- / HOME

As a manufacturer of capital goods, AIXTRON may be affecTed by the development of the general economic environment, as this could impact its own suppliers, manufacturing costs, and sales opportunities, driven by the customers' willingness to invest.

Despite numerous challenges in some regions, the economic environment in 2023 has developed somewhat more positively than expected. The US economy in particular performed better than expected, while growth in other regions of the world varied widely and remained below expectations. The central banks continued to raise key interest rates to curb high inflation. Although inflation eased slightly, it remained at a very high level in many areas. Supply chains also relaxed, driven by lower freight costs and increased freight capacity.

After the significant adjustments to the growth forecasts at the beginning of 2023, the International Monetary Fund (IMF) is assuming 3.1% and thus stable growth in global economic output compared to 2023 in its “World Economic Outlook Update” (WEO) from January 2024. The forecast for 2024 is therefore at the level of the forecast from October 2023. For the industrialized nations, the expected growth rate for 2024 is 1.5% (2023: 1.6%). The growth rate for emerging and developing countries in 2024 is expected to be 4.1% (2023: 4.1%). Expectations for world trade in 2023 were 0.4% (2022: 5.2%) and are expected to rise to 3.3% in 2024, while the inflation rate in industrialized nations is expected to decrease significantly compared to the previous year at 5.8% (2022: 6.8%).1

The strongly export-oriented German machinery and equipment engineering sector also suffered from increasing reluctance of customers to invest over the course of the year due to the increased economic uncertainties. According to order balance of the German Engineering Federation (VDMA), companies recorded a price-adjusted decline in incoming orders of 12% in 2023. International orders decreased by 13% while domestic orders decreased by 11%.2

Demand for AIXTRON's products remains largely dependent on industry-specific developments, such as the introduction of new applications in consumer electronics, IT infrastructure, electromobility, or demand in sub-segments of the global semiconductor market. These developments are based on the megatrends of digitalization, electrification, and sustainability and thus continued to be very robust.

The U.S. dollar exchange rate showed a very volatile development under the impact of the U.S. Federal Reserve's actions to reduce inflation in 2023. The US dollar closed the year at 1.11 USD/EUR (2022: 1.07 USD/EUR), depreciating by around 3.5% overall. AIXTRON applied an average USD/ EUR exchange rate of 1.08 USD/EUR in fiscal year 2023 (Q1/2023: 1.07 USD/EUR; Q2/2023: 1.09 USD/EUR; Q3/2023: 1.09 USD/EUR; Q4/2023:

1.08 USD/EUR). On average over the year, the exchange rate was thus slightly above the prior-year average (2022: 1.06 USD/EUR). Compared to the previous year, this had a moderate impact on the AIXTRON’s Executive Board continuously monitors the developments of the global economy and the financial markets to decide what can potentially be done to mitigate negative external effects on AIXTRON’s business. The global crisis situations and market developments continued to have only a minor overall impact on AIXTRON's business. In 2023, no forward exchange contracts or other hedging transactions were entered into. Therefore, no currency hedging contracts were in place as of December 31, 2023. The Executive Board reserves the right to carry out hedging transactions in the future, should this be deemed appropriate.

1 IMF: World Economic Outlook Update, January 2024

2 VDMA: Incoming orders December / total 2023, February 2024

Competitors in the market for CVD/MOCVD equipment are Veeco Instruments, Inc. (USA, “Veeco”), Taiyo Nippon Sanso (Japan, “TNS”), Tokyo Electron Ltd. (Japan, “TEL”), ASM International N.V. (Netherlands, “ASMI”), Nuflare Technology Inc. (Japan, „Nuflare“), Advanced Micro-Fabrication Equipment Inc. (China, “AMEC”), Beijing NAURA Microelectronics Equipment Co., Ltd. (China, “Naura”) and Tang Optoelectronics Equipment Corporation Limited (China, “TOPEC”). Other companies are also continuing to try to qualify their own CVD/MOCVD-systems with their customers. For example, Technology Engine of Science Co. Ltd. (South Korea, “TES”), Zhejiang Jingsheng Mechanical & Electrical Co., Ltd. (China, “JSG”) and Hermes-Epitek Corp. (Taiwan, “HERMES”) and Shenzhen Nashe Intelligent Equipment Co., Ltd. (China, “Naso Tech”) worked on developing its own CVD/MOCVD system solutions and are trying to establish them on the market.

According to a study by the market research institute Gartner, AIXTRON has maintained its global market leadership position in 2022. AIXTRON's once again takes the top spot: market share has slightly decreased to 70% (2021: 75%), followed by AMEC (China) with 18% (2021: 14%) and Veeco (USA) with 12% (2021: 11%). At the same time, the global market for MOCVD tools grew from USD 561 million to USD 566 million in 2022. For fiscal year 2023, no current market share figures from independent market analysts are yet available.

Power semiconductors based on Wide-Band-Gap (WBG) materials are one of the main applications of AIXTRON's deposition technology. These materials enable the production of very compact and highly efficient power supplies and AC/DC as well as DC/DC converters which are used, for example, in the industrial space for applications such as power supplies of modern data centers, the more efficient feed-in of regenerative energies into the power grid and in electromobility. They are therefore increasingly used in a broad spectrum of applications covering a wide power range. WBG power semiconductors reduce conversion losses by up to 40% and thus contribute significantly to increasing energy efficiency and reducing CO2 emissions. There are two main groups of commercially available WBG power semiconductors: GaN (gallium nitride) and SiC (silicon carbide).

GaN semiconductor components are primarily used in low and medium power and voltage classes, such as in power supplies for smartphones and laptops as well as in the power supply for modern data centers. According to analysts at Yole Group (Yole), GaN semiconductor device sales were USD 235 million in 2023 compared to USD 126 million in 2021, growing at an average annual rate of over 30% over the past two years, which underlines the increasing market acceptance of GaN technology in the field of power semiconductors. For example, there is already a wide range of commercially available 65W power supplies that use GaN technology and are marketed as such. In addition, customers are continually developing new applications, for example in the area of data centers, in IT infrastructure as well as micro inverters in the area of photovoltaics or on- board chargers in the area of electromobility. In addition, the customer base for AIXTRON systems for the production of GaN semiconductor components is continually expanding while existing customers expand their production capacities.

Due to the wide range of applications, analysts of the Yole Group (Yole) expect the market for GaN power semiconductors to grow very strongly to USD 2.2 billion in 2028, corresponding to a compound annual growth rate (CAGR) of around 60%.

Furthermore, GaN semiconductor devices are increasingly used in high-frequency applications. In 5G telecom networks and likely in subsequent network generations such as 6G, the GaN technology advantage of lower power losses at high frequencies comes into play. As a result, more and more manufacturers of high-frequency switches are changing their production from Silicon to GaN. Yole analysts forecast the GaN high- frequency semiconductor device market to grow from USD 1.3 billion in 2022 to USD 3.0 billion in 2027 at a compound annual growth rate (CAGR) of 18%.

The adoption of SiC power semiconductors in the area of high-voltage and high-power applications has increased further in 2023 The main fields of application within electromobility are in particular the main inverters in the powertrain as well as the on- board chargers, but also the charging stations, as well as the inverters in the field of industrial photovoltaics and wind energy. SiC is also used in industrial motor control systems. In all these applications, SiC enables a significant reduction in conversion losses during the conversion of electrical energy. This leads, for example, to a greater range per battery charge in battery electric vehicles and to lower conversion losses in the field of power generation.

Driven by significantly increased awareness of the importance of energy efficiency and CO2 reduction, both in the regulatory and private sectors, as well as by bans imposed in several countries on the sale of vehicles with internal combustion engines from 2035 onwards, car manufacturers worldwide have raised their targets for powertrain electrification.

Based on this development, Yole forecasts that the SiC device market will grow from USD 2 billion in 2022 to USD 8 billion by 2027 at a CAGR of 40% and are forecasting even stronger growth than in the previous year's report (34% CAGR). According to the analysts, this is particularly due to the development of electric vehicles sales and the corresponding fast charging infrastructure.

Red, orange and yellow LEDs (ROY LEDs) are used in, among other things, large-format color displays in sports stadiums, airports and shopping malls, as well as in automotive taillights or in the area of indoor farming. In addition, televisions and monitors in the premium segment are increasingly being equipped with Mini LEDs for backlighting as an alternative to OLED displays. While the market for the production of conventional LEDs is currently largely stable, the market for systems for production of Mini LEDs will grow at an annual growth rate of 31% until 2028. According to Yole Growth the biggest growth drivers will be automotive applications and are expected to grow by an average of 99.5% per year over the same period.

The market for UV LEDs (Ultra-Violet Light Emitting Diodes) is another specialized segment in the LED market that AIXTRON addresses. UV LEDs are used for curing plastics and disinfecting surfaces, circulating air and (drinking) water. Due to the increasing demand for hygiene, this market is expected to gain importance in the future. After an initial strong increase in demand for mass production systems for UV LEDs in the first years of the COVID pandemic, this has since been significantly reduced to tools for development and small series production in the past year. Nevertheless, UV LEDs are a product segment with very specific applications such as air disinfection systems, vehicle air conditioning or sterilization of running water.

Micro LEDs form a basis for new types of displays. Analysts expect Micro LEDs to be used initially in very small displays such as smartwatches and very large displays such as large- screen premium TVs. In the long term, other potential applications include displays in smartphones, tablets and notebooks. Micro LED technology is currently still in the early stages of development but has seen very large investments in the recent past. The speed of market development and thus the growth rates are strongly linked to the forecasted technical progress, but are generally very high. The market researchers at Yole estimate the market for Micro LED panels to be approximately USD 150 million in 2024 with strong growth to USD 1 billion in 2027 and further to USD 2.2 billion in the base scenario (corresponding to a CAGR of 80% ) or to USD 12 billion in the “full penetration scenario” (corresponding to a CAGR of 130%) until 2030.

As Micro LED technology matures, AIXTRON expects the currently still very young market for Micro LEDs to mature both technically and commercially. Developments are currently focusing on the cost per pixel, as well as on the yield and quality of the industrial manufacturing process. Accordingly, analysts also expect the initial commercial introductions in the area of high-end applications and a subsequent continuous expansion of the applications across other segments.

The volume of data, transmitted over fiber optic cables continues to increase, driven by the increased use of cloud computing and Internet services. In addition, demand for bigger amounts of data will accelerate even further in the coming years due to the triumph of artificial intelligence. The ongoing increase of video-on-demand use and communication from connected devices via the Internet ("Internet of Things") also contribute to the increased data volumes. In addition to data volumes, the rapid transmission of data - at the speed of light - also plays an important role in the expanding field of application of optical data communication. Diode lasers manufactured on AIXTRON systems are key components for high-speed optical data transmission. The growth of global data traffic through AI, mobile telecommunications, the transition to 5G standards and the continuous expansion of fiber optic networks are increasing the demand for lasers as optical signal transmitters, photodiodes as receivers and optical amplifiers and switches.

Market research firms such as Yole and Strategies Unlimited expect investments in laser- based communications to continue to increase to accommodate growing data traffic. Yole analysts expect sales of transceivers used in telecommunications to grow at an annual rate of 12% from 2022 to 2028. The total market volume in 2028 is estimated by Yole to be over USD 22.3 billion. Yole also expects demand for the laser diodes used for this to rise sharply by 2026 and now expects data communications to be the biggest driver of demand over the next five years.

Laser-based 3D sensors are often used in high-end mobile phones. Since this technology was introduced to the market with the iPhone® X in 2017, Apple® has been using it in its current generation smartphones and is also using it in its tablet series. With these sensors, the environment can be captured in three dimensions, which is important for many applications, e. g. augmented reality. Another rapidly growing application of this technology is in the automotive sector. Autonomously driving vehicles need such 3D sensor technology in order to monitor the road in front of them even at night and in bad weather conditions and to be able to control the vehicle autonomously.

According to market research firm Yole, demand for laser-based 3D sensors, so-called vertical cavity surface-emitting lasers, will increase from USD 980 million in 2022 to USD

1.4 billion in 2028, a compound annual growth rate of 6% corresponds.

In addition to applications in consumer electronics, edge and surface emitting lasers are increasingly being used in the industrial and automotive sectors in the area of 3D sensing. Yole expects demand for these components to increase sharply by 71% by 2028.

Fiscal year 2023 was once again marked by significant geopolitical events, some of which had serious macroeconomic effects. The energy crisis, inflation and serious geopolitical conflicts are examples of external factors that many people and companies have had to deal with. We have successfully met these challenges through targeted measures. We were able to gain many new colleagues and fully meet our forecast, which was increased over the course of the year, in all areas. Demand for our systems and in particular the newly launched G10 product family has been and continues to be very strong. Our profitability also developed as we expected.

The very strong increase in demand for AIXTRON systems for the production of energy- efficient silicon carbide (SiC) and gallium nitride (GaN) power components was able to overcompensate for temporarily lower demand for systems for the production of lasers and LEDs.

With orders totaling EUR 640.7 million (2022: EUR 585.9 million), we recorded an 9% increase in order volume in the fiscal year 2023. As expected, revenues also developed very positively and, at EUR 629.9 million (2022: EUR 463.2 million), within our guidance range. At 44%, the gross margin was in line with internal expectations. The increased operating expenses of EUR 122.3 million was mostly driven by increased expenses for Research and Development. The operating result was EUR 156.8 million with an EBIT margin of 25% (2022: EUR 104.7 million; 23%). This resulted in a net profit of EUR 145.2 million (2022: EUR 100.5 million). For 2023, a free cash flow (cash flow from operating activities - investments in property, plant and equipment, intangible assets and non- current financial assets + result from the disposal of property, plant and equipment) of EUR -109.7 million (2022: EUR 7.7 million) was reported.

In 2023, AIXTRON completed the renewal of the product portfolio after successfully launching the new G10-GaN on the market in September of that year in addition to the G10-SiC and G10-AsP systems. Significant orders from both existing and new customers have already been recorded for all systems in the G10 product family. To achieve an unabated profitable development of the AIXTRON Group in the future, our product portfolio focuses exclusively on product lines with a positive contribution to earnings or those that promise a significant return on investment (ROI) in the foreseeable future.

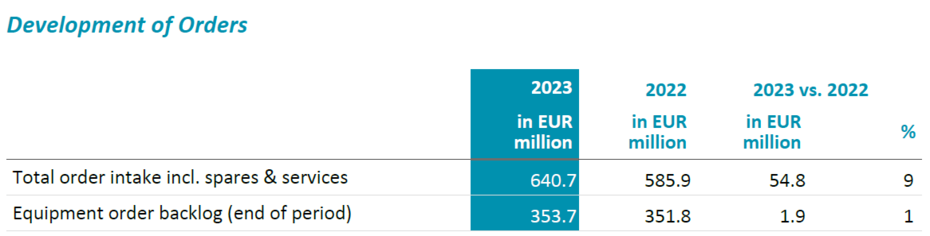

In fiscal year 2023, US dollar-denominated order intake and order backlog have been recorded at the budget exchange rate of 1.15 USD/EUR (2022: 1.20 USD/EUR). Spares & service orders are not included in the order backlog.

In 2023, total order intake including spares & services stood at EUR 640.7 million, thus significantly higher than the previous year’s figure. This development was driven in particular by continuously strong demand from power electronics. In Q4/2023, order intake was booked at EUR 204.5 million and with that was up 73% against the previous quarter (Q3/2023: EUR 118.5 million).

At EUR 353.7 million, equipment order backlog as of December 31, 2023, was also higher than the order backlog of EUR 351.8 million at the end of 2022 (2023 budget rate: 1.15 USD/EUR; 2022 budget rate: 1.20 USD/EUR). Compared to the end of the previous quarter, the order backlog slightly decreased due to the high number of shipments in the fourth quarter by 4% at year-end (September 30, 2023: EUR 368.0 million).

In line with strict internal procedures, AIXTRON has defined clear conditions that must be met for the recording of equipment orders in order intake and order backlog. These conditions include the following requirements:

In addition, and taking into account current market conditions, the Executive Board reserves the right to assess whether the actual realization of each system order is sufficiently likely to occur in a timely manner. If, as a result of this review, the Executive Board comes to the conclusion that the realization of an order is not sufficiently likely or involves an unacceptable degree of risk, it will exclude this specific order or a portion of this order from the recorded order intake and order backlog figures until the risk has decreased to an acceptable level. Such Risk factors include, for example, technological risks in orders for new product generations or delays in the granting of export licenses. The order backlog is regularly assessed and – if necessary – adjusted in line with potential execution risks.

Revenues in fiscal year 2023 amounted to EUR 629.9 million and were thus significantly higher than in the previous year by about 36% (2022: EUR 463.2 million). EUR 97.6 million or 15% of revenues in fiscal year 2023 were generated from the sale of consumables, spare parts and services (2022: 18%). Revenues with MOCVD systems rose by around 40% year-on-year. In particular, the strong increase in demand for MOCVD equipment for the production of GaN and SiC power devices led to an increase of equipment revenues for power electronics. Demand for systems in the laser and LED application areas was below the previous year due to temporarily lower demand, but recovered significantly in the fourth quarter The proportions of revenues developed as following: Power electronics contributed 74% of equipment revenues, followed by optoelectronics with 12% and LEDs including Micro LEDs with 11%.

With EUR 314.4 million or 50%, about half of the demand was driven by customers in Asia in 2023 (2022: 68%). The significantly higher proportion of customers in Europe is due to increased demand from companies in Europe.

Cost of sales amounted to EUR 350.8 million in the past fiscal year (2022: EUR 267.9 million) and were almost on the same level as last year with 56% (2022: 58%). This resulted in a gross profit of EUR 279.0 million (2022: EUR 195.3 million) in the fiscal year, which corresponds to a gross margin of 44% (2022: 42%). The significant increase in the gross margin of two percentage points is primarily related to an improved product mix.

In absolute terms, operating expenses increased on an absolute basis significantly during 2023 compared to the previous year, but were stable as percentage of revenues. In absolute terms, operating expenses increased to EUR 122.3 million in the year 2023 compared to EUR 90.6 million in the past fiscal year. Increased personnel costs driven by the higher number of employees and higher variable remuneration components contributed to the increase in operating expenses. In addition, research and development expenses increased, while at the same time higher income from the valuation and sale of funds as well as higher government grants more than compensated for the lower foreign currency income.

The following individual effects must be taken into account:

Selling, general and administrative (SG&A) expenses were higher in a year-on-year comparison at EUR 46.7 million (2022: EUR 40.4 million). In proportion to revenues, SG&A expenses amounted to 7% (2022: 9%). The development was mainly attributable to higher personnel costs as well as higher variable remuneration components.

Research and development (R&D) expenses, including expenses for development activities for our new generations of systems, increased significantly by 52% year-on-year to EUR 87.7 million (2022: EUR 57.7 Mio.). In fiscal year 2023, AIXTRON has both driven the completion of new product generations and already started to invest in the development of next generation products.

Net other operating income and expenses in 2023 resulted in an income of EUR 12.1 million (2022: operating income of EUR 7.6 million). This includes net income from the valuation and sale of funds amounting to EUR 4.8 million (2022: EUR 0.0 million).

In the reporting year, other operating income including grants for publicly funded development projects increased from EUR 5.3 million in 2022 to EUR 6.8 million, which was largely due to the completion of two new major funding projects. In fiscal year 2023, a net foreign exchange gain of EUR 0.8 million (2022: EUR 2.8 million gain) was recorded from transactions in foreign currencies and the translation of balance sheet items.

At EUR 115.0 million, personnel costs in fiscal year 2023 were 26% higher than the EUR

91.1 million in 2022. This increase is due to salary increases to compensate for inflation, higher variable compensation components and increased personnel costs due to the higher number of employees.

The operating result (EBIT) significantly improved year-on-year by 50% and amounted to EUR 156.8 million in the fiscal year 2023 (2022: EUR 104.7 million). This resulted in an EBIT margin of 25% (2022: 23%). This development is mainly attributable to the year-on- year increase in revenues and related higher gross margin and is thus related to the business and cost developments described above.

Result before tax at EUR 157.7 million in 2023 was significantly higher than in the previous year (2022: EUR 105.1 million). This includes net interest income of EUR 0.92 million (2022: EUR 0.45 million).

In 2023, AIXTRON reported a net income tax expense of EUR 12.5 million (2022: EUR 4.7 million income tax expense). This consists of a tax expense from current taxes of EUR 19.7 million (2022: EUR 13.9 million) and an income from the capitalization of deferred taxes on loss carryforwards in the amount of EUR 7.2 million (2022: EUR 9.2 million income) due to expected future profits.

The AIXTRON Group's consolidated net income in fiscal year 2023 was EUR 145.2 million, or 23% of revenues and with that significantly above the previous year (2022: EUR 100.5 million or 22%).

The balance sheet total as of 31 December 2023 increased to EUR 1,029.9 million year- on-year (December 31, 2022: EUR 902.6 million).

Property, plant and equipment increased to EUR 147.8 million as of 31 December 2023 compared to 2022 (EUR 99.0 million as of 31 December 2022). The significant increase is primarily related to the construction of the Innovation Center. Investments were also made in new demonstration systems in the laboratories and in the expansion of production and development areas.

Goodwill was EUR 72.3 million compared to EUR 72.5 million as of December 31, 2022. The difference is entirely related to exchange rate fluctuations. No impairment losses were recognized.

Other intangible assets increased to EUR 4.4 million as of 31 December 2023 (31 December 2022: EUR 3.3 million), due to investments in licenses, software and IT- solutions.

Inventories, including components and work in process, increased by EUR 170.9 million year-on-year to EUR 394.5 million (December 31, 2022: EUR 223.6 million). This development is primarily related to higher inventory levels in preparation for the high amount of planned sales in the coming quarters.. The inventory turnover rate at the end of 2023 was 0.9 (2022: 1.2).

Trade receivables were EUR 157.6 million at December 31, 2023 (December 31, 2022: EUR 119.7 million), reflecting the high volume of shipments in the fourth quarter of 2023.

Cash and cash equivalents and financial assets decreased to EUR 181.7 million as of December 31, 2023 (31. December 2022: EUR 325.2 million). This development is essentially due to the build-up of inventories as a result of the increase in business volume, the increase in receivables due to a disproportionately strong sales contribution in the last quarter, and the increased investments, particularly for the construction of the innovation center.

As of December 31, 2023, other financial assets include fund investments of EUR 83.7 million (December 31, 2022: EUR 220.4 million).

Trade payables increased to EUR 57.8 million as of December 31, 2023 (December 31, 2022: EUR 46.1 million), due to the increased procurement volume.

Provisions (non-current and current) were similar to previous year's levels at EUR 36.9 million as of December 31, 2023 (EUR 36.1 million as of December 31, 2022) .

At EUR 141.3 million as of December 31, 2023, advance payments received from customers were on the previous year's level (December 31, 2022: EUR 141.2 million), reflecting the ongoing strong order levels.

Other current liabilities include payments received for publicly funded development projects and decreased slightly year-on-year to EUR 5.4 million (December 31, 2022: EUR

6.6 million).

AIXTRON has a central financial management system whose primary objective is to ensure the long-term financial strength of the Group. AIXTRONs financial management includes the control of its global liquidity as well as its interest and currency management. Financial processes and responsibilities are defined throughout the Group. The investment policy is approved by the Supervisory Board.

Our capital structure management aims to determine an appropriate capital structure for each company within the Group while minimizing costs and risks. An appropriate structure must comply with tax, legal and commercial requirements. The Group increases or decreases the capital in line with the strategic orientation of the companies.

Our liquidity management aims to ensure the effective management of cash flows within each company of the group. The central finance department and local management monitor the cash flows within the group on a daily basis and take corrective action where necessary. Financing requirements are covered by cash within the group, either through intra-group loans or through changes in equity.

The principles of the investment policy are determined by the Executive Board and approved by the Supervisory Board of AIXTRON SE. Excess cash is invested by the finance department in accordance with this policy. The policy only allows for low-risk investments.

Due to its global business operations, AIXTRON generates a portion of its revenues in foreign currencies, i. e. in currencies other than the Euro. The most prevalent foreign currency relevant for AIXTRON is the US dollar. The associated exchange rate risk is monitored by the central finance department and taken into account as part of liquidity management. Speculative foreign currency transactions are not entered into.

In the semiconductor equipment industry, it is essential to have sufficient cash and cash equivalents at all times in order to be able to quickly finance possible business expansion. AIXTRON’s current cash requirements are generally covered by cash inflows from operating activities. The Company can draw on a high level of cash and cash equivalents and other short-term investments to secure further corporate financing and to support its indispensable research and development activities. In addition, AIXTRON has the option, if necessary and subject to the approval of the Supervisory Board, to issue financial instruments on the capital market to cover additional capital requirements.

The equity ratio increased driven by the high net profit compared to the previous year and amounted to 75% as of December 31, 2023 compared to 73% as of December 31,

2022.

The share capital of AIXTRON SE amounted to EUR 113,411,020 as of December 31, 2023 (December 31, 2022: EUR 113,348,420). It is divided into 113,411,020 no-par value registered common shares with a pro rata amount of share capital of EUR 1.00 per share. All shares are fully paid in. The increase in share capital is attributable to the shares issued in the fiscal year under stock option programs.

In fiscal year 2023, 62,600 stock options from past stock option programs were exercised (2022: 56,400 options) and no new stock options were issued (2022: 0 options).

As of December 31, 2023 and 2022, AIXTRON did not have any bank borrowings.

To safeguard advance payments received from customers for orders, the Group had bank guarantee lines amounting to EUR 104.4 million as of December 31, 2023 (2022: EUR

105.2 million), of which EUR 18.4 million (2022: EUR 49.8 million) had been utilized as of the reporting date.

In the year 2023, AIXTRON´s total capital expenditures amounted to EUR 62.6 million (2022: EUR 29.7 million).

Driven by the Group's growth, EUR 60.2 million (2022: EUR 27.4 million) was invested in property, plant and equipment in fiscal year 2023. Of this, EUR 36.6 million are related to the construction of the new innovation center, which began in November 2023. In addition, besides further testing and demonstration equipment in the laboratories, the investments also include the expansion of production and development areas.

EUR 2.5 million were invested in intangible assets including licenses (2022: EUR 2.3 million).

During 2023 EUR 139.4 million of fund investments were divested while fixed-term bank deposits changed by EUR 0.0 million (2022: EUR 79.6 million investments in fund investments; EUR 60.0 million reduction of fixed-term deposits).

All capital expenditures in fiscal years 2023 and 2022 were self-financed.

As of the reporting date, there were investment commitments for the construction of the innovation center amounting to EUR 55.8 million, which will be financed with cash on balance sheet.

Cash and cash equivalents including other financial assets decreased to EUR 181.7 million as of December 31, 2023 (December 31, 2022: EUR 325.2 million). As of December 31, 2023, other financial assets exclusively included fund investments totaling EUR 83.7 million (2022: EUR 220.4 million) (see also Investments).

There are no restrictions on access to the Company's cash and cash equivalents.

Cash flow from operating activities amounted to EUR -47.3 million in fiscal year 2023 (2022: EUR 37.1 million). This is mainly the result of the build-up of inventories and the increase in receivables as of the reporting date.

Cash flow from investing activities in the 2023 fiscal year was EUR 78.1 million (2022: EUR -48.3 million). The positive inflow was mainly influenced by the sale of fund investments, which more than offset the outflows for investments in tangible and intangible assets (see also Investments).

Cash flow from financing activities amounted to EUR -35.9 million in 2023 (2022: EUR

-34.6 million). The main drivers were the dividend payment of EUR -34.8 million (2022: EUR -33.7 million) and repayments of lease liabilities EUR -1.9 million, (2022: EUR -1.5 million). Cash inflows from the issue of new shares under stock option programs were of EUR 0.8 million (2022: EUR 0.7 million).

Free cash flow (cash flow from operating activities - investments + proceeds from disposals adjusted for changes in financial assets) for the 2023 fiscal year was EUR -109.7 million compared to EUR 7.7 million in 2022. The difference compared to the previous year is mainly related to the increase in inventories, the increased receivables due to the timing of tool shipments and higher investments in property, plant and equipment.

In fiscal year 2023, AIXTRON continued to focus on successfully serving the targeted growth markets with sustainable profitability. At the same time, the Group continued to drive development and sales activities, particularly for GaN- and SiC power electronics equipment and for the production lasers as well as Mini and Micro LED displays.

Equipment revenues in 2023 amounted to EUR 532.3 million, of this, EUR 396.1 million (74%) were generated by MOCVD/CVD systems for the production of components for the area of power electronics (GaN/SiC) and EUR 66.2 million (12%) to MOCVD systems for the area of optoelectronics (laser, solar and Telecom), as well as EUR 59.9 million (11%) for the LED area including Micro LED. Further structural growth can be expected in the end markets mentioned because the materials gallium nitride and silicon carbide are increasingly replacing traditional Silicon in modern power electronic components, the use of lasers in the areas of optical data transmission and in 3D sensing continues to increase, and new types of micro LED displays are increasingly being used commercially.

In addition to the above-mentioned activities, there is a focus on the costs as well as the margin contributions of individual revenue drivers. Furthermore, the Executive Board continuously reviews the product portfolio with a view to changing framework conditions, such as time windows for the market launch of new technologies or evaluation of our customers' product requirements.

Fiscal year 2023 developed very positively in all markets addressed by our core technology, especially with GaN and SiC power electronics. Management expects further revenue growth in the future, driven by the megatrends of digitalization, electromobility, energy efficiency and environmental sustainability.

In this context, the AIXTRON Group maintains a healthy financing structure with a high level of cash and cash equivalents and without any bank debt.

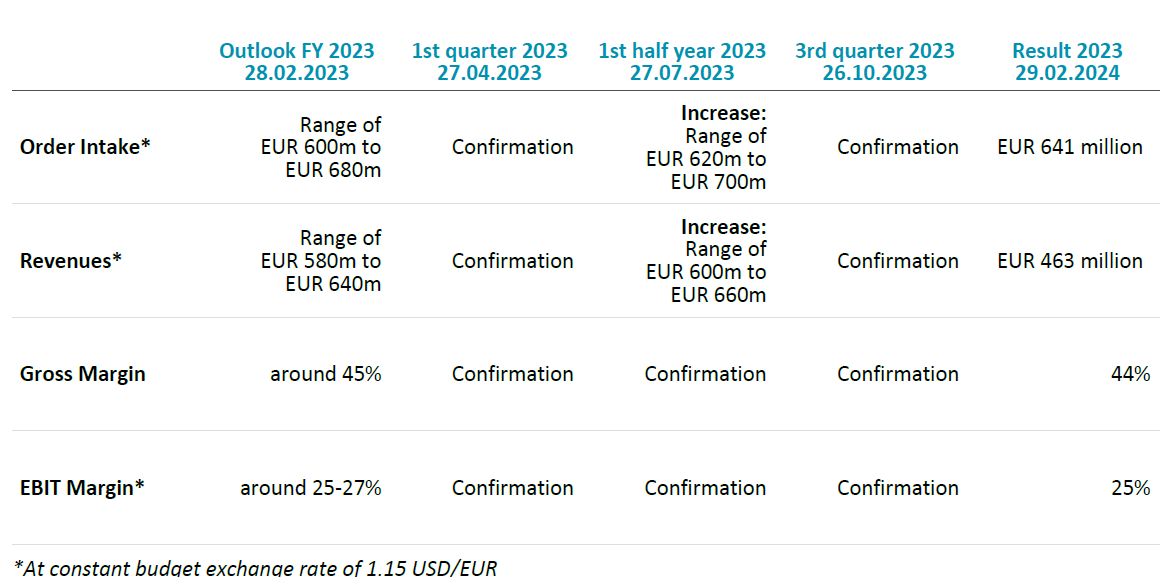

The order intake, revenue, gross margin and EBIT margin forecasts for fiscal 2023 published in the Annual Report 2022 and adjusted in conjunction with the publication of the third quarter report were fully met. This also applies with regard to the adjusted forecast ranges for order intake and revenues, which were increased when the half-year results were published::

Alan Tai

Taiwan/Singapore

Christof Sommerhalter

USA

Christian Geng

Europe

Hisatoshi Hagiwara

Japan

Nam Kyu Lee

South Korea

Wei (William) Song

China

AIXTRON SE (Headquarters)

AIXTRON 24/7 Technical Support Line

AIXTRON Europe

AIXTRON Ltd (UK)

AIXTRON K.K. (Japan)

AIXTRON Korea Co., Ltd.

AIXTRON Taiwan Co., Ltd. (Main Office)

AIXTRON Inc. (USA)

Christoph Pütz

Senior Manager ESG & Sustainability

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Ralf Penner

Senior IR Manager

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Prof. Dr. Michael Heuken

Vice President Advanced Technologies