- / HOME

The management report of AIXTRON SE and the Group management report of the AIXTRON Group are combined according to Section 315 Para. 5 HGB in conjunction with Section 298 Para. 2 HGB. The report is published in the Federal Gazette.

The annual financial statements of AIXTRON SE have been prepared in accordance with the Ger-man Commercial Code (HGB) and the German Stock Corporation Act (AktG). The individual financial statements generally serve to determine the balance sheet profit and thus the possible distribution amount.

The combined management report comprises all legally required information regarding AIXTRON SE. In addition to the reporting on the AIXTRON Group we explain the development of AIXTRON SE.

AIXTRON SE is the parent company of the AIXTRON Group and has its headquarters in Herzogenrath, Germany. The AIXTRON SE Management is responsible for key management functions for the Group, such as corporate strategy, risk management, investment management, executive and financial management, and communication with key target groups of the Group. AIXTRON SE generates the majority of its consolidated revenues through its operating activities of the development, production, sale and maintenance of equipment for the deposition of semiconductor materials. In addition to seven directly or indirectly wholly owned subsidiaries, which are primarily responsible for the worldwide distribution of AIXTRON's products, AIXTRON SE currently holds an 87% interest in the APEVA Group.

AIXTRON SE is not managed separately using its own performance indicators because the Company is integrated into the Group management. We refer here to the respective explanations provided for the Group. The economic framework conditions of AIXTRON SE are essentially the same as those of the AIXTRON Group and are described in detail in the chapter Business Report.

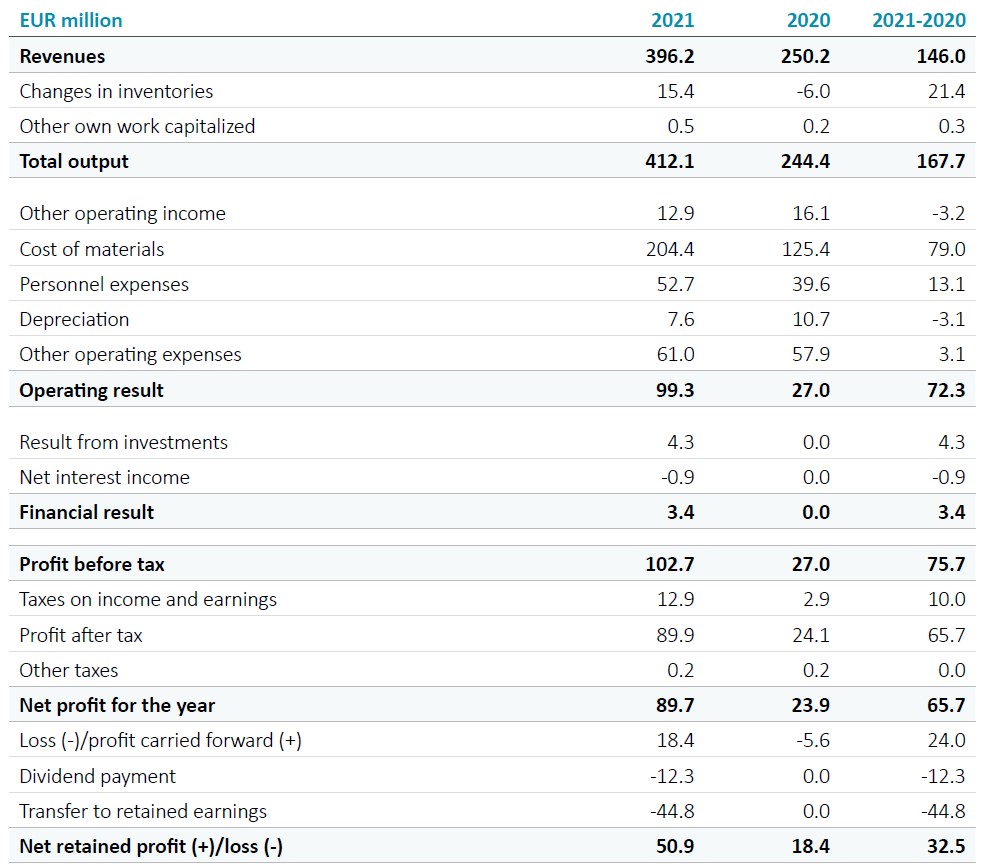

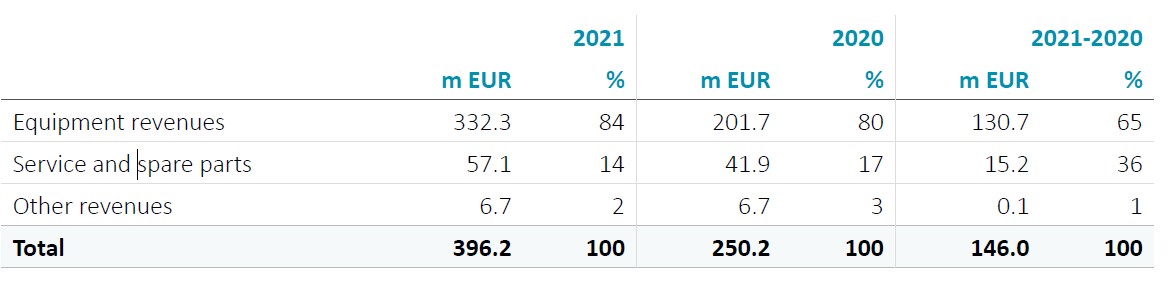

AIXTRON SE’s revenues amounted to EUR 396.2 million in fiscal year 2021 and thus increased by EUR 146.0 million, or 58%, compared with the previous year (2020: EUR 250.2 million). Revenues were influenced by continued high demand for MOCVD systems in the fields of GaN power electronics, wireless and optical data communication as well as LED applications. The other revenues are attributable to intra-Group charges.

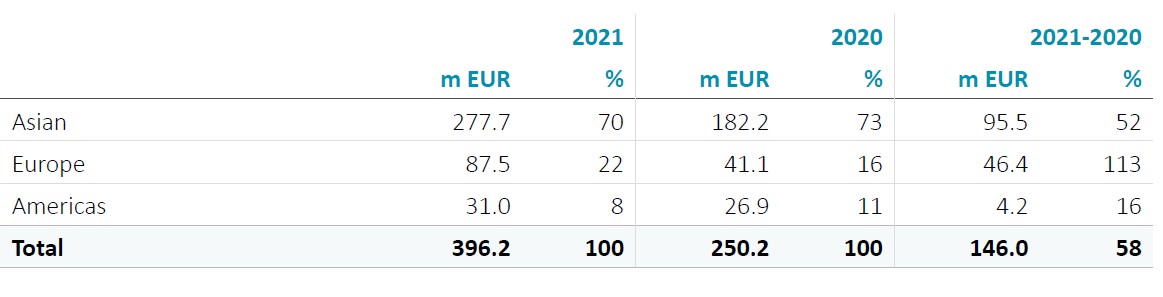

At 70%, demand from customers in Asia still accounted for the largest share of total revenues in 2021.

At 70%, demand from customers in Asia still accounted for the largest share of total revenues in 2021.

At EUR 89.7 million (2020: EUR 23.9 million), the net result for the year was significantly higher than in the previous year. The following factors contributed to this development:

At 50%, the cost of materials ratio (cost of materials in relation to total output) was slightly below the previous year’s figure (2020: 51.4%), mainly attributable to a more favorable product-mix.

The annual average number of employees at AIXTRON SE rose from 431 in the previous year to 477 in the fiscal year 2021. As result of the increased number of employees and variable remuneration components, personnel expenses increased from EUR 39.6 million in the previous year to EUR 52.7 million in fiscal year 2021.

Depreciation and amortization decreased by EUR 3.1 million from EUR 10.7 million in 2020 to EUR 7.6 million in 2021. In the previous year, higher depreciation due to shorter useful lives of some laboratory equipment had led to higher expenses.

Other operating expenses were higher at EUR 61.0 million compared to EUR 57.9 million in fiscal year 2020. The main drivers were higher variable expenses for shipped systems and expenditures for the expansion of production capacities.

In comparison to 2020, other operating income decreased from EUR 16.1 million to EUR 12.9 million in the 2021 fiscal year. This is mainly due to a one-off effect from the reversal of impairment losses due to the change in use of a production facility in the previous year.

In addition, a result from investments of EUR 4.3 million (2020: EUR 0) was generated in fiscal year 2021. This includes dividend income from subsidiaries in the amount of EUR 8.3 million as well as an impairment loss on the investment in APEVA Holdings Ltd. in the amount of EUR 4.0 million, whose earnings prospects have permanently deteriorated due to the lack of customer interest.

Net interest income totaled EUR -0.9 million in fiscal year 2021 compared to EUR 0 million in 2020. This is mainly attributable to expenses from the fair value measurement of fund investments.

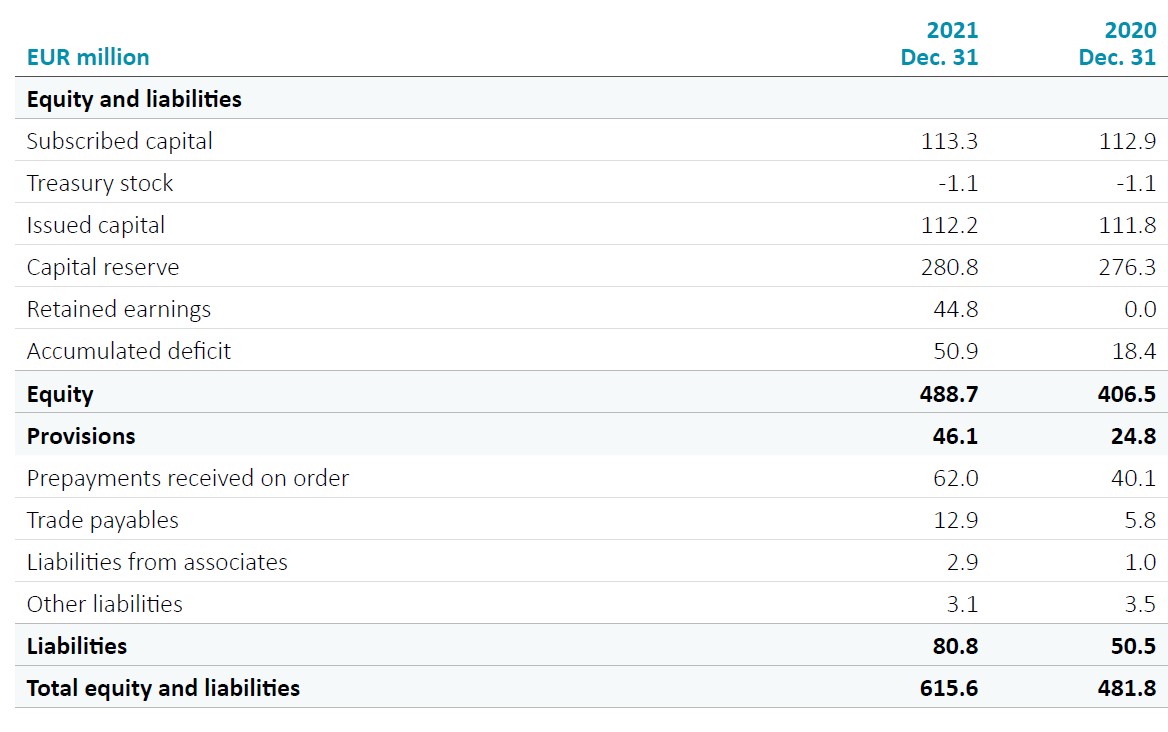

The net income of AIXTRON SE amounted to EUR 89.7 million. An amount of EUR 44.8 million was transferred to retained earnings. Together with the profit carried forward from the previous year in the amount of EUR 18.4 million and the dividend payment in May 2021 in the amount of EUR 12.3 million, this results in a new accumulated profit of EUR 50.9 million as of December 31, 2021 (2020: EUR 18.4 million). The Management Board and Supervisory Board will propose to the Annual General Meeting that a dividend of EUR 0.30 per share (2020: EUR 0.11) be paid for 2021.

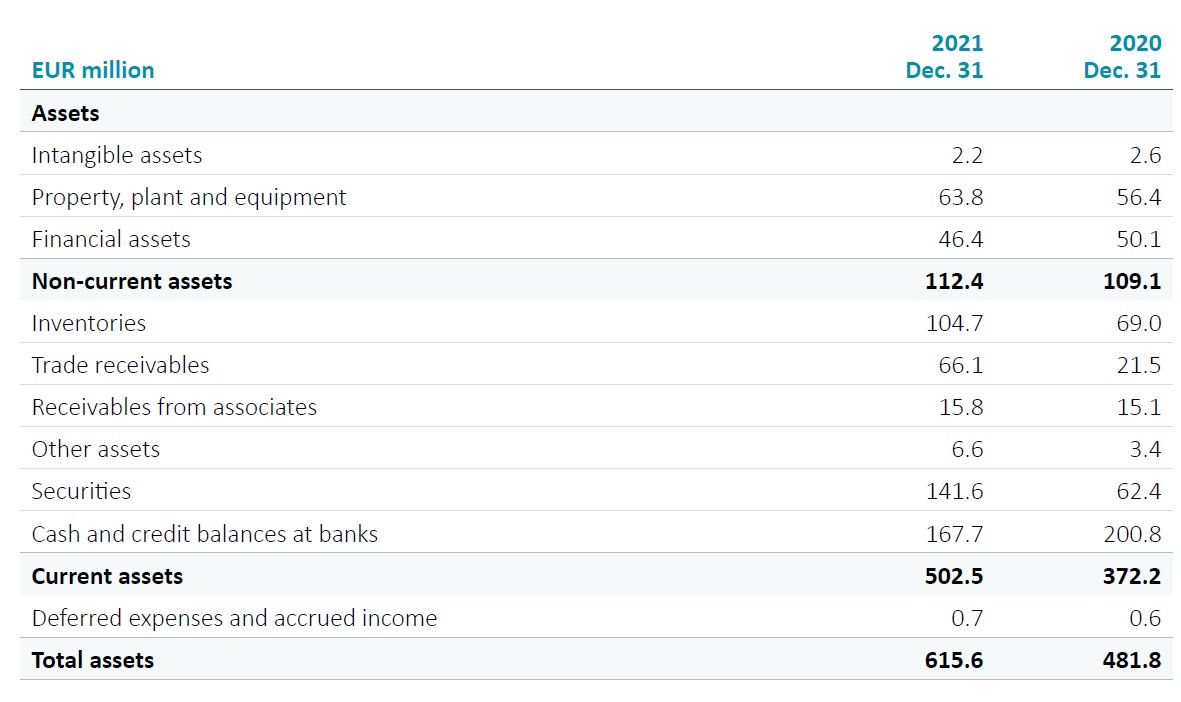

At EUR 615.6 million, total assets at AIXTRON SE at the end of 2020 were about 28% higher than the previous year’s figure (2020: EUR 481.8 million). This was due in particular to advance payments received from customers and the positive net result for the year.

Property, plant and equipment increased from EUR 56.4 million in 2020 to EUR 63.8 million in fiscal year 2020 due to increased capital expenditures, mainly for laboratory plant and equipment.

Financial assets decreased to EUR 46.4 million (2020: EUR 50.1 million) due to an impairment loss on the investment in APEVA Holdings Ltd. amounting to EUR 4.0 million.

The increase in inventories from EUR 69.0 million as of December 31, 2020 to EUR 104.7 million as of December 31, 2021 mainly reflects the high expected sale of systems in the following quarters and the high order backlog.

Trade receivables increased from EUR 21.5 million to EUR 66.1 million due to a high number of deliveries at the end of the 2021 financial year.

The subscribed capital of AIXTRON SE was at EUR 113.3 million as of December 31, 2021 (December 31, 2020: EUR 112.9 million). Issued capital was EUR 112.2 million (2020: EUR 111.8 million). A total of 364,700 shares were issued in the context of stock option programs in the fiscal year.

As a result of the exercise of the stock options, the capital reserve increased from EUR 276.3 million as of December 31, 2020, to EUR 280.8 million as of December 31, 2021.

Due to the higher balance sheet total, the equity ratio decreased to 79% in the fiscal year compared to 84% in the previous year, despite the increased total equity.

To secure prepayments received on orders, AIXTRON SE had aval lines with banks of EUR 57.5 million as of December 31, 2021 (2020: EUR 57.5 million), of which EUR 23.9 million had been utilized as of the balance sheet date (2020: EUR 25.9 million).

Trade payables increased to EUR 12.9 million due to reporting date factors and a higher procurement volume (2020: EUR 5.8 million).

As of December 31, 2021, AIXTRON did not have any bank borrowings, as was the case on the prior-year balance sheet dates.

Investments

In the context of the Company’s growth, capital expenditures at AIXTRON SE totaled EUR 12.2 million in fiscal year 2021 (2020: EUR 5.7 million).

Thereof EUR 10.9 million in 2021 were for property, plant and equipment (2020: EUR 4.2 million). As in the previous year, this capital expenditure was mainly for laboratory equipment and test and demonstration equipment.

Furthermore, AIXTRON SE invested EUR 1.1 million in intangible assets for licenses and software (2020: EUR 1.4 million).

Investments of EUR 0.3 million (2020: EUR 0 million) were made in financial assets in fiscal year 2021.

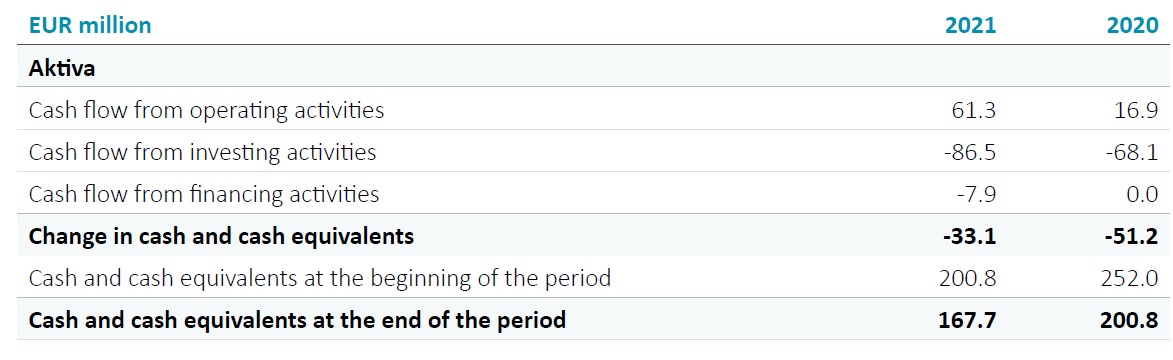

Cash and cash equivalents decreased by EUR 33.1 million from EUR 200.8 million to EUR 167.7 million in the fiscal year, mainly due to cash and cash equivalents being invested in fund assets. Adjusted for this effect, liquidity would have increased by EUR 46.1 million.

Cash flow from operating activities improved from EUR 16.9 million in 2020 to EUR 61.3 in the fiscal year 2021 mainly as a result of the significant improvement in net income, which has not yet been fully reflected in cash flow due to the high level of receivables and increased inventories as of the reporting date.

Cash flow from investing activities was amounted to EUR -86.5 million in fiscal year 2021 (2020: EUR -68.1 million) mainly due to additional investments in fund assets of EUR -79.2 million (2020: EUR -62.4 million).

There are no restrictions on access to the Company's cash and cash equivalents.

The business development of AIXTRON SE is subject to substantially the same risks and opportunities as the AIXTRON Group. AIXTRON SE generally participates in the risks of its subsidiaries in proportion to its respective ownership interest. As a result of the centralized financial management of the AIXTRON Group, all financing transactions are conducted through AIXTRON SE. As the parent company of the AIXTRON Group, AIXTRON SE is integrated into the Group-wide risk management system. For further information, please refer to the Opportunities and Risks Report.

The outlook for the AIXTRON Group largely reflects the expectations of AIXTRON SE. The earnings development of AIXTRON SE should continue to be in line with that of the Group in the future, as the results of the subsidiaries are reflected in the income from investments of the Group’s parent company. Management by means of performance indicators is carried out exclusively at Group level. The comments on the expected results of operations and financial position therefore also apply to AIXTRON SE. For further information please refer to section “Expected Developments” of this report.

Alan Tai

Taiwan/Singapore

Christof Sommerhalter

USA

Christian Geng

Europe

Hisatoshi Hagiwara

Japan

Nam Kyu Lee

South Korea

Wei (William) Song

China

AIXTRON SE (Headquarters)

AIXTRON 24/7 Technical Support Line

AIXTRON Europe

AIXTRON Ltd (UK)

AIXTRON K.K. (Japan)

AIXTRON Korea Co., Ltd.

AIXTRON Taiwan Co., Ltd. (Main Office)

AIXTRON Inc. (USA)

Christoph Pütz

Senior Manager ESG & Sustainability

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Ralf Penner

Senior IR Manager

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Prof. Dr. Michael Heuken

Vice President Advanced Technologies