- / HOME

As a manufacturer of capital goods, AIXTRON may be affected by the development of the general economic environment, as this could impact its own suppliers, manufacturing costs, and sales opportunities, driven by customers’ willingness to invest.

In 2021, the global economy recovered significantly from the COVID-19-related slump of the previous year. On the one hand, this is thanks to the COVID-19 vaccines that are now available. On the other hand, the recovery of the global economy has been supported by further fiscal policy measures, particularly in the US. At the same time, the recovery is taking place at different speeds - depending, for example, on the uneven distribution of vaccines, national fiscal and monetary policy options, or the different extent of the pandemic-related burden on the individual economies, e. g. predominantly production versus tourism-oriented orientations. For example, the economies of China and the USA, which are particularly important for AIXTRON, have recovered from the crisis much faster than many other countries. However, in the second half of the year, the recovery was partially slowed down by pandemic-related supply bottlenecks and sharply rising raw material prices. In addition, the development remains subject to numerous uncertainties. These include in particular the global progress of the vaccination programs, the inflation trend, which poses a difficult task for monetary policy in particular, and also the employment trend, which is not keeping pace. Overall, in the January 2022 update of its World Economic Outlook, the International Monetary Fund (IMF) sees global economic output growing by 5.9% in 2021, following a 3.1% decline in 2020. The growth rate for the industrialized nations is 5.0% (2020: -4.5%), while the growth rate for the emerging and developing countries is 6.5% (2020: -2.0%). Meanwhile, world trade grew by 9.3% (2020: -8.2%). Correspondingly, the strongly export-oriented German mechanical and plant engineering sector also developed positively. According to reports by the German Engineering Federation (Verband Deutscher Maschinen- und Anlagenbau e. V.). (VDMA) , the sector recorded a real increase in order intake of 33% in the first eleven months of the year. Orders from abroad increased by 41%, while domestic orders rose by 18%. Overall, the trend leveled off over time, as the economy continues to perform well but catch-up effects have now been worked off.

Demand for AIXTRON products continues to be largely dependent on industry-specific developments, such as the introduction of new applications in consumer electronics, IT infrastructure, electromobility, or demand in sub-segments of the global semiconductor market, which continued to be very robust overall - also due to the trend towards digitalization, which was reinforced by the pandemic. In addition, AIXTRON can continuously rely on a stable and uninterrupted supply chain.

Expectations about the Fed's future interest rate policy had a major influence on the development of the US dollar exchange rate in 2021. Accordingly, the exchange rate reacted strongly to many news, be it inflation rates or bond yields, which pointed to an approaching end of the loose monetary policy. While the US dollar traded in a relatively narrow range around the 1.20 USD/EUR mark in the first half of the year, it gained steadily in value in the second half of the year as inflationary pressure increased. The US dollar closed the year at 1.1372 USD/EUR on December 31, 2021 (2020: 1.2232 USD/EUR), thus strengthening by 7% overall. AIXTRON applied an average USD/EUR exchange rate of 1.19 USD/EUR in fiscal year 2021 (Q1/2021: 1.22 USD/EUR; Q2/2021: 1.20 USD/EUR; Q3/2021: 1.18 USD/EUR; Q4/2021: 1.15 USD/EUR). On average for the year, the exchange rate was thus just above the previous year's average (2020: 1.14 USD/EUR).

Compared to the previous year, this had a correspondingly negative impact on the Group’s US dollar denominated revenues.

AIXTRON Management continues to carefully monitor the developments of the global economy and the financial markets to decide what can potentially be done to mitigate negative exogenous effects on AIXTRON’s business. In 2021, no forward exchange contracts or other hedging transactions were entered into. As of December 31, 2021, no currency hedging contracts were in place. The Executive Board reserves the right to carry out hedging transactions in the future, should this be deemed appropriate.

Competitors in the market for CVD/MOCVD equipment are Veeco Instruments, Inc. (USA, “Veeco”), Taiyo Nippon Sanso (Japan, “TNS”), Tokyo Electron Ltd. (Japan, “TEL”), Advanced Micro-Fabrication Equipment Inc. (China, “AMEC”), Tang Optoelectronics Equipment Corporation Limited (China, “TOPEC”) as well as LPE (Italy) and Nuflare Technology Inc. (Japan, “Nuflare”). Other companies are also continuing to try to qualify their own MOCVD systems with their customers. For example, Technology Engine of Science Co. Ltd. (South Korea, “TES”), Zhejiang Jingsheng Mechanical (China) (“JSG”) and HERMES Epitek (Taiwan, “HERMES”) are working on the development of their own MOCVD system solutions and are trying to establish them in the market.

Based on the published financial results of competitors and own estimates, AIXTRON sees its global market leadership for MOCVD equipment in 2020 confirmed. AIXTRON thus holds the top position for the fifth year in a row: accordingly, AIXTRON's market share amounted to 58%, followed by Veeco (USA) with 26% and AMEC (China) with 16%. At the same time, the global market for MOCVD equipment decreased slightly in 2020 compared to the previous year, totaling USD 438 million (2019: USD 488 million). For fiscal year 2021, no current market share figures from independent market analysts are yet available.

Power semiconductors based on Wide-Band-Gap (WBG) materials are one of the main applications of AIXTRON's deposition technology. These materials enable the production of very compact and highly efficient power supplies and AC/DC as well as DC/DC converters. They are therefore increasingly used in a wide range of applications that can cover a wide power range. WBG power semiconductors reduce conversion losses by up to 50% and thus contribute significantly to increasing energy efficiency and reducing CO2 emissions. There are two main groups of WBG power semiconductors: GaN (gallium nitride) and SiC (silicon carbide).

GaN semiconductor devices are used primarily in the low and medium power and voltage classes, such as in power supplies for smartphones and laptops, and in power supplies for servers and other IT infrastructure. GaN semiconductor devices had achieved significant volume in the market for the first time in 2020 and have since seen rapid growth, particularly in fiscal 2021. Customers are continuously tapping into new applications, for example in the field of micro inverters in the photovoltaic sector or on-board chargers in the field of electromobility. In addition, the customer base for AIXTRON's GaN semiconductor equipment is continuously expanding, while existing customers are increasing their production capacities.

Due to the wide range of applications, Yole Développment (Yole) analysts expect the market for GaN power semiconductors to grow very strongly, from USD 46 million in 2020 to USD 1.1 billion in 2026, corresponding to a compound annual growth rate (CGAR) of 70% between 2020 and 2026.

Furthermore, GaN semiconductor devices are increasingly used in high-frequency applications. In 5G telecommunication networks and - likely - in subsequent network generations such as 6G, the advantage of GaN technology of lower power losses at high frequencies will come into play. As a result, more and more manufacturers are switching their production of high-frequency switches from silicon to GaN. Yole analysts expect the market for GaN high-frequency semiconductor devices to grow from USD 891 million in 2020 to USD 2.4 billion in 2026 at a compound annual growth rate (CAGR) of 18%.

WBG power components made of silicon carbide (SiC) also continued their growth course in 2021. They are particularly suitable for use in higher power and voltage classes. Fields of application are primarily electric vehicles and their fast charging stations, but also converters in the field of photovoltaics and wind energy and other electric drives. In these applications, SiC enables a significant reduction in conversion losses, resulting in a greater range per battery charge in vehicles and a higher amount of energy delivered in the power generation sector.

Driven by significantly increased awareness of the importance of energy efficiency and CO2 reduction, both in the regulatory and private sectors, vehicle manufacturers worldwide have raised their targets for powertrain electrification. This trend is increasingly accelerated by the push in numerous states to set specific dates for a halt in registrations or sales of new vehicles with internal combustion engines.

Based on this trend, Yole forecasts that the SiC device market will grow from under USD 1.1 billion currently to USD 4.4 billion by 2026 at a CAGR of 32%. According to the analysts, this is particularly due to the development of electric cars and the corresponding fast charging infrastructure.

Red, orange and yellow LEDs (ROY LEDs) are used in Mini LED displays, among other things, in large-format color displays for sports stadiums, airports and shopping malls, as well as in automotive taillights or for indoor farming. In addition, televisions and monitors in the premium segment are increasingly being equipped with Mini LEDs for backlighting. The market for infrared and ROY LED manufacturing equipment is expected to double from 2020 to 2025, reaching USD 108 million (Epitaxy Growth Equipment for More than Moore Devices Report, Yole, 2020). According to Yole, the demand for the global area of direct-emitting, large-area LED display walls is growing at an average rate of 63% per year between 2017 and 2024.

The market for UV LEDs (Ultra-Violet Light Emitting Diodes) is another specialized segment in the LED market that AIXTRON addresses. UV LEDs are used for curing plastics and disinfecting surfaces, circulating air and (drinking) water. Due to the increasing demand for hygiene, this market is expected to gain importance in the future. According to LEDInside (Deep UV LED Application Market and Branding Strategies, LEDInside 2020), the market for UV LEDs is expected to grow at a high rate from USD 310 million in 2020 to USD 1.4 billion in 2025, representing an annual growth rate of 35%.

According to LEDinside, the greatest growth potential in the field of LEDs is the market for Micro LEDs. Analysts expect Micro LEDs to be used initially in very small displays such as smartwatches and very large displays such as large-screen premium TVs. In the long term, other potential applications include displays in smartphones, tablets and notebooks. LED technology is currently still in the early stages of development, so estimates of future market size by various analysts diverge widely. For example, LEDinside predicts the Micro LED market to grow from USD 318 million in 2020 to USD 2.9 billion in 2025. As Micro LED technology matures, AIXTRON expects the currently still very young market for Micro LEDs to differentiate both technically and commercially.

The volume of data transmitted via fiber optic cable continues to grow exponentially, driven by the increasing use of cloud computing and Internet services. Especially the growing use of video-on-demand, as well as the communication of networked devices via the Internet (“Internet of Things”) contribute to increasing data volumes. In addition to the data volumes, the enormously fast transmission at the speed of light for optical data transmission also plays a major role. Lasers, which are manufactured on AIXTRON equipment, are key components for high-speed optical data transmission. The growth in global data traffic due to mobile telecommunications, the switch to 5G standards, and data transfer via optical fibers increase the demand for lasers as optical signal generators, photodiodes as receivers, and optical amplifiers and switches.

Market research firms such as Yole and Strategies Unlimited expect investment in laser-based communications to continue to increase to accommodate growing data traffic. For this reason, market research firm Yole predicts that revenues from transceivers used in telecommunications will grow at a compound annual growth rate of 14% from 2020 to 2025. The total market volume in 2025 is forecast by Yole to exceed USD 20.9 billion.

Laser-based 3D sensors are often used in high-end mobile phones. Since this technology was introduced to the market with the iPhone X in 2017, Apple has been using it in its third-generation smartphones and is now also using it in its tablet series. In addition, more and more mobile phone manufacturers are equipping their models with 3D sensors. With these sensors, the environment can be captured in three dimensions, which is important for many applications, e. g. augmented reality. Consumer electronics, for example, will be the main demand driver for laser-based 3D sensors in the next few years, according to market research company Yole. Yole expects surface emitting lasers to grow from USD 1.2 billion in 2021 to USD 2.4 billion in 2026, representing a compound annual growth rate ("CAGR") of 13.5%.

In addition to consumer electronics applications, edge and surface emitting lasers are increasingly being used in the industrial and automotive sectors for 3D sensing. Yole expects a strong increase in demand for these components by 2026, especially from the automotive industry, as an element for distance measurement in driver assistance systems and in autonomous vehicles (LiDAR).

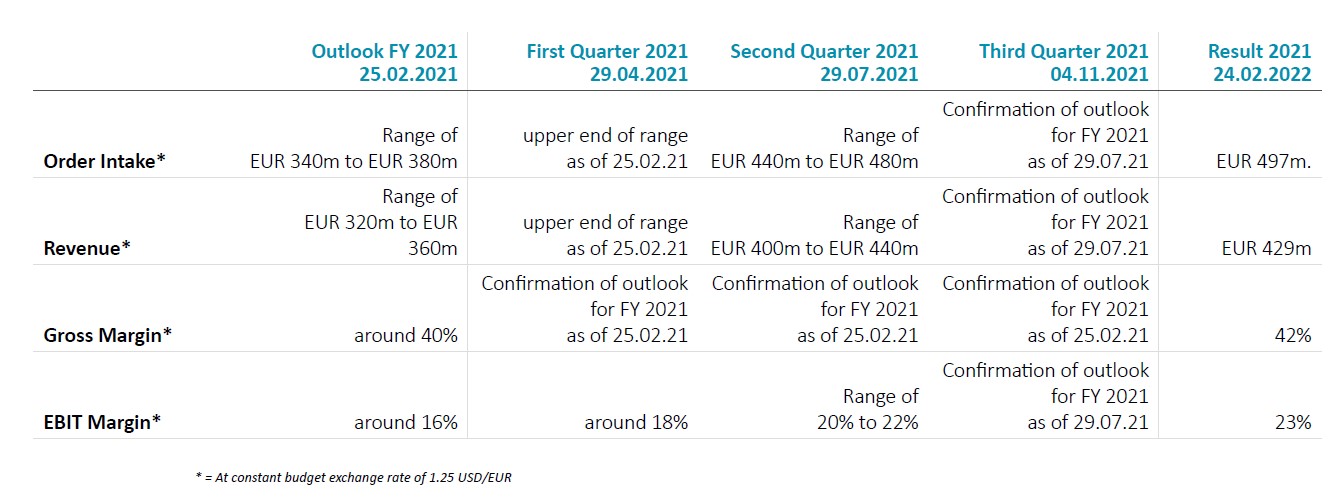

The global COVID-19 pandemic continued to have a significant impact on the world economy and global supply chains in fiscal year 2021. However, through early initiated and consistently applied protective measures, this had only a minor impact on AIXTRON SE’s workforce. AIXTRON was also able to effectively mitigate the strain in the global supply chains through early implemented countermeasures, resulting in revenue growth of 59% in 2021. Accordingly, we again met our guidance issued in February 2021 and increased during the year in all key performance indicators without exception.

In particular, a strong increase in demand for AIXTRON’s Gallium Nitride (GaN) power device production equipment characterized the year under review. AIXTRON’s other products also experienced strong demand in 2021, for example, systems for the production of lasers for optical data communication and 3D sensing, systems for LEDs, and increasingly systems for Micro LEDs. Customer demand also increased for equipment to manufacture energy-efficient power electronics based on silicon carbide (SiC), as well as for equipment to manufacture components for wireless telecommunications. With orders totaling EUR 497.3 million (2020: EUR 301.4 million), we recorded the highest order volume since 2011 in fiscal year 2021. As expected, revenues also developed very positively and, at EUR 429.0 million (2020: EUR 269.2 million), were in line with the forecast given and also reached the highest level since 2011. At 42%, the gross margin achieved was slightly above expectations, mainly due to the strong increase in the USD exchange rate in the 4th quarter. The increased operating expenses of EUR 82.5 million included higher variable compensation components as well as one-time expenses for our subsidiary APEVA in the amount of EUR 3.9 million. The operating result was EUR 99.0 million with an EBIT margin of 23% (2020: EUR 34.8 million; 13%). This resulted in a net profit of EUR 94.8 million (2020: EUR 34.5 million). Free cash flow (cash flow from operating activities adjusted for changes in financial assets - investments + proceeds from disposals) of EUR 48.7 million (2020: EUR 14.0 million) was reported for the financial year 2021.

In the year 2021, AIXTRON has been actively pursuing the renewal of its product portfolio. The next generation of systems in the GaN power electronics, SiC power electronics and laser / Micro LED market segments have made great progress in development and are currently undergoing trials with first customers. In addition, we have won further well-known customers such as Bosch and Nexperia for our equipment technology for the efficient large-scale production of high-performance silicon carbide power electronics.

Our OLED subsidiary APEVA was initially restructured in the second quarter of 2021 and focused on the Chinese market. However, as customers in this market are also opting for Micro LED as the technological basis for the development of the next generation of displays even faster than originally expected, the shareholders of APEVA have decided not to make any further investments in APEVA and to recognize corresponding impairment losses.

In order to achieve a sustainable profitable development of the AIXTRON Group in the future, our product portfolio focuses exclusively on product lines with a positive earnings contribution or those that promise a significant return on investment (ROI) in the foreseeable future.

In the fiscal year 2021 US dollar-based order intake and order backlog have been recorded at the budget exchange rate of 1.25 USD/EUR (2020: 1.20 USD/EUR). Spares & service orders are not included in the order backlog.

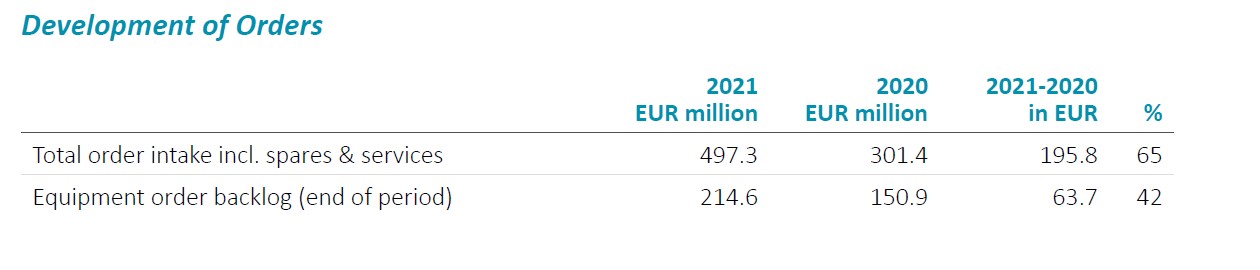

In 2021, total order intake including spares & services stood at EUR 497.3 million, thus significantly higher than the previous year’s figure. This development was driven in particular by continuously strong demand from the fields of power electronics, optical data communication and LEDs. In Q4/2021, order intake at EUR 119.7 million was up 5% against the previous quarter (Q3/2021: EUR 114.2 million).

At EUR 214.6 million, the equipment order backlog as of December 31, 2021, was also higher than the order backlog of EUR 150.9 million at the end of 2020 (2021 budget rate: 1.25 USD/EUR; 2020 budget rate: 1.20 USD/EUR). Compared to the end of the previous quarter, the order backlog decreased due to the high number of shipments in the fourth quarter by 20% at year-end (September 30, 2021: EUR 267.6 million).

In line with strict internal procedures, AIXTRON has defined clear conditions that must be met for the recording of equipment orders in order intake and order backlog. These conditions include the following requirements:

1. the receipt of a firm written purchase order,

2. the receipt or securing of the agreed down payment,

3. accessibility to the required shipping documentation,

4. a customer confirmed agreement on a system specific delivery date.

In addition, and taking into account current market conditions, the Management Board reserves the right to assess whether the actual realization of each system order is sufficiently likely to occur in a timely manner. If, as a result of this review, Management comes to the conclusion that the realization of an order is not sufficiently likely or involves an unacceptable degree of risk, Management will exclude this specific order or a portion of this order from the recorded order intake and order backlog figures until the risk has decreased to an acceptable level. The order backlog is regularly assessed and - if necessary - adjusted in line with potential execution risks.

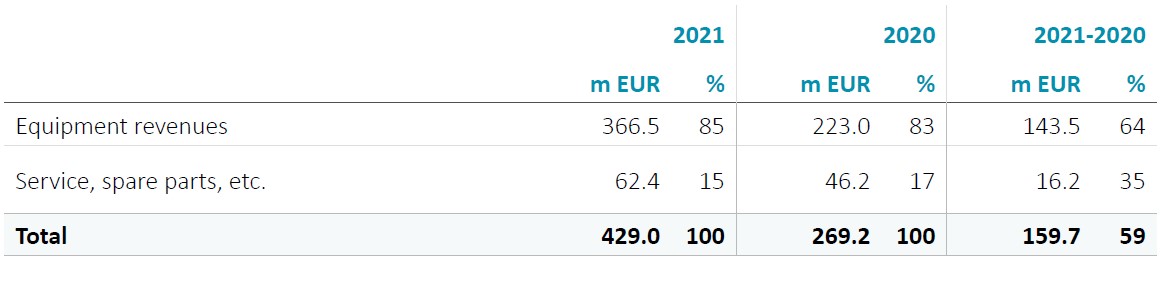

Revenues in fiscal year 2021 amounted to EUR 429.0 million and were thus about 59% higher than in the previous year (2020: EUR 269.2 million). EUR 62.4 million or 15% of revenues in fiscal year 2021 were generated from the sale of spare parts and services. In total, revenues with MOCVD systems rose by around 64% year-on-year. In particular, the strong increase in demand for MOCVD equipment for the production of GaN power devices led to a doubling of equipment sales in the power electronics segment. The optoelectronics business also grew, driven in particular by continued strong demand from the optical data transmission sector for fiber optic networks. Due to demand, particularly from the field of LED displays, and initial demand from the field of Micro LEDs, AIXTRON also grew in this segment. The revenue shares developed as follows: Power electronics contributed 38% of equipment revenues, followed by optoelectronics with 37% and specialty LEDs with 23%.

At EUR 299.9 million, demand from customers in Asia continued to account for the majority of total revenues in 2021. The lower contribution from customers outside of Asia were a result of the regional mix of customers addressing the above-mentioned demand drivers.

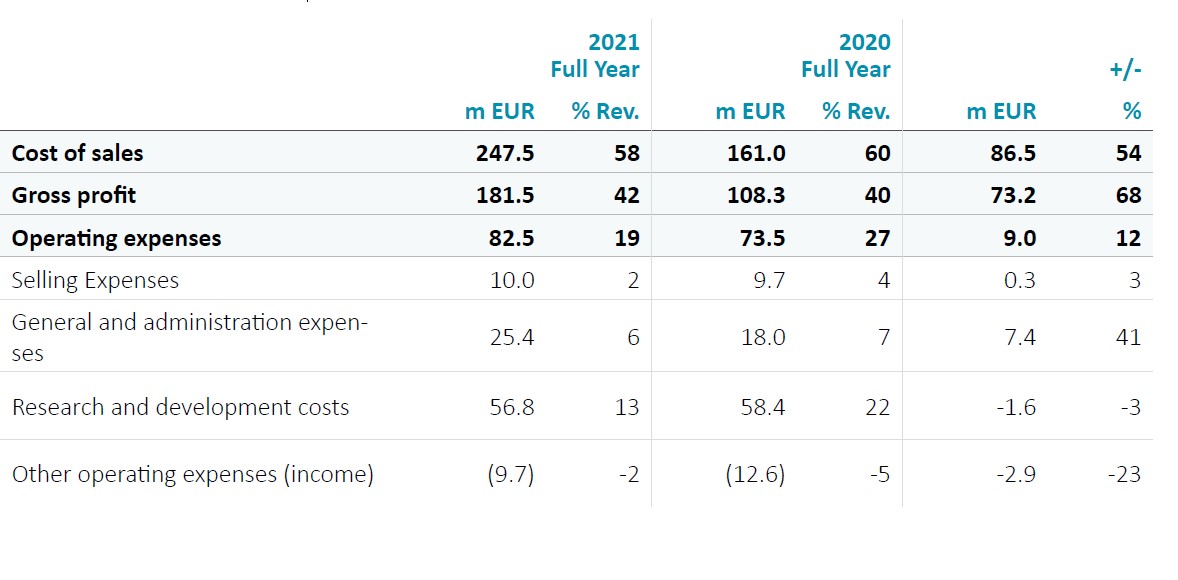

Cost of sales amounted to EUR 247.5 million in the past fiscal year (2020: EUR 161.0 million) and decreased relative to revenues to 58% (2020: 60%). This is mainly due to a more favorable product-mix. This resulted in a gross profit of EUR 181.5 million in the fiscal year, which corresponds to a gross margin of 42%.

In absolute terms, operating expenses increased significantly in the 2021 fiscal year compared to the previous year, but they declined relative to revenues. In absolute terms, operating expenses increased from EUR 73.5 million in the year 2020 to EUR 82.5 million in the past fiscal year. Contributing to the increase in operating expenses were higher variable remuneration components. Furthermore, additional restructuring expenses and other non-recurring expenses for APEVA in the total amount of approximately EUR 3.9 million were incurred. EUR 3.2 million of these expenses had been recognized in Q2 2021 in connection with the realignment to the Chinese market. Due to the faster than expected orientation of customers towards Micro LED also in this market and the resulting decision not to invest further in APEVA, further depreciation and other expenses in the amount of EUR 0.7 million were incurred. In the previous year, a special effect due to a change of use for a production facility had led to other operating income in the amount of EUR 2.9 million.

The following individual effects must be taken into account:

Selling, general and administrative expenses were higher in a year-on-year comparison at EUR 35.4 million (2020: EUR 27.7 million). Relative to revenues, selling, general and administrative expenses amounted to 8% (2020: 10%). The development was mainly attributable to higher variable remuneration.

Research and development expenses, including expenses for OLED development activities, decreased slightly by 3% year-on-year to EUR 56.8 million. This is mainly due to a reduction in development expenses for OLED technology, which was offset only to a lesser extent by an increase in the development expenses for next-generation MOCVD equipment.

Net other operating income and expenses in 2021 resulted in an income of EUR 9.7 million (2020: income of EUR 12.6 million).

The high positive figure for the previous year was significantly influenced by the above-mentioned special effect from the reversal of impairment losses due to the change of use of a production facility.

Other operating income includes grants for publicly funded development projects amounting to EUR 8.9 million (2020: EUR 8.1 million).

In fiscal year 2020, a net foreign exchange gain of EUR 1.2 million (2020: EUR 0.8 million loss) was recorded from transactions in foreign currencies and the translation of balance sheet items.

At EUR 79.3 million, personnel costs in fiscal year 2021 were 20% higher than the EUR 66.1 million in 2020. This increase was mainly due to higher variable expenses and the above-mentioned restructuring charges.

The operating result (EBIT) improved year-on-year by 184% and amounted to EUR 99.0 million in the fiscal year 2021 (2020: EUR 34.8 million). This development is mainly due to the year-on-year increase in revenues and the related gross margin and is thus attributable to the business and cost development described above. Further details are provided in the consolidated statement of profit or loss in the consolidated financial statements on page 120.

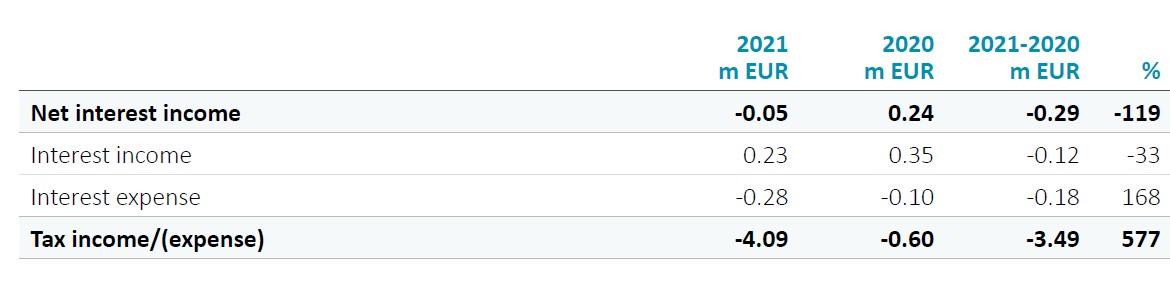

Profit before tax at EUR 98.9 million in 2021 was clearly higher than in the previous year (2020: EUR 35.1 million). This includes net interest result of EUR 0.05 million.

In 2021, AIXTRON reported an income tax expense of EUR 4.1 million (2020: EUR 0.6 million income tax expense). This includes income from the capitalization of deferred taxes on loss carryforwards in the amount of EUR 9.6 million due to expected future profits.

The AIXTRON Group's consolidated net income in fiscal year 2021 was EUR 94.8 million, or 22% of revenues (2020: EUR 34.5 million or 13%).

The Balance Sheet Total as of 31 December 2021 increased year-on-year to EUR 740.7 million (December 31, 2019: EUR 590.4 million). The complete consolidated statement of financial position can be found in the consolidated financial statements on page 122.

Property, plant and equipment increased from EUR 63.5 million as of 31 December 2020 to EUR 74.0 million as of 31 December 2021 due to increased investments, particularly in laboratory plant and equipment.

Goodwill was EUR 72.3 million compared to EUR 71.0 million as of December 31, 2020. The difference is completely due to exchange rate fluctuations. No impairment losses were recognized. Further information on goodwill is provided in Note 12 "Intangible assets" in the Notes to the Consolidated Financial Statements.

Other intangible assets decreased to EUR 2.2 million as of 31 December 2021 (31 December 2020: EUR 2.9 million), as depreciation was slightly higher than capital expenditures.

Inventories, including components and work in progress, increased by EUR 41.6 million year-on-year to EUR 120.6 (December 31, 2020: EUR 79.0 million), indicating the high number of deliveries planned in subsequent quarters. The inventory turnover rate at the end of 2021 was 2.0 (2020: 2.0).

Trade receivables were EUR 81.0 million at December 31, 2021 (December 31, 2020: EUR 41.3 million), reflecting the high volume of shipments in the fourth quarter of 2021. The current days sales outstanding was 23 days at the end of 2021 compared to 18 days at the end of 2020.

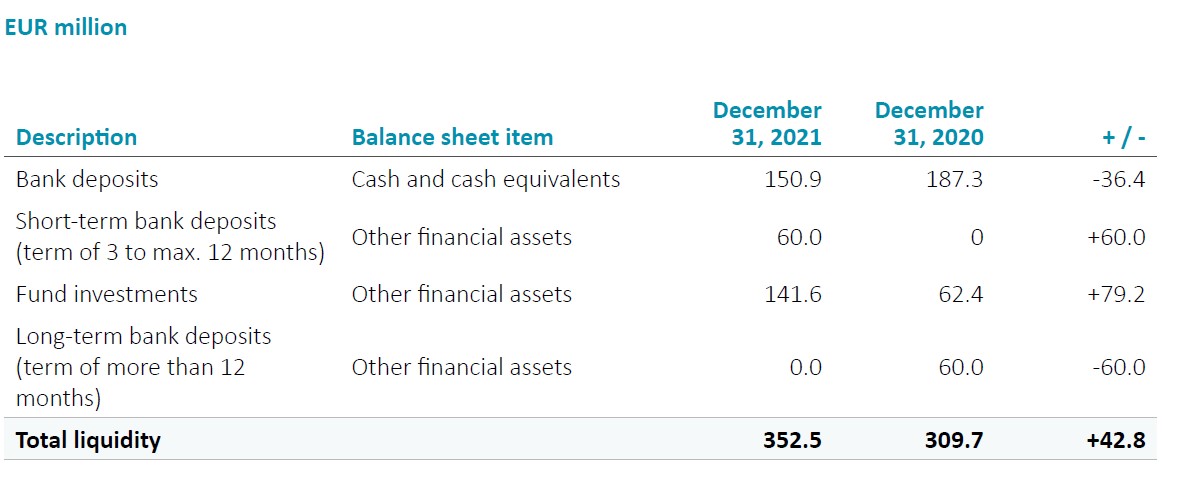

Cash and cash equivalents and financial assets increased to EUR 352.5 million as of December 31, 2021 (31. December 2020: EUR 309.7 million). The increase is mainly due to the higher net income for the period. This is countered by offsetting effects from the build-up of inventories, mainly as a result of the higher business volume as well as from higher receivables, due to a disproportionately strong revenue contribution in the last quarter.

As of December 31, 2021, other financial assets include fund investments of EUR 141.6 million (December 31, 2020: EUR 62.4 million), short-term bank deposits of EUR 60.0 million (December 31, 2020: EUR 0 million) and long-term bank deposits of EUR 0 million (December 31, 2020: EUR 60.0 million). The non-current bank deposits of EUR 60.0 million included as of December 31, 2020 were reclassified to current financial assets in 2021. Please also refer to note 17 of the notes to the consolidated financial statements.

Trade payables increased to EUR 19.6 million as of December 31, 2021 (December 31, 2020: EUR 10.8 million), due to the increased procurement volume.

Provisions (non-current and current) increased from EUR 20.2 million as of December 31, 2020, to EUR 31.8 million as of December 31, 2021. This was due on the one hand to a high number of systems being shipped with associated provisions for warranties, and on the other hand to higher provisions for variable remuneration.

At EUR 77.0 million as of December 31, 2021, advance payments received from customers were significantly above the previous year's level (December 31, 2020: EUR 50.8 million), reflecting the current positive order situation.

Other current liabilities include payments received for publicly funded development projects and decreased slightly year-on-year to EUR 6.4 million (December 31, 2020: EUR 7.4 million).

AIXTRON has a central financial management system whose primary objective is to ensure the long-term financial strength of the Group. AIXTRONs financial management includes the control of its global liquidity as well as its interest and currency management. Financial processes and responsibilities are defined throughout the Group. The investment policy is approved by the Supervisory Board.

Our capital structure management aims to determine an appropriate capital structure for each company within the Group while minimizing costs and risks. An appropriate structure must comply with tax, legal and commercial requirements. The Group increases or decreases the capital in line with the strategic orientation of the companies.

Our liquidity management aims to ensure the effective management of cash flows within each company of the group. The central finance department and local management monitor the cash flows within the group on a daily basis and take corrective action where necessary. Financing requirements are covered by cash within the group, either through intra-group loans or through changes in equity.

The principles of the investment policy are determined by the Executive Board and approved by the Supervisory Board of AIXTRON SE. Excess cash is invested by the finance department in accordance with this policy. The policy only allows for low-risk investments.

Due to its global business operations, AIXTRON generates a portion of its revenues in foreign currencies, i. e. in currencies other than the Euro. The most prevalent foreign currency relevant for AIXTRON is the US dollar. The associated exchange rate risk is monitored by the central finance department and taken into account as part of liquidity management. Speculative foreign currency trans-actions are not concluded.

In the semiconductor equipment industry, it is essential to have sufficient cash and cash equivalents at all times in order to be able to quickly finance possible business expansion. AIXTRON’s current cash requirements are generally covered by cash inflows from operating activities. The Company can draw on a high level of cash and cash equivalents and other short-term investments to secure further corporate financing and to support its indispensable research and development activities. In addition, AIXTRON has the option, if necessary and subject to the approval of the Supervisory Board, to issue financial instruments on the capital market to cover additional capital requirements.

The equity ratio decreased slightly mainly due to the significantly increased advance payments from customers and the correspondingly higher balance sheet total compared to the previous year and amounted to 80% as of December 31, 2021 compared to 84% as of December 31, 2020.

The share capital of AIXTRON SE amounted to EUR 113,292,020 as of December 31, 2021 (December 31, 2020: EUR 112,927,320; December 31, 2019: EUR 112,927,320). It is divided into 113,292,020 no-par value registered common shares with a pro rata amount of share capital of EUR 1.00 per share. All shares are fully paid in. The increase in share capital is attributable to the shares issued in the fiscal year under stock option programs. Please also refer to Note 22 in the Notes to the consolidated financial statements.

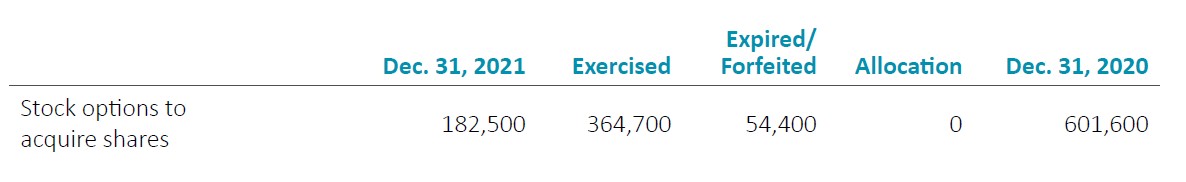

In fiscal year 2021, 364,700 stock options from past stock option programs were exercised (2020: 0 options) and no new stock options were issued (2020: 0 options). Please also refer to note 22 in the notes to the consolidated financial statements.

As of December 31, 2021 and 2020, AIXTRON did not have any bank borrowings.

To safeguard advance payments received from customers for orders, the Group had aval lines amounting to EUR 70.1 million as of December 31, 2021 (2020: EUR 71.8 million), of which EUR 24.7 million (2020: EUR 35.3 million) had been utilized as of the reporting date.

In the fiscal year 2021, AIXTRON Group’s total capital expenditures amounted to EUR 17.7 million (2020: EUR 9.3 million).

In the course of the Group's growth, EUR 16.4 million (2020: EUR 7.8 million) was invested in property, plant and equipment in fiscal year 2021. These investments include additional test and demonstration facilities as well as the expansion of production and development areas. A further EUR 1.3 million was invested in financial assets and intangible assets including software licenses and other non-current financial assets (2020: EUR 1.4 million).

For fiscal year 2021, the cash flow statement showed a cash outflow from investing activities of EUR 0 million due to changes in time deposits with a maturity of at least three months (2020: outflow of EUR 32.5 million).

All investments in the fiscal years 2021 and 2020 were funded out of available cash resources.

Cash and cash equivalents including other financial assets increased to EUR 352.5 million as of December 31, 2021 (December 31, 2020: EUR 309.7 million). As of December 31, 2021, other financial assets included fund investments in the amount of EUR 141.6 million and, in addition, bank deposits, primarily in euros, with a maturity of less than twelve months in the amount of EUR 60.0 million, which were reported under other non-current assets in the previous year due to their maturity and were reclassified to current financial assets in the financial year (see also “Investments”).

There are no restrictions on access to the Company's cash and cash equivalents.

Mainly due to an increase in fund investments, cash flow from operating activities amounted to EUR 13.5 million in fiscal year 2021 (2020: EUR -39.2 million). Adjusted for this effect, cash flow amounted to EUR 66.4 million (2020: EUR 23.3 million). This is mainly the result of the increase in net income for the year. This was offset by the effects of the increase in inventories and the higher level of receivables as of the reporting date.

Cash flow from investing activities in the 2021 fiscal year was EUR -17.5 million (2020: EUR -41.5 million). This figure is mainly attributable to investments, above all in laboratory plant and equipment. In the previous year, cash flow from investing activities included changes in fixed-term deposits with a maturity of at least three months amounting to EUR -32.5 million (change in fixed-term deposits 2021: EUR 0.0 million; 2020: EUR -32.5 million). Adjusted for the effect of changes in fixed-term deposits, cash flow from investing activities would have been EUR -9.0 million in 2020.

Cash flow from financing activities amounted to EUR -8.6 million in 2021 (2020: EUR -0.9 million; 2019: EUR -1.2 million). The main drivers were the dividend payment of EUR -12.3 million (2020: EUR 0) and cash inflows from the issue of new shares under stock option programs of EUR 4.8 million (2020: EUR 0). In 2020, the cash outflow resulted mainly from repayments of lease liabilities.

Free cash flow (cash flow from operating activities adjusted for changes in financial assets - investments + proceeds from disposals) for the 2021 fiscal year was EUR 48.7 million compared to EUR 14.0 million in 2020 (free cash flow 2019: EUR 35.1 million). The difference compared with the previous year is mainly due to the increase in net income for the year and higher trade receivables as of the balance sheet date.

AIXTRON’s key performance indicators are order intake, revenues, gross margin and EBIT margin. These form the basis for group-wide operational and strategic planning. They are used to pursue the goal of combining profitable revenue growth with cost and asset efficiency in order to achieve a sustainable increase in value. Thus, AIXTRON now focuses on four key performance indicators for the Group.

As non-financial performance indicators, the proportions of environmentally sustainable revenues, capital expenditures (CapEx) and operating expenses (OpEx) as defined by the EU Taxonomy Regulation are used for internal corporate management.

In fiscal year 2021, AIXTRON continued to focus on successfully addressing the targeted growth markets with sustainable profitability. At the same time, the Group continued to drive development and sales activities, particularly for power electronics equipment and for the production of Mini and Micro LED displays.

Equipment revenues in 2021 amounted to EUR 366.5 million, of which EUR 139.7 million (38%) was generated by MOCVD/CVD equipment for the production of components for the power electronics segment (GaN/SiC) and EUR 137.0 million (37%) by MOCVD equipment for the optoelectronics segment (laser, solar and telecom). Further fundamental growth is expected in the aforementioned markets, as modern power electronics components are increasingly made of silicon carbide or gallium nitride materials, and the use of lasers in the fields of optical data transmission and 3D sensor technology continues to increase.

In addition to the above-mentioned activities, there is a focus on the costs as well as the margin contributions of individual revenue drivers. In addition, the Executive Board continuously reviews the product portfolio with a view to changing framework conditions, such as time windows for the market launch of new technologies or evaluation of our customers' product requirements.

The fiscal year 2021 developed very positively in all markets addressed by our core technology. Management expects further revenue growth in the future, driven by the megatrends of digitalization, electromobility, energy efficiency and climate protection.

In this context, the AIXTRON Group maintains a healthy financing structure with a high level of cash and cash equivalents and without any bank debt.

In order to give our stakeholders including our shareholders the opportunity to follow our business development, we regularly publish our guidance for the current year with the publication of the annual report of the previous year. The order intake, revenue, gross margin and EBIT margin forecasts for the 2021 financial year published in the 2020 Annual Report and raised several times in the course of the year were fully met.

For the non-financial performance indicators newly defined in fiscal year 2020, energy consumption of the AIXTRON Group (measured in kWh standardized to the most important consumption drivers) and further training of the employees of the AIXTRON Group (measured in completed further training hours), target figures were defined for the expiry of a reference period of three years in each case. These non-financial performance indicators can therefore be reported for the first time at the end of fiscal year 2022 as part of a plan/actual comparison.

Alan Tai

Taiwan/Singapore

Christof Sommerhalter

USA

Christian Geng

Europe

Hisatoshi Hagiwara

Japan

Nam Kyu Lee

South Korea

Wei (William) Song

China

AIXTRON SE (Headquarters)

AIXTRON 24/7 Technical Support Line

AIXTRON Europe

AIXTRON Ltd (UK)

AIXTRON K.K. (Japan)

AIXTRON Korea Co., Ltd.

AIXTRON Taiwan Co., Ltd. (Main Office)

AIXTRON Inc. (USA)

Christoph Pütz

Senior Manager ESG & Sustainability

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Ralf Penner

Senior IR Manager

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Prof. Dr. Michael Heuken

Vice President Advanced Technologies