- / HOME

The AIXTRON share is listed in the Prime Standard of the Frankfurt Stock Exchange as well as in the MDAX and TecDAX. In Deutsche Börse’s MDAX ranking, which includes a total of 50 stocks, it was ranked 15th in terms of market capitalization as of December 31, 2022 (2021: 42nd place). Among the 30 TecDAX members, the share marked an 8th place (2021: 17th place).

In addition to the traditional trading platforms such as XETRA and the German regional stock exchanges, trading in AIXTRON shares also takes place to a significant extent on alternative trading platforms such as Tradegate or Chi-X.

The AIXTRON share benefited from the very successful business development of the group and was able to clearly set itself apart from the total market and the competition in the overall challenging market environment from March onwards. Due to the high valuation levels that had then been reached, technology stocks in particular reacted very sensitively to the news about the war in Ukraine, the associated sharp increase in inflation and interest rate hikes by the European Central Bank and the US Federal Reserve. The AIXTRON share was not always able to escape this development.

After a positive start to the stock market year 2022, the upward movement ended at the end of January and the subsequent downward movement was reinforced by interest rate movements and the beginning of the Russian invasion into Ukraine. The publication of the annual results for 2021 and the positive prospects for 2022 were able to break the downward trend in the following trading weeks. The share price rose significantly by the end of May. The announcement of further operational successes, the very good result for the first quarter of 2022 and positive studies from renowned analyst firms such as Jefferies or Exane supported this positive development.

After profit-taking and a volatile month in June, the share traded around the barrier of EUR 21.18 in early July, only to reach its multi-year high of EUR 31.65 in early December. The publication of the third quarter results led to a short-term consolidation of the share. However, the share was able to quickly break through this trend, as investors assumed strong market growth for SiC, GaN and Micro LEDs. After the stock's excellent year-to- date performance, some investors took profits towards the end of the year.

Despite the slight sell-off at the end of the 2022 stock market year, the AIXTRON share clearly set itself apart with a plus of 51% at a XETRA closing price of EUR 26.97 on December 30 compared to the benchmark indices, which fell significantly in value during this period. The market capitalization at the end of the year was EUR 3,057 million (year- end 2021: EUR 2,024 million). The benchmark indices MDAX and TecDAX fell by 28.5% to 25,117 points and 25.2% to 2,921 points over the course of 2022.

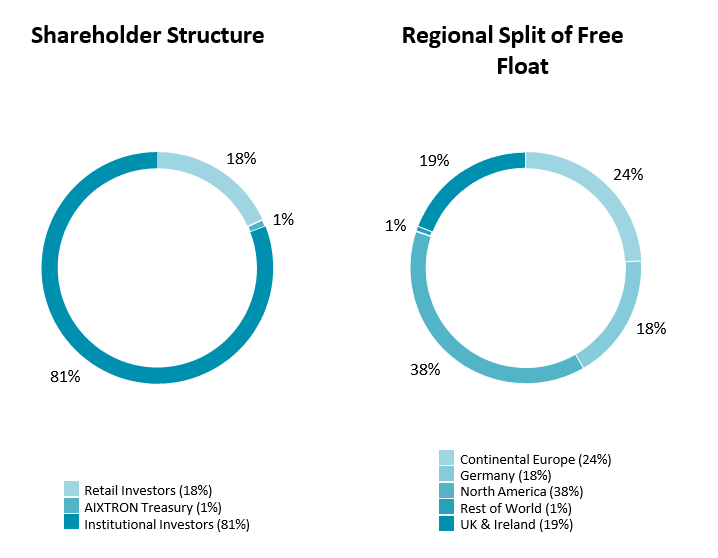

As of December 31, 2022, around 18% of AIXTRON shares were held by private individuals (2021: 22%), mostly based in Germany. Around 82% of the outstanding AIXTRON shares were held by institutional investors (2021: 77%). The majority of institutional investors are based in North America (38%), followed by Great Britain and Ireland (19%) and Germany (18%). The remaining investors come from other parts of Europe and the rest of the world. According to voting rights notifications received by the end of 2022, Baillie Gifford & Co. was the largest single shareholder with 4.9%, followed by Bank of America Corp. with 4.8%, Invesco International Mutual Funds with 4.3% and Norges Bank with 3.7%. According to the definition of Deutsche Börse, 99% of the shares were in free float and around 1% of the AIXTRON shares were held by the company itself.

All voting rights notifications made in 2022 and thereafter in accordance with sections 33 et seq. of the German Securities Trading Act (WpHG) can be found on our website. Information on reportable holdings that currently exceed or fall below a certain threshold can be found in the appendix to this report.

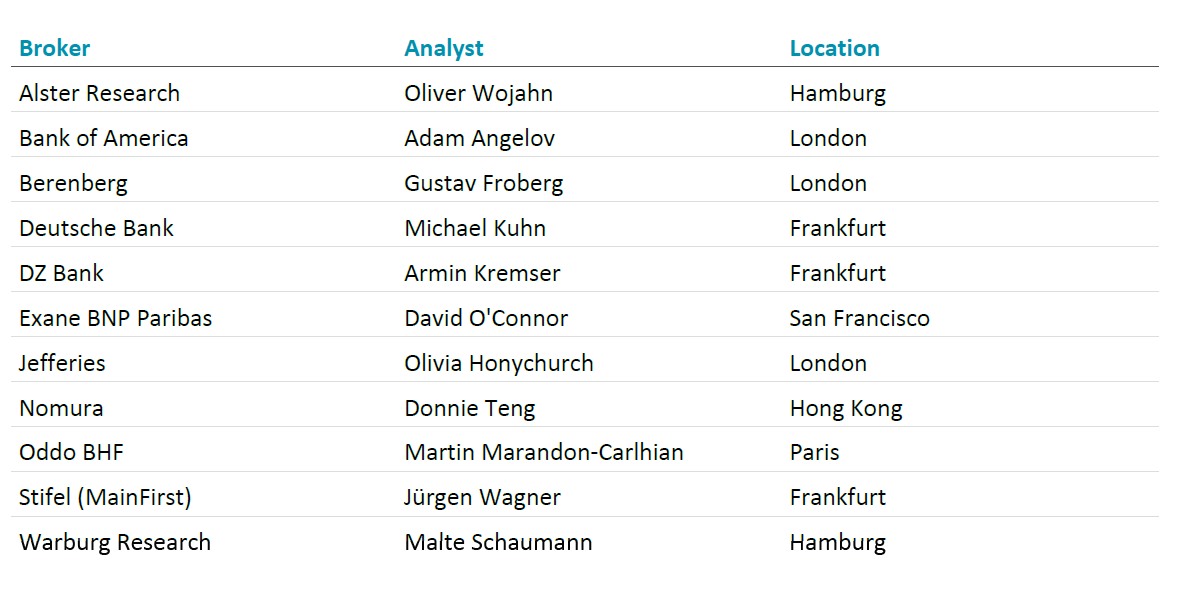

During the fiscal year of 2022, a total of eleven international banks and brokerage houses (2021: twelve) published stock research reports on AIXTRON and the development of the semiconductor industry on a frequent basis. Barclays stopped analyzing AIXTRON shares last year. Nomura, Jefferies and Bank of America initiated coverage in 2022. Of the eleven financial analysts who observed our shares at the end of 2022, eight issued a buy recommendation and three recommended holding the AIXTRON share. The average target price at the end of December 2022 was EUR 25.00 (2021: EUR 23.55). At the end of the year, the AIXTRON share was covered by the following sell-side analysts (the current status can be found on our website):

Our aim is transparency and openness in a continuous dialogue with our shareholders and participants in the capital market. Our Investor Relations work aims at strengthening long-term trust in our share and at achieving a fair valuation on the capital market. To this end, we provide our shareholders and the capital market with accurate, timely and relevant information both about the business of the AIXTRON Group and about the market environment. In addition, AIXTRON is committed to complying with the principles of good corporate governance.

In one-on-one or group discussions at investor roadshows and conferences, our management and Investor Relations team answered questions from investors and financial analysts on the business strategy and development of the AIXTRON Group as well as on industry and market trends. With more than 400 discussions (2021: 250) with 530 financial market players, the exchange was significantly intensified in the fiscal year of 2022.

The virtual Annual General Meeting of AIXTRON SE took place on May 25, 2022. Around 64% of the share capital was represented. The Executive Board explained the results of the 2021 fiscal year and the first quarter of 2022 as well as the operational highlights and technologies of the AIXTRON Group. Together with the Chairman of the Supervisory Board, the Executive Board answered in detail the questions submitted by the shareholders ahead of the Annual General Meeting. For the 2021 fiscal year, AIXTRON significantly increased the dividend payment to shareholders to EUR 0.30 per share (2020: EUR 0.11 per share). This corresponded to a payout of EUR 33.7 million.

In view of the strong operational and financial development in 2022, the company's solid financial position and the management's confidence in the long-term growth prospects, the Executive Board and Supervisory Board of AIXTRON SE will propose a dividend of EUR 0.31 per dividend-entitled share to the Annual General Meeting on May 17, 2023 (2022: EUR 0.30 per share). The total payout of EUR 34.8 million (2022: EUR 33.7 million) corresponds to a payout ratio of around 35% of AIXTRON's consolidated net income for the year (2022: around 35%), based on the number of shares outstanding as of December 31, 2022.

Declaration of Corporate Governance

AIXTRON is committed to the principles of transparent and responsible corporate governance aimed at creating sustainable value. Through appropriate management and supervision of the Company, we – the Executive Board and the Supervisory Board – aim to merit the trust placed in us by our shareholders, the financial markets, our customers, business partners, employees, and the general public. We are convinced that this approach to corporate governance, as well as the responsible actions of our employees, are an essential basis for the success of our Company.

The Declaration of Corporate Governance in accordance with Sections 289f, 315d of the German Commercial Code (“Handelsgesetzbuch”, HGB), as well as the current Declaration of Conformity in accordance with Section 161 of the German Stock Corporation Act (“Aktiengesetz”, AktG) as adopted by the Executive Board and the Supervisory Board in February 2023, are permanently available on our website at Investors/Corporate Governance.

The German Corporate Governance Code (“Deutsche Corporate Governance Kodex”, DCGK) was revised during the year under review. The new version dated April 28, 2022 became the basis for the Declaration of Conformity upon publication in the Federal Gazette on June 27, 2022 (“GCGC 2022”). The Executive Board and the Supervisory Board of AIXTRON SE declare that AIXTRON SE has complied with the recommendations of the GCGC 2022 and will continue to comply with them in the future with the following exception:

Consideration of the higher time commitment of the Chair and Deputy Chair of the Supervisory Board as well as the Chair and the members of committees in Supervisory Board compensation (G.17 GCGC 2022)

According to G.17 GCGC 2022, the remuneration of Supervisory Board members shall take into account, in an appropriate manner, the higher time commitment of the Chair and the Deputy Chair of the Supervisory Board as well as of the Chair and the members of committees. The Supervisory Board remuneration resolved by the Annual General Meeting on May 16, 2018, only takes into account the Chair and Deputy Chair of the Supervisory Board and the Chair of the Audit Committee in addition to membership of the Supervisory Board.

Further consideration of the Deputy Chair of the Audit Committee, Chair or Deputy Chair of other committees, and membership of committees is not deemed appropriate, as the time and effort involved in these activities is already adequately covered by the Supervisory Board remuneration.

Herzogenrath, February 27, 2023 AIXTRON SE

The Executive Board of AIXTRON SE

Alan Tai

Taiwan/Singapore

Christof Sommerhalter

USA

Christian Geng

Europe

Hisatoshi Hagiwara

Japan

Nam Kyu Lee

South Korea

Wei (William) Song

China

AIXTRON SE (Headquarters)

AIXTRON 24/7 Technical Support Line

AIXTRON Europe

AIXTRON Ltd (UK)

AIXTRON K.K. (Japan)

AIXTRON Korea Co., Ltd.

AIXTRON Taiwan Co., Ltd. (Main Office)

AIXTRON Inc. (USA)

Christoph Pütz

Senior Manager ESG & Sustainability

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Ralf Penner

Senior IR Manager

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Prof. Dr. Michael Heuken

Vice President Advanced Technologies