative careers site and other communication channels, we use a wide variety of target group-oriented recruitment channels, increasingly in social media. Personal contact with potential applicants at job fairs and similar events, as well as in the context of our close cooperation with universities worldwide, is also of great importance to us.

AIXTRON is working consistently to establish a modern corporate culture with a mature leadership culture and good teamwork. We attach great importance to supporting our employees competently and in a spirit of partnership, to promoting them individually, and to challenging them with future-oriented projects and tasks. As part of our companywide personnel development concept, we offer our employees a wide range of measures for continuous training as well as individual advanced training measures and development opportunities. This includes e-learnings in the areas of health, software, communication or conflict management, which our employees can use at any time, but also training on working methods such as time, project management and facilitation techniques, which are carried out with external trainers. In addition, employees can take advantage of coaching and mediation services.

Another central pillar of our corporate culture is AIXTRON’s commitment to diversity and equal opportunities, which form an essential basis for our innovative strength and competitiveness. We explicitly encourage collaboration in diverse teams. We also attach great importance to an appropriate gender balance and a balanced age structure.

In the 2023 fiscal year, the number of employees in the Group increased by approximately 21% from 895 at the end of 2022 to 1,086 as at 31 December 2023. The increase in the number of headcount is due to the continued strong growth of the Group's core business. As in previous years, the majority of employees are located in Europe.

Today's customers of AIXTRON have successfully established and expanded their value chains in the fields of power electronics, optoelectronics and the display industry. Increasing digitalization has raised the need for semiconductor devices with higher performance for applications in IT infrastructure, such as data centers. Consumer electronics, as well as power generation and electromobility, are also driving the development of the current markets. Electromobility in particular is gaining in importance: Due to the rapid adoption of power semiconductors and their low switching losses, which leads to efficiency increases in power conversion, we are experiencing strong growth in the high-performance areas of power electronics. The main applications are inverters in electric vehicles as well as fast charging stations. In addition, they are used in railway technology, wind and solar energy generation, and in industrial applications where high-voltage current is processed.

In optoelectronics, AIXTRONS’s customers still manufacture lasers for data transmission, entertainment electronics and the automotive sector and are advancing into areas of autonomous driving.

Customers from the display industry, on the other hand, concentrate, among other things, on the production of new types of LEDs (mini and micro LEDs) - already with the first demonstrators - in order to address displays of all sizes, from smartwatches to large- area display panels.

In today's customers ecosystem, we differentiate between customers who either prefer vertical integration and thus serve the entire value chain up to the end user, or independent manufacturers of various devices or epitaxy wafers. The latter supply products manufactured on AIXTRON equipment to companies at the next stage in the value chain, the manufacturers of electronic components. In addition to industrial customers, AIXTRON's customers also include research institutes and universities, where research into novel materials and new fields of application is being driven forward to create the basis for novel components of the next generation.

AIXTRON's products are sold worldwide. The market segments and the product mix are regionally different. The current demand for systems for the production of GaN and SiC power semiconductors is mostly driven by the expansion of production capacities in western markets such as America and Europe. AIXTRON generates around half of its current sales here. The other half is generated in Asia, with power electronics also accounting for a large portion of sales, followed by optoelectronics with a little less than 40%.

The Development of Revenues chapter contains a detailed breakdown of revenues by region.

With the development, manufacture, sale and maintenance of systems for deposition of complex compound materials, AIXTRON addresses growing future markets along many end-use fields, such as consumer electronics, IT infrastructure, the automotive industry, telecommunications and power generation.

In the area of these complex deposition processes, AIXTRON's strategy is to develop the technology and products with a clear focus on its core competencies in such a way that they address as many end applications as possible. Above all, it is about increasing productivity and thus a high level of competitiveness in the specific requirement profile of the respective application. In this way, AIXTRON is addressing the fast-growing end markets in order to generate income for the development of other promising future applications.

Our strategic goal is to secure our market position in our core markets in the long term through continuous innovation and technological leadership. In addition, we aim to expand the range of addressable end applications and penetrate adjacent markets by applying our core competencies. The ecological and economic sustainability of our business, increasing sales and improving profitability are at the center of our strategic planning.

The core of our strategy is to adapt the products to the requirements of the respective application areas while maintaining the focus on using AIXTRON's core competencies. This targeted addressing of the applications and markets that are attractive for AIXTRON in terms of size, growth, profitability and differentiation potential is currently very successful. Because these applications from different areas such as consumer electronics, IT infrastructure and electromobility are subject to growth dynamics that are largely independent of one another. AIXTRON is not dependent on a single segment, but strives to be robust against fluctuations in individual application markets across the range of applications and the broadly diversified customer base. For this purpose, AIXTRON is actively developing a broad technology portfolio through its own or funded developments, through cooperation or targeted acquisitions. The maintenance and development of technology ecosystems in close cooperation with customers and, if necessary, their customers or technology partners allows AIXTRON to establish new technologies and develop new applications.

Our main focus is on markets where the application of our technology enables a clear differentiation from our competitors and thus offers significant added value to our customers. This is achieved, among other things, by the homogeneity of the physical properties of the deposited layers and thus a high yield on the wafer with simultaneous high throughput and low material and maintenance costs. An important differentiating factor is the high productivity and cost-effectiveness of our systems, e.g. due to the high throughput of the systems thanks to the so-called batch reactor, in which several wafers can be produced at the same time. This allows our customers to allocate the direct and indirect system costs, such as costs for clean room space, to high production volumes. In many applications, the high efficiency of the use of materials due to the reactor architecture is another important cost factor.

AIXTRON is pursuing a platform strategy with its system families based on the planetary principle. With a high proportion of identical parts, the systems can be customized. As outlined in the previous section, this enables broad diversification and the use of numerous applications. In addition to the planetary systems, which address customers with high production volumes, AIXTRON sells systems based on the showerhead principle in university and niche markets. AIXTRON makes this possible, e.g. to be involved early in the development of newly emerging applications and to understand the emerging customer needs in new markets at an early stage.

Since numerous business activities within the group are largely integrated at the operational level, the Executive Board of AIXTRON SE controls the group at the level of the overall group. The developments forecast for the Group by the Executive Board therefore also apply to AIXTRON SE.

The most important financial performance indicators for the AIXTRON Group are revenues, gross profit relative to revenue (gross margin) and earnings before interest and taxes relative to revenues (EBIT margin). They are determined monthly in the AIXTRON reporting system and made available to management in a comprehensive report. This enables the Executive Board to identify growth drivers at an early stage, to analyze developments during the year and take prompt countermeasures in the event of any discernible deviations.

AIXTRON aims to achieve organic revenue growth, exchange rate effects are excluded when setting revenue targets. The gross margin provides information on the profitability and return on investment of AIXTRON’s operating business. The EBIT margin is used as an additional important indicator for operational management and analysis of the earnings situation.

The key financial indicators mentioned are the most important financial performance indicators for AIXTRON.

Order intake was classified as a key performance indicator until the 2023 financial year. Since short-term market and demand fluctuations, large individual customer orders and the fulfilling of requirements to book existing orders in order intake are becoming increasingly difficult to predict, using it as a central financial performance indicator and a short-term forecast is no longer meaningful.

However, order intake remains an important performance indicator and is explained below in the order development section.

Since the introduction of the current Executive Board remuneration system in fiscal year 2020, AIXTRON has defined annual sustainability targets for the Executive Board as part of the Long Term Incentive (LTI), which are to be achieved over a three-year reference period, and includes corresponding non-financial performance indicators in the Group management.

The following non-financial performance indicators were defined for the LTI reference period beginning in the 2023 financial year:

In addition to the R&D center at its headquarters in Herzogenrath, AIXTRON also operates a R&D laboratory in Cambridge, United Kingdom. These in-house laboratories are equipped with AIXTRON systems and are used to research and develop new equipment, materials and processes for the production of semiconductor structures.

In May 2023, the company announced that it will invest in a new innovation center at the Herzogenrath site. The start of the construction project, which includes a clean room area of around 1,000 square meters, was initiated in November 2023. The new building will provide sufficient space for the development of the next product generations.

The Group's R&D activities in 2023 continued to include development programs for future technologies and new products, as well as continuous improvement of AIXTRON's existing products. In order to increase industrial maturity, products were optimized along the entire value chain, e.g. through design improvements of externally supplied components or through improved data analysis. In addition, AIXTRON is working on customer-specific development projects and researching new technologies, often in the context of publicly funded projects.

The Group’s R&D expertise remains of great strategic importance to AIXTRON, as we believe it ensures a competitive, leading edge technology portfolio and supports the future business development. AIXTRON invests specifically in research and development projects in order to maintain or expand the Company’s leading position in MOCVD equipment for applications such as lasers, Micro LEDs, specialty LEDs and for the production of wide-band-gap materials for power electronics. In addition, the Group is working on novel 2D-nanostructures, which are currently seen as having great potential in research.

For the consistent technological evolution of our product portfolio, we invested EUR 87.7 million, or around 14% of revenues (2022: EUR 57.7 million, 12% of revenues), in research and development (R&D) in 2023. At year-end 2023, 366 of AIXTRON Group’s total 1,086 employees were employed in the Research and Development department (2022: 254 of 895 employees).

AIXTRON aims to secure its technology by patenting and protecting inventions, provided it is strategically expedient for the Company to do so. As of December 31, 2023, the Group had 265 (thereof AIXTRON SE: 250) patent families available (December 31, 2022: 252 patent families). In the reporting period, new applications for patent protection were filed for 14 patent families (AIXTRON SE: 13), and one patent expired. Usually, patent protection for inventions is applied for in those markets relevant to AIXTRON, specifically in Europe, China, Japan, South Korea, Taiwan and the United States. AIXTRON's patent portfolio is evaluated annually and adjusted accordingly. The individual patents expire between 2024 and 2043. In addition, AIXTRON continuously performs a worldwide patent analysis in order to identify and assess changes in the competitive environment at an early stage.

Together with our project partners, we again worked on promising research projects in the reporting year. Here, too, we operate on a global scale and focus on areas with attractive growth potential.

Examples of the Group's research work include the following projects:

The aim of the HoverGaN project (holistic development of vertical GaN transistors for operating voltages up to 1.7kV) is to research future-oriented vertical transistor architectures. The aim is to develop and test powerful transistors with low static and dynamic losses and high dielectric strength on low-defect GaN substrates. AIXTRON SE will fundamentally investigate and further develop the MOCVD technology for deposition of the necessary layer structures.

The BMBF joint project NEUROTEC researches technologies for neuromorphic electronics. A central building block is the memristive cell. The project contributes to the digital transformation and strengthening of high technology in the Rhineland region. In the AIXTRON sub-project, MOCVD technology for deposition of the required layer structures, here 2D materials, is being intensively researched and further developed.

The EU-funded project SKYTOP (Topological Insulators and Weyl Semimetals Technology) aims to combine topological states in both real and reciprocal space through the use of Topological Materials (TM) such as Topological Insulators and/or Weyl Semimetals and magnetic skyrmions. The aim is to develop a Skyrmion-TM based platform and realize devices with interlocking electronic spins and topologies for improved efficiency and new functions. These should lead to a new paradigm for ultra-dense, low-power nanoelectronics. AIXTRON is developing the necessary MOCVD system technology for a route to exploit the emerging Weyl semimetal materials

TRANSFORM (Trusted European SiC Value Chain for a greener Economy) is a research and development project funded by the EU and national funding authorities. This project aims to establish a complete and competitive European supply chain for power electronics based on SiC semiconductor technology from substrates to energy converters such as transistors and modules. It is intended to serve as a source of supply for silicon carbide components and systems in Europe.

Alan Tai

Taiwan/Singapore

Christof Sommerhalter

USA

Christian Geng

Europe

Hisatoshi Hagiwara

Japan

Nam Kyu Lee

South Korea

Wei (William) Song

China

AIXTRON SE (Headquarters)

AIXTRON 24/7 Technical Support Line

AIXTRON Europe

AIXTRON Ltd (UK)

AIXTRON K.K. (Japan)

AIXTRON Korea Co., Ltd.

AIXTRON Taiwan Co., Ltd. (Main Office)

AIXTRON Inc. (USA)

Christoph Pütz

Senior Manager ESG & Sustainability

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Ralf Penner

Senior IR Manager

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Prof. Dr. Michael Heuken

Vice President Advanced Technologies