- / HOME

In its "World Economic Outlook" (January 2022), the IMF forecasts global economic growth of 4.4% for 2022. Supported by further vaccination progress, all advanced economies are expected to return to their pre-crisis levels in the coming year, with existing supply bottlenecks and disrupted supply chains continuing to cause uncertainty. Inflation should return to normal levels once the base effects from the crisis year 2020 have expired. At this point in time, AIXTRON does not expect the general global economic environment to have a significant impact on its business development. The industry and sector-specific conditions for the demand for AIXTRON equipment remain intact, although the risk of renewed setbacks for the global economy, e. g. due to possible new virus variants, cannot be excluded.

Market experts are very positive about the development of production equipment for the semiconductor industry in the coming years. According to a January 2022 study by SEMI , the leading global industry association, the total market for wafer fab equipment, which includes AIXTRON's deposition equipment, is expected to grow from approximately USD 89 billion in the year 2021 to approximately USD 98 billion in the year 2022, an all-time high. Korea, Taiwan and China continue to account for a large share of the market, together accounting for approximately 73% of the global market. According to SEMI, the market for wafer fab equipment continues to grow in this regard, despite a very strong increase in the previous year. Investments in new capacities for the production of microcontrollers and power devices are the strongest drivers of this growth.

Irrespective of the market development of the semiconductor industry as a whole, the segments on which AIXTRON focuses are determined by megatrends, the development of which will be decisive for the future development and size of AIXTRON’s sales markets:

Sales of power semiconductors made of GaN and SiC materials are mainly driven by the need to increase energy efficiency in global IT infrastructure and data centers in order to curb the rapid increase in energy consumption. It is expected that the use of electric vehicles in the future will lead to an increased use of SiC components both, in the powertrain and in the charging infrastructure in order to better meet the requirements for range and efficiency.

The increasing demand for lasers manufactured on AIXTRON systems is due to the exponentially growing need for fast and energy-efficient optical data communications (cloud computing, video streaming, etc.) as well as the adoption of 3D sensing in consumer electronics (smart phones, televisions) and in access control areas. Also, the progress of industrial digitization and a growing number of semi-autonomous vehicles that use 3D sensing technology will lead to increased demand for lasers.

Finally, AIXTRON’s future markets will be driven by the adoption of novel displays in smartwatches, TVs, smartphones and notebooks: Micro LED displays, whose self-illuminating LED pixels can be produced on AIXTRON MOCVD equipment, aim to replace today's LCD or OLED display technology with innovative, energy-saving alternatives offering better luminosity, contrast, color fidelity and resolution. The adoption of these novel display technologies will significantly determine the size of AIXTRON's sales markets.

For the fiscal year 2022, the Group again expects a growing revenue development compared to 2021. Customer demand continues to span all technology areas. The Executive Board is optimistic about both the short- and long-term positive outlook, both for demand for MOCVD equipment for the production of lasers, in particular for optical data transmission, and for LED-based display applications. In terms of demand for equipment for the production of power devices based on the wide band gap materials SiC- and GaN (silicon carbide, gallium nitride), the Executive Board again anticipates an increasing revenue contribution in fiscal year 2022 compared to 2021.

Based on the current Group structure, an assessment of the order situation and the budget exchange rate of 1.20 USD/EUR (2021: 1.25 USD/EUR), the Executive Board expects order intake in a range between EUR 520 million and EUR 580 million for the Group in fiscal year 2022. With revenues in a range between EUR 450 million and EUR 500 million, the Executive Board expects to achieve a gross margin of approximately 41% and an EBIT margin of approximately 21% - 23% of revenues in fiscal year 2022. The expectations for 2022 are subject to the condition that the COVID-19 pandemic continues to have no significant impact on the development of our business.

In addition, with a view to the sustainability targets, the Executive Board is aiming for a slight increase in the share of environmentally sustainable sales, capital expenditures (CapEx) and operating expenses (OpEx) in the medium term as defined by the EU Taxonomy Regulation.

As in previous years, the Executive Board expects that AIXTRON will not require external bank financing in fiscal year 2022. Furthermore, it is expected that the Group will be able to maintain a solid equity base for the foreseeable future.

AIXTRON's equipment enables the production of power semiconductors for highly efficient energy conversion in the field of power supply for data centers or consumer electronics, or for electric vehicles and their charging infrastructure (GaN and SiC devices). Lasers manufactured using AIXTRON equipment are key components in high-speed optical data transmission (cloud computing, Internet of Things), in 3D sensor technology, and increasingly in complex vehicle assistance systems. AIXTRON technology also enables the production of high frequency chips for 5G mobile networks and key components for the production of latest generation displays (fine pitch displays, Mini and Micro LED displays).

Based on AIXTRON's proven ability to develop and market innovative deposition equipment in flexible numbers for multiple customer markets, the Executive Board is convinced of the positive future prospects for the Group and its target markets.

As of December 31, 2021, AIXTRON did not have any legally binding agreements regarding financial investments, acquisitions or disposals companies or businesses.

AIXTRON’s risk management system is centrally controlled and involves all major organizational units of the AIXTRON Group in the process. The Board Member of AIXTRON SE in charge of Corporate Governance & Compliance is responsible for establishing an effective risk management system and informs the Executive Board and Supervisory Board of AIXTRON SE at regular intervals or, if necessary, ad-hoc. In this context, opportunities are considered and documented in a process that runs separately from AIXTRON’s risk management system.

The primary purposes of the risk management system are to support the achievement of strategic business objectives and to identify at an early stage potential risks to current corporate planning that could have a negative impact on the achievement of strategic business objectives and on business activities. The risk management system supports the Executive Board in the systematic, effective and efficient management of identified risks by defining, prioritizing and tracking risk-reducing measures.

In order to meet the extended requirements of IDW PS 340 n.F., the conformity and informative value of AIXTRON's risk management system were examined and key instruments were further optimized in terms of their presentation and informative value. The main subjects of this review were the further development of the risk management system framework, the risk assessment scheme, the risk-bearing capacity, and the resulting overall risk position in the AIXTRON Group. The results and resulting adjustments were integrated into the risk management process and risk reporting, applied in the quarterly risk inventory, and documented in the Group-wide risk management system manual. All members of the senior management team as well as the general managers and other key employees were informed about the adjustments and trained in their application.

As a result of the enhancement of the risk management system in fiscal year 2021, the approach to assessment and presentation has not changed significantly, so that the risk situation is fundamentally comparable with the previous year.

The periodic quarterly risk inventory is initiated, carried out and monitored by the central risk manager. During this process, all risk managers from the operational and administrative areas, all general managers of the AIXTRON subsidiaries, and the Executive Board are asked about current developments in already known risks and measures to reduce them, as well as about potential new risks. The results are collated at central level and discussed in a Risk Committee before the Supervisory Board is informed.

AIXTRON uses risk management software to support the risk management process. All risk managers have access to the software. This ensures that abrupt changes in the risk situation or newly identified risks are reported by the risk officers and integrated into the risk portfolio and reporting.

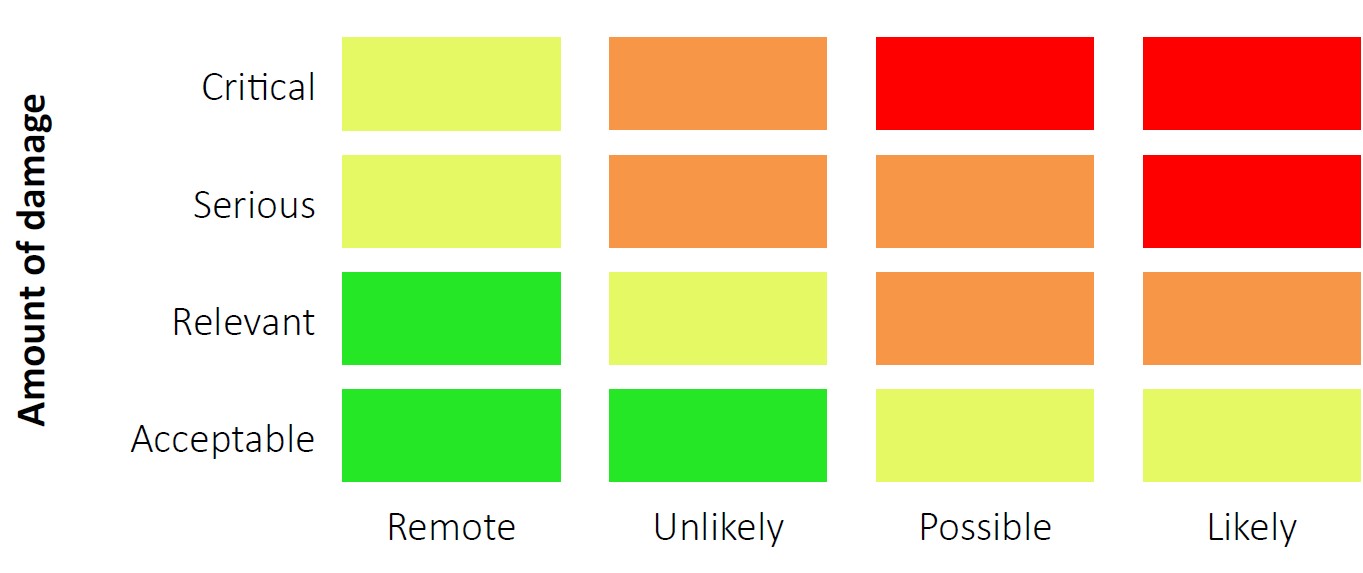

At AIXTRON, all individual risks and risk aggregates are assessed and classified according to a defined scheme. The probability of occurrence is assessed in four stages, as is the potential amount of damage if the risk occurs. The amount of damage relates to the impact on the operating result (EBIT) of the AIXTRON Group; in the case of materiality for relevant risks, a possible outflow of cash is also taken as the amount of damage.

The probability of risks occurring is broken down into:

Wherever possible, risks with a probability of occurrence of more than 50% are recognized as provisions in the financial statements or taken into account in planning.

The criterion used to assess the potential financial impact of a risk on the AIXTRON Group’s earnings (EBIT) is the potential net loss (measured as a percentage of equity):

The impact of risk is presented both in terms of potential gross/net impact and in terms of different periods under consideration (up to 12 months, 13-24 months and greater than 24 months). The gross loss represents the potential loss in the event of a risk occurrence without taking into account further effects such as risk reduction measures.

The net loss describes the potential loss in the event of a risk occurring, taking into account the effects resulting from the risk reduction measures, such as insurance, provisions, budget and forecast recognition of risks. A risk matrix is derived from this assessment, which divides the risks of the AIXTRON Group into the following four risk classes (see chart for color scale):

The risks classified as substantial are those that are significant in terms of a threat to the continued existence of the AIXTRON Group as a going concern as defined by German Accounting Standard (GAS 20).

The following risks could potentially have a substantially adverse impact on the revenue, the financial position, the net assets, the Company’s liquidity and the market price of the AIXTRON share, and on the actual outcome of matters which the forward-looking statements contained in this combined management report refer to. The risks described below are not the only ones the AIXTRON Group faces. There may be additional risks that AIXTRON is currently unaware of, as well as general corporate risks such as political risks, the risk of force majeure and other unforeseeable events. There may also be risks that AIXTRON currently considers to be immaterial, but which may ultimately also have a significantly adverse effect on the AIXTRON Group. Further information on forward-looking statements can be found in the section “Forward Looking Statements”.

In accordance with German Accounting Standard (GAS) 20, the following risks were assessed as material as of December 31, 2021:

AIXTRON’s target markets are globally distributed, with a regional focus on Asia. AIXTRON is there-fore exposed to global economic cycles and geopolitical risks, e. g. the trade conflict between the USA and Chian, which could have a negative impact on the AIXTRON Group’s business. Such risks cannot be influenced by the AIXTRON Group.

The markets addressed by AIXTRON are cyclical and can therefore be volatile. The timing, length and intensity of these industry cycles are difficult to predict and to influence by AIXTRON. In order to diversify market-related risks, AIXTRON therefore diversifies and offers products in different target markets.

AIXTRON competes with other companies in each of these markets. There is always the possibility that new competitors may enter the market, or that established competitors may adopt strategies or bring products to market that may negatively affect market expectations as a whole or for individual key customers of AIXTRON.

AIXTRON continuously monitors and assesses market developments. In order to reduce the risk of dependence on individual markets and their fluctuations, AIXTRON has implemented a management system to ensure that market developments are recognized at an early stage and exploited optimally.

AIXTRON’s market and competitive risks are classified as substantial risks, as the level of damage in the event of a possible risk occurrence would have a significant impact on the Group's medium to long-term high revenue and earnings expectations.

The technologies offered by AIXTRON sometimes enable new, disruptive application opportunities. This often means long development and qualification cycles for AIXTRON's products, as demanding technical and/or other customer requirements have to be met (sometimes for the first time) before a deal can be closed.

Due to the often long development and qualification cycles of AIXTRON's products, AIXTRON may develop technologies and products for markets or application areas in which the general conditions of the sales markets or the strategic plans of potential customers change fundamentally during the development cycle.

The continued focus on research and development activities in the past fiscal year and the intensive involvement of external technology partners are still considered by AIXTRONSE’s Executive Board to be suitable measures to reduce this risk.

AIXTRON’s technology risks are classified as substantial risks, as the level of damage in the event of a potential risk materializing could have a significant impact on the Group's medium- to long-term high revenue and earnings expectations.

If it turns out that a technology risk has materialized and the introduction of a new technology cannot be realized as planned, this can consequently lead to planned and forecast revenues being exposed to the risk of postponement or discontinuation, and thus to development activities being refinanced later than planned or not at all.

AIXTRON’s risk management system considers the following risks to be not material to the Group:

AIXTRON defines IT and information security risks as breaches of integrity, confidentiality, and liability.

The Group has invested in extensive technical and organizational measures to enhance information security and protect information from unauthorized access, unintentional modification, or deletion. The information security measures taken are subject to regular monitoring and continuous improvement and are supported by targeted awareness and training concepts. Accordingly, the risk classification was reduced overall.

The evolution and impact of the COVID-19 pandemic are continuously monitored. For this purpose, among other things, an interdisciplinary team has been formed and protective and preventive measures have been introduced. In addition, the Executive Board regularly communicates the current situation - i. e. the latest developments in general and at AIXTRON, as well as the measures derived from them - to the employees.

As part of the risk management system, the impact, measures, and outlook related to the current COVID-19 pandemic situation, as well as possible resulting effects on global material availability and supply chains, are recorded, discussed, assessed, and reported in our regular quarterly risk inventory.

Compared to fiscal year 2020, the overall risk situation remains unchanged for fiscal year 2021, with the exception of the changes in the AIXTRON Group outlined above. The continued focus of research and development activities, with an emphasis on the renewal and expansion of the product portfolio, streamlines the risk portfolio and thus improves the exploitation of opportunities and the avoidance of risks in AIXTRON’s target markets.

Neither in fiscal year 2021 nor at the time of writing this Management Report has the Executive Board of AIXTRON SE identified risks to the Company that could threaten its continued existence as of December 31, 2021.

AIXTRON’s core competence is the development of cutting-edge technology for the precise deposition of complex semiconductor structures and other functional materials. The company has achieved globally leading positions in these areas. In order to defend or expand these positions, AIXTRON invests in appropriate research and development projects, such as for MOCVD systems to produce semiconductors for use in LEDs, lasers or power electronics. The renewal and expansion of the entire equipment portfolio is planned for the coming years. The Executive Board will maintain the focus on this core competence in order to successfully develop both existing as well as new markets.

Important market segments for power electronics based on wide-band-gap materials such as gallium nitride (GaN) and silicon carbide (SiC) are the automotive, energy, telecommunications and consumer electronics industries. The development of energy-efficient solutions for AC-DC converters, inverters and high-frequency power amplifiers are increasingly gaining in importance. The trend towards electrification of vehicles and there charging infrastructure using SiC-based components plays an important role in this regard. GaN-based components, e. g. for fast charging of mobile devices, are becoming increasingly popular. The demand for energy-efficient GaN-based power supply in IT, such as data centers or servers, is currently growing rapidly and is also expected to increase further over the coming years as additional market segments are developed. GaAs or GaN-based radio frequency devices are used for signal transmission in 5G networks or for the WLAN 6 standard, among others. AIXTRON expects demand for production equipment to increase as the market penetration of these applications gains momentum.

Important market segments in optoelectronics include consumer electronics, data communications and display technology. The trend towards optical data transmission also across shorter distances, e. g. in data centers or FTTH, as well as the global expansion of fiber optic networks for high-speed data transmission, is creating increasing demand for equipment to manufacture edge and surface emitting lasers (VCSEL). AIXTRON expects demand in this area to increase over the coming years, particularly as demand for 3D sensor technology also increases due to virtual reality or LiDAR applications in the automotive sector. In addition, AIXTRON continues to see high demand for equipment for the production of red, orange and yellow (ROY), infrared and UV LEDs, for example, due to the growing adoption of direct emitting LED displays and applications such as indoor farming. In addition, the upcoming commercialization of Micro LED displays has the potential to generate significant demand for equipment for this demanding application. These display technologies have high potential in various consumer electronics end-use applications.

AIXTRON expects the following market trends and opportunities in the relevant end user markets could possibly have a positive effect on future business:

Increasing use of wide-band-gap GaN- or SiC-based devices for energy-efficient power electronics in automobiles, consumer electronics, mobile devices and IT infrastructure

Increasing use of GaN-based devices in the field of 5G network infrastructure

Increasing use of GaAs-based devices in mobile devices (e.g. smartphones) for 5G mobile communications or WLAN 6 technology

Further increasing demand for lasers for high-volume optical data transmission, e.g., for video streaming and Internet-of-Things (IoT) applications

Increasing use of compound semiconductor-based lasers for 3D sensing in mobile devices and infrastructure applications

Increasing use of LEDs and specialty LEDs (esp. red-orange-yellow, UV or IR) in display and other applications

Commercialization of micro LED displays

Development of new applications based on wide-band-gap materials such as high-frequency chips or system-on-chip architectures with integrated energy management

Development of alternative LED applications, such as visual light communication technology

Increasing application of compound semiconductor-based laser sensors for autonomous driving

Use of GaN-based devices in mobile devices (e.g. smartphones) for the millimeter-wave range of 5G and 6G mobile communications

Increased development activities for high-performance solar cells made of compound semiconductors

IAs part of the assessment of our business opportunities, options for investments or development projects are reviewed and prioritized for their potential value contribution to ensure an effective allocation of resources. We focus specifically on growth markets that are positively influenced by global trends such as increasing electromobility, digitization, and networking, among others, in order to systematically and optimally exploit the opportunities that arise for the sustainable and profitable business development of the Group.

Should identified opportunities be considered probable, then these are included in the business plans and short-term forecasts. Any further trends or events that could lead to a positive development for our net assets, financial position and results of operations are being observed and may have a positive impact on our medium to long-term prospects.

The AIXTRON Group’s internal control system covers both the accounting process of AIXTRON SE and the Group accounting process. It defines controls and monitoring activities that are measures designed to ensure the proper conduct of business activities, reliable financial reporting, and compliance with laws and regulations. An appropriate control system, taking into account the size of the Company and its business activities, is the prerequisite to effectively manage operational, financial and other risks.

Controls are defined at risk points in the accounting process to help ensure that the consolidated financial statements are prepared in accordance with the rules. A separation of functions appropriate to the size of the company and the application of the dual control principle reduce the risk of fraudulent acts.

A global IT system is used to prepare the annual financial statements and the consolidated financial statements and for consolidation, ensuring uniform and consistent procedures and data security. Central system backups are regularly performed for the relevant IT systems to prevent data loss. In addition, defined authorizations and access restrictions are part of the security concept.

The Group function Finance is technically and organizationally in charge of the preparation of the consolidated financial statements. In the decentralized units, local employees are responsible for preparing the local financial statements. Uniform Group accounting is ensured by Group-wide guidelines on content and timing, as well as accounting policies and valuation principles. The Compliance department regularly reviews the observance and effectiveness of the controls and is thus integrated into the overall process.

It is the opinion of the Executive Board that these coordinated processes, systems and controls ensure that the Group accounting process is in accordance with IFRS and that the annual financial statements comply with the German Commercial Code (HGB) and other accounting-related regulations and laws and are reliable.

The Declaration of Corporate Governance pursuant to § 289f HGB has been combined with the Group Declaration of Corporate Governance pursuant to § 315d HGB. This combined declaration including a Corporate Governance Report is available on the homepage of AIXTRON SE at Corporate Governance Statement.

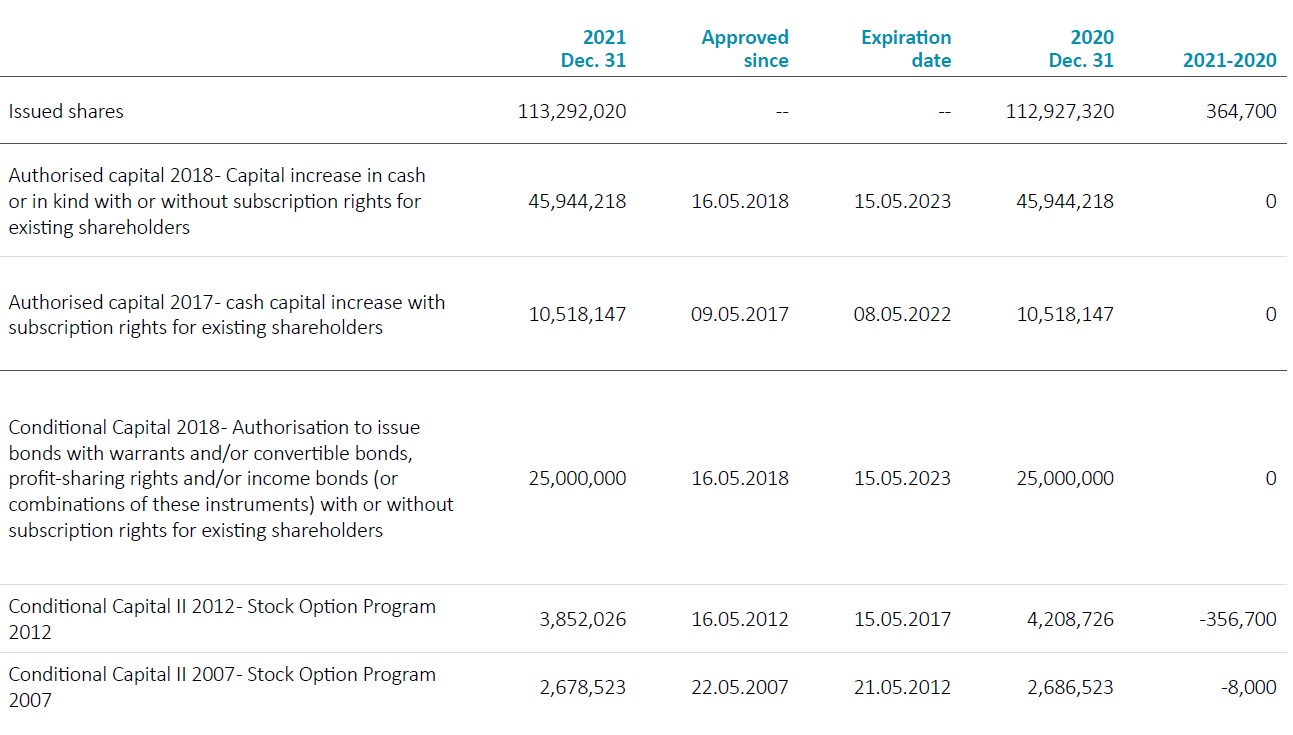

The share capital of AIXTRON SE as of December 31, 2021, amounted to EUR 113,292,020 (December 31, 2020: EUR 112,927,320) divided into 113,292,020 registered shares with a proportional interest in the share capital of EUR 1.00 per no-par value registered share. Each no-par value share represents the proportionate share in AIXTRON’s stated share capital and carries one vote at the Company’s annual shareholders’ meeting. All registered shares are fully paid in.

AIXTRON SE has issued a share certificate representing multiples of shares (global share). Shareholders do not have the right to the issue of a share certificate representing their share(s). There are no voting or transfer restrictions on AIXTRON’s registered shares that are related to the Company’s Articles of Association. There are no classes of securities endowed with special control rights, nor are there any provisions for control of voting rights, if employees participate in the share capital without directly exercising their voting rights.

Additional funding needs could be covered by the following additional capital as authorized by the annual shareholders’ meeting:

In accordance with Section 71 (1) no. 8 German Corporations Act, AktG, the Company is authorized until May 15, 2023, with the approval of the Supervisory Board, to purchase its own shares representing an amount of up to EUR 11,292,473 of the share capital. This authorization may not be used by the Company for the purpose of trading in own shares. The authorization may be exercised in full, or in part, once, or on several occasions by the Company, by companies dependent on the Company or in which the Company directly or indirectly holds a majority interest, or by third parties appointed by the Company. The shares may be purchased (1) on the stock market or (2) by way of a public offer to all shareholders made by the Company or (3) by way of a public invitation to submit offers for sale.

Any amendment to the Articles of Association related to capital measures requires a 75% majority of the share capital represented at the Annual General Meeting (Article 59 SE Regulation, SE-VO; Section 179 German Corporations Act, AktG). Other amendments to the Articles of Association require a majority of two thirds of the votes cast or, if at least one half of the share capital is represented, a simple majority of the votes cast.

As of December 31, 2021, approximately 22% of AIXTRON's shares were held by private individuals, most of whom are based in Germany. Approximately 77% of the outstanding AIXTRON shares are held by institutional investors. At the end of fiscal year 2021, the five largest shareholders, each holding more than 5% of the AIXTRON shares in their portfolios, were Société Générale, T. Rowe Price International, Artisan Partners, Invesco, and Citigroup. 99% of the shares were in free float as defined by Deutsche Börse.

The Supervisory Board appoints and removes from office the members of the Executive Board, who may serve for a maximum term of six years before being reappointed.

In the event of a “change of control”, the individual members of the Executive Board are entitled to terminate their employment with three months’ notice to the end of the month and to resign from office with effect from the date of termination. Upon termination of employment due to a so-called “change of control” event, all members of the Executive Board receive a severance payment in the amount of the fixed and variable remuneration expected to be owed by the Company for the remaining term of the employment contract, up to a maximum of two years’ remuneration. A “change of control” as defined above exists if a third party or a group of third parties, who contractually combine their shares to act as a third party, directly or indirectly holds more than 50% of the Company’s share capital. Apart from the aforementioned, there are no other “change of control” clauses.

The AIXTRON Group’s Sustainability Report (CSR Report) is available on our website at Publications

Alan Tai

Taiwan/Singapore

Christof Sommerhalter

USA

Christian Geng

Europe

Hisatoshi Hagiwara

Japan

Nam Kyu Lee

South Korea

Wei (William) Song

China

AIXTRON SE (Headquarters)

AIXTRON 24/7 Technical Support Line

AIXTRON Europe

AIXTRON Ltd (UK)

AIXTRON K.K. (Japan)

AIXTRON Korea Co., Ltd.

AIXTRON Taiwan Co., Ltd. (Main Office)

AIXTRON Inc. (USA)

Christoph Pütz

Senior Manager ESG & Sustainability

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Ralf Penner

Senior IR Manager

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Prof. Dr. Michael Heuken

Vice President Advanced Technologies