- / HOME

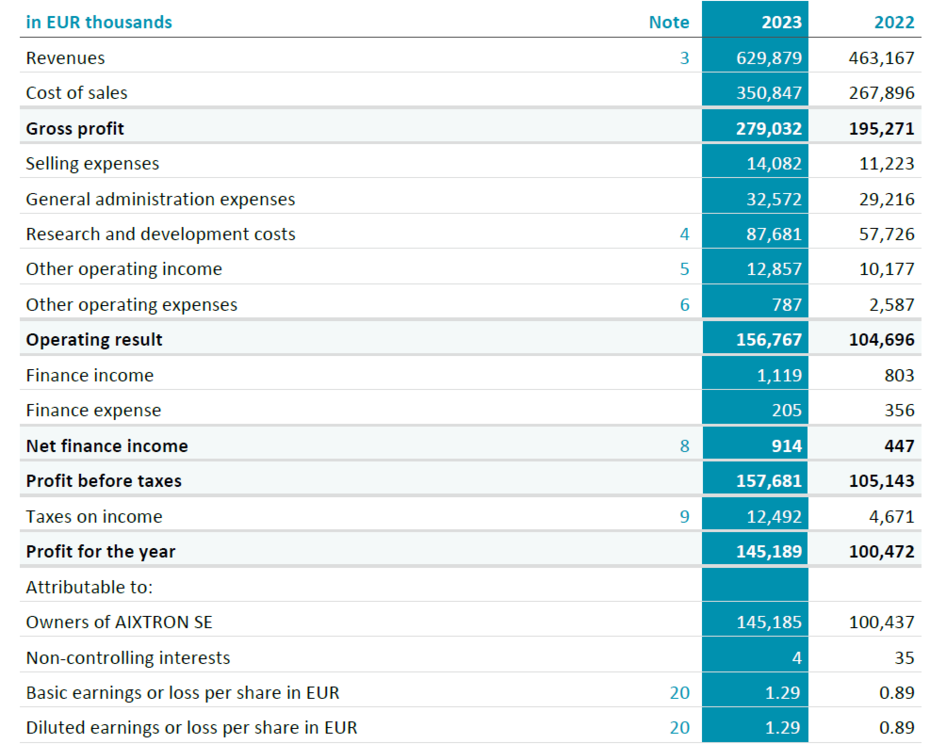

For explanations, see the accompanying notes to consolidated financial statements.

| 1. | General Principles | 119 |

| 2. | Significant Accounting Policies | 120 |

| 3. | Segment Reporting and Revenues | 133 |

| 4. | Research and Development | 135 |

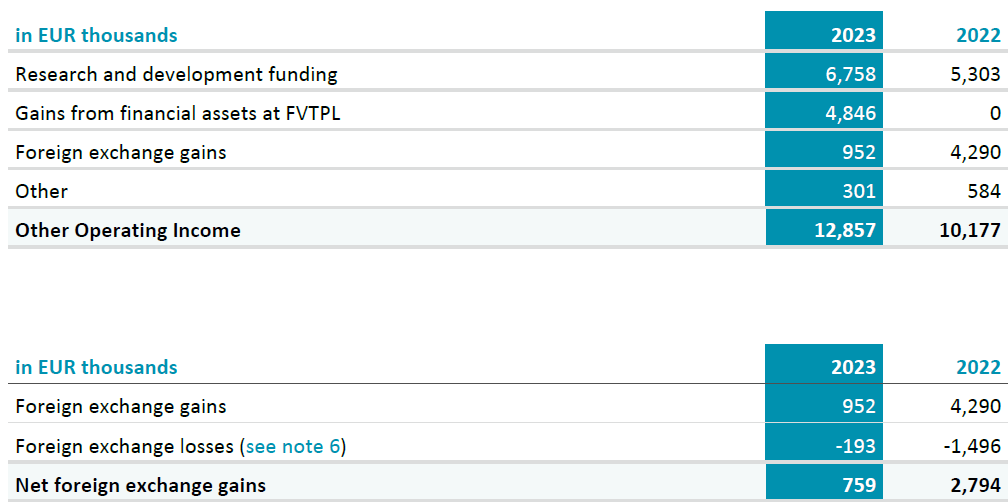

| 5. | Other Operating Income | 136 |

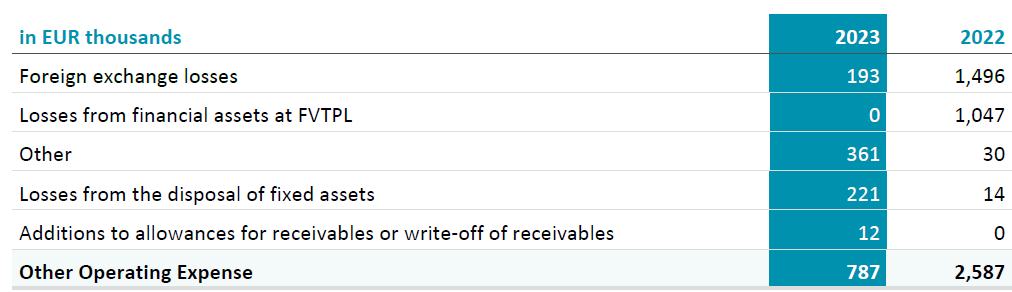

| 6. | Other Operating Expenses | 136 |

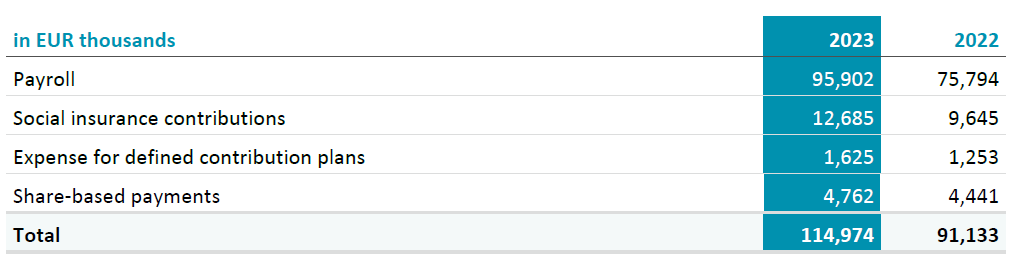

| 7. | Personnel Expense | 137 |

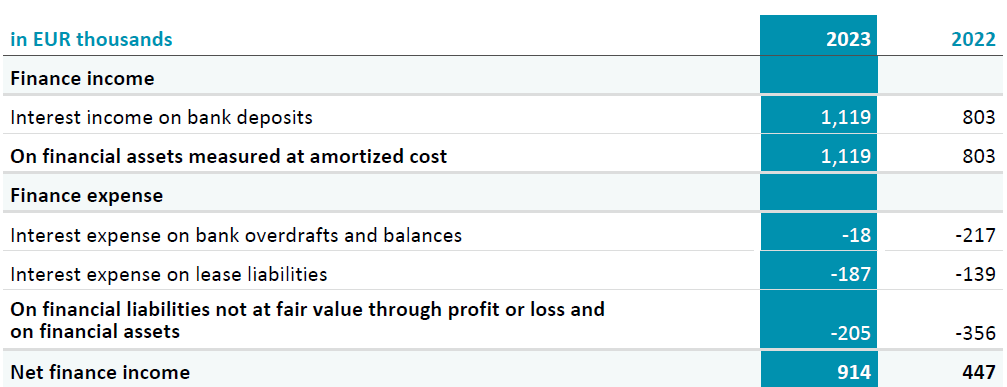

| 8. | Net Finance Income | 137 |

| 9. | Income Tax Expense / Benefit | 138 |

| 10. | Current Tax Receivable and Payable | 139 |

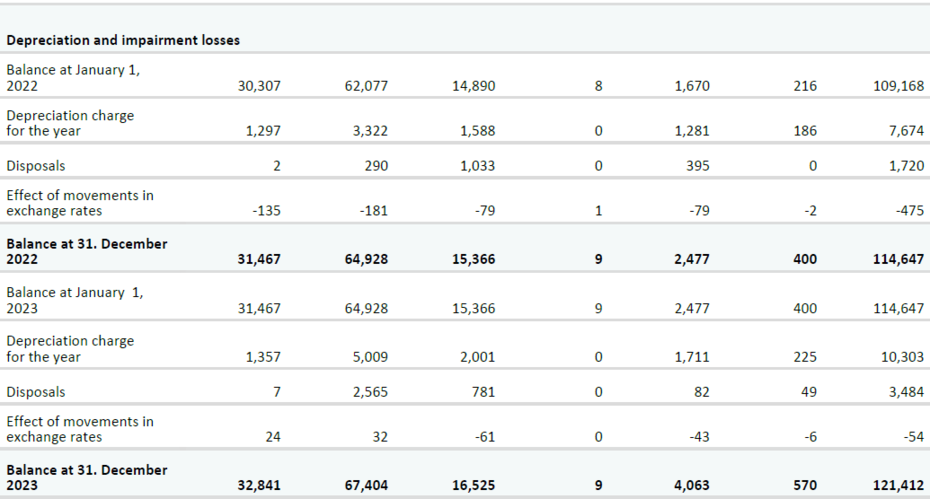

| 11. | Property, Plant and Equipment and Leased Assets | 140 |

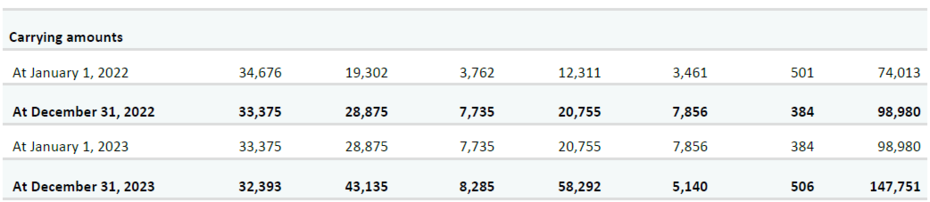

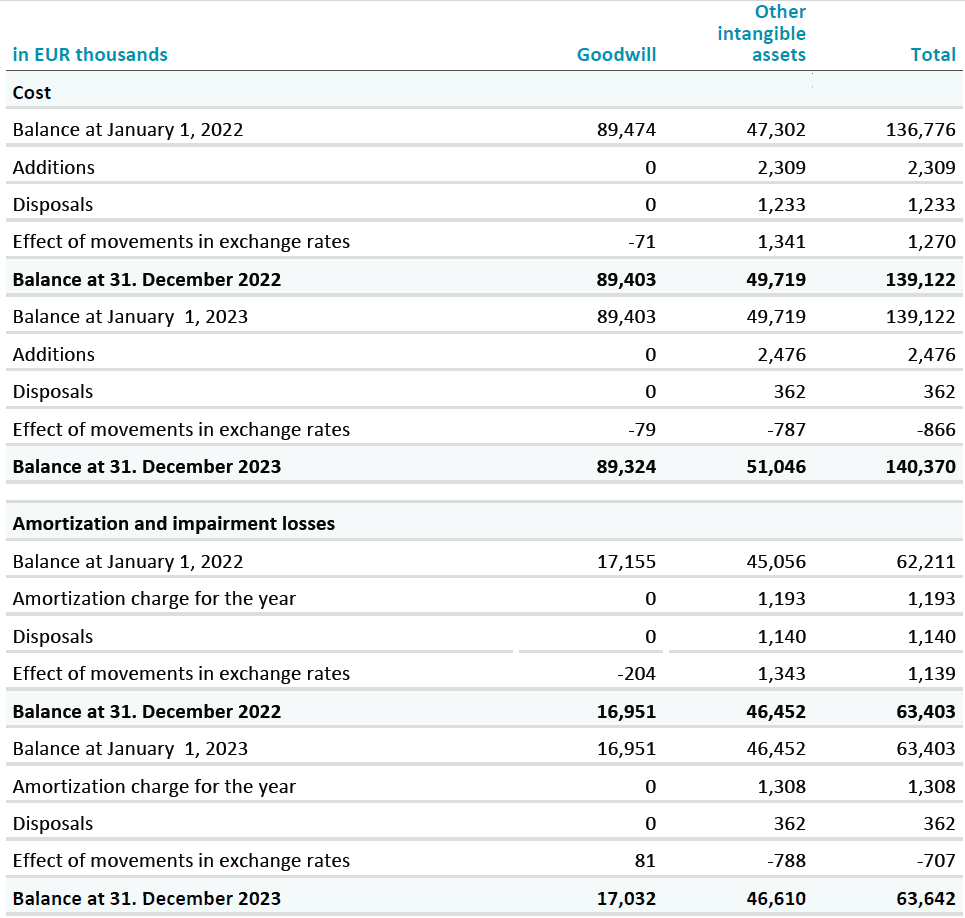

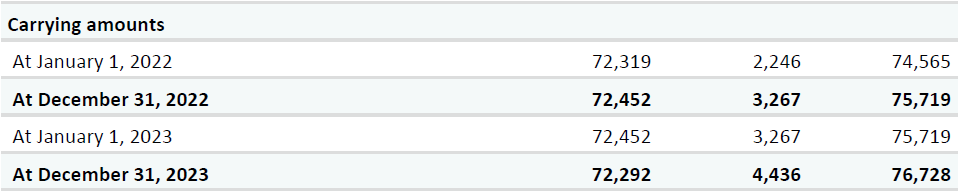

| 12. | Intangible Assets | 142 |

| 13. | Other Non-Current Financial Assets | 144 |

| 14. | Deferred Tax Assets and Deferred Tax Liabilities | 145 |

| 15. | Inventories | 147 |

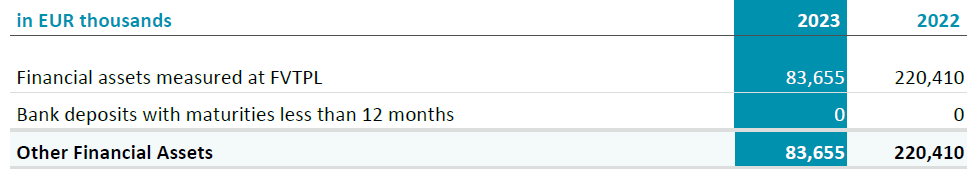

| 16. | Trade Receivables and Other Current Assets | 147 |

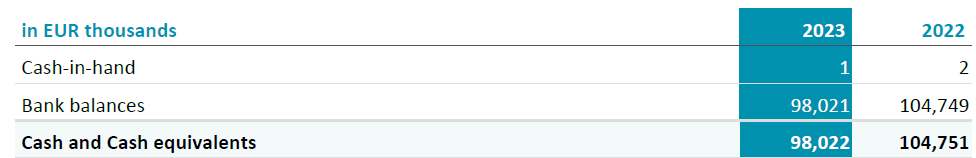

| 17. | Other Financial Assets | 149 |

| 18. | Cash and Cash Equivalents | 149 |

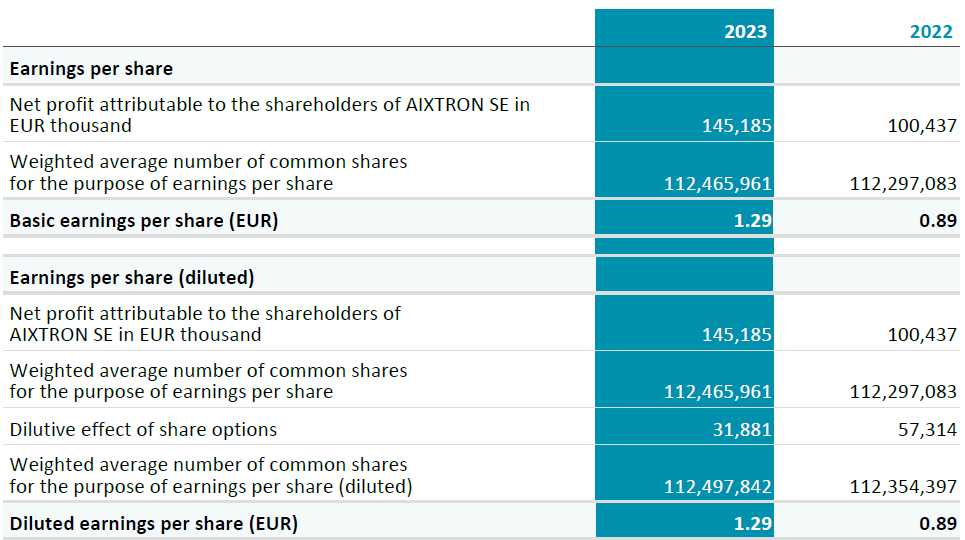

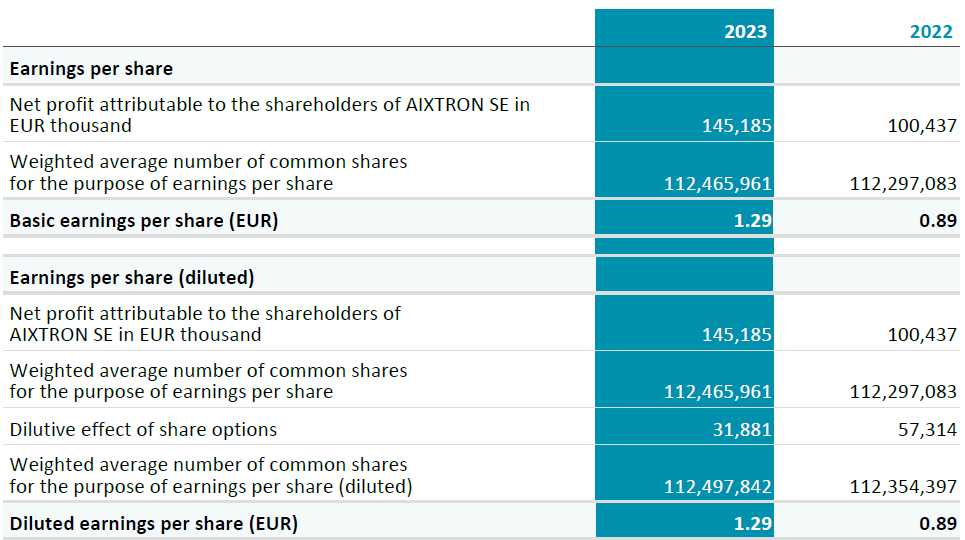

| 19. | Shareholders’ Equity | 150 |

| 20. | Earnings Per Share | 151 |

| 21. | Employee Benefits | 152 |

| 22. | Share-Based Payment | 153 |

| 23. | Provisions | 155 |

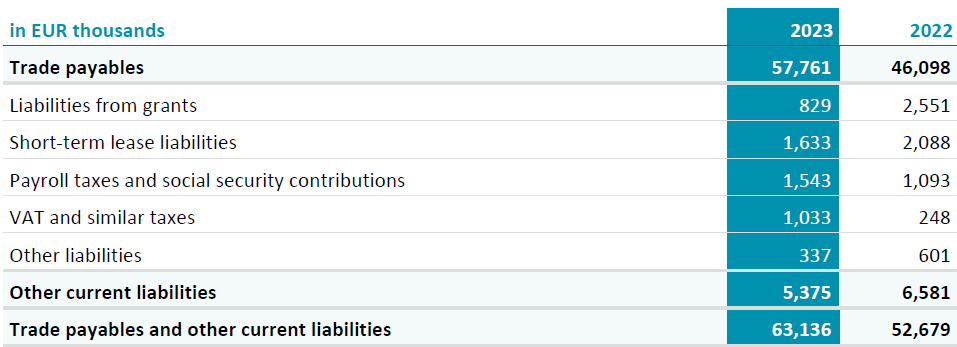

| 24. | Trade Payables and Other Current Liabilities | 157 |

| 25. | Financial Instruments | 157 |

| 26. | Advance Payments – Contract Liabilities | 162 |

| 27. | Leases | 163 |

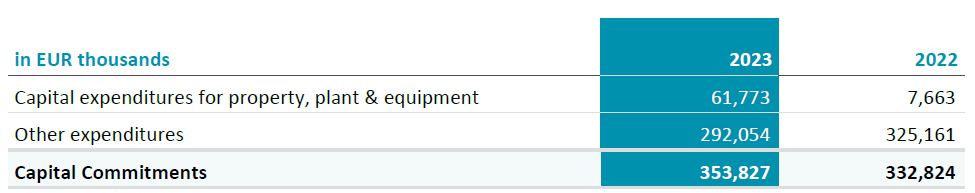

| 28. | Capital Commitments | 164 |

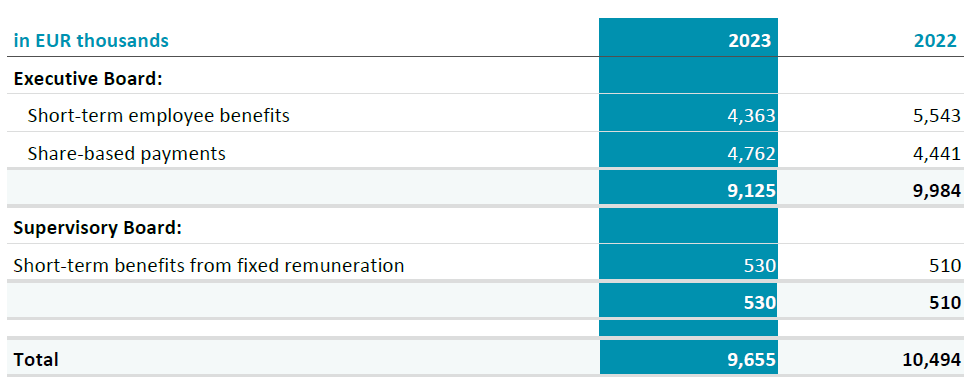

| 29. | Contingencies | 164 |

| 30. | Related Parties | 165 |

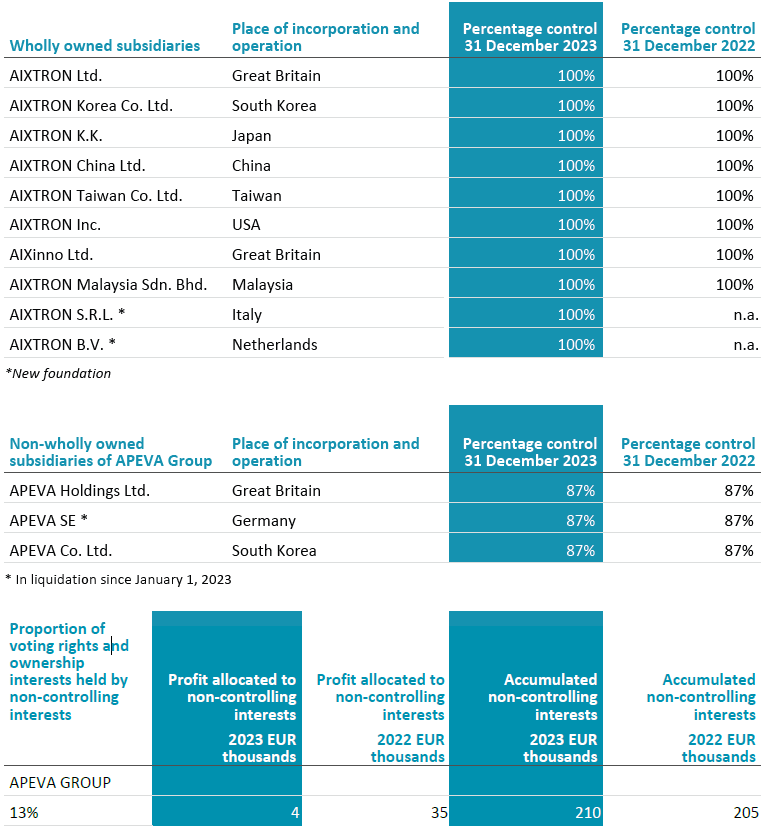

| 31. | Consolidated Entities | 166 |

| 32. | Events After the Reporting Period | 167 |

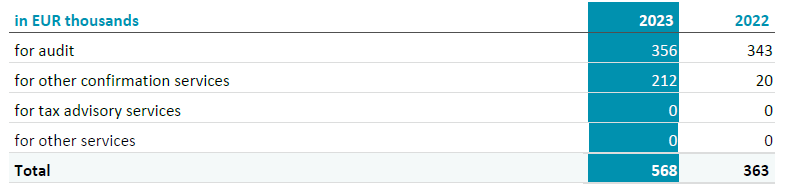

| 33. | Auditors’ Fees | 167 |

| 34. | Employees | 167 |

| 35. | Supervisory Board and Executive Board | 168 |

| 36. | Critical Accounting Judgements and Key Sources of Estimation and Uncertainty | 169 |

| 37. | Disclosures according to section 161 German Stock Corporation Act (AktG) | 171 |

AIXTRON SE (“Company”) is incorporated as a European Company (Societas Europaea) under the laws of the Federal Republic of Germany. The Company is domiciled at Dornkaulstraße 2, 52134 Herzogenrath, Germany. AIXTRON SE is registered in the commercial register of the District Court (“Amtsgericht”) of Aachen under HRB 16590.

The consolidated financial statements of AIXTRON SE and its subsidiaries (“AIXTRON“ or “Group“) have been prepared in accordance with, and fully comply with

The Group is a leading provider of deposition equipment to the semiconductor industry. It offers its customers high-tech systems for the production of high-performance compound semiconductor components for power electronics and optoelectronics. The devices are used in a variety of innovative applications and industries. These include laser, LED, display technologies, optical and wireless data transmission, SiC and GaN power electronics, and many other leading-edge applications. The Group’s products are used by a broad range of customers.

These consolidated financial statements have been prepared by the Executive Board and have been submitted to the Supervisory Board at its meeting held on February 26, 2024 for approval and publication.

Companies included in consolidation are AIXTRON SE, and companies controlled by AIXTRON SE. The balance sheet date of all consolidated companies is December 31. A list of all consolidated companies is shown in note 31.

The consolidated financial statements are presented in Euro (EUR). The amounts are rounded to the nearest thousand Euro (EUR thousand).

The financial statements have been prepared on the historical cost basis, except for the revaluation of certain financial instruments.

The preparation of financial statements in conformity with IFRS, as they are to be applied in the EU, requires management to make estimates and judgements that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the balance sheet date and the reported amounts of income and expenses during the reported period. Actual results may differ from these estimates.

The estimates and judgements are reviewed on an ongoing basis. Revisions to accounting estimates and judgements are recognized in the period in which the estimate is revised if this revision affects only that period, or in the period of the revision and future periods if the revision affects both current and future periods. Estimates and judgments which have a significant effect on the Group’s financial statements are described in note 36.

The accounting policies set out below have been applied consistently to all periods presented in these consolidated financial statements.

The accounting policies have been applied consistently by each consolidated company.

(I) Subsidiaries

The consolidated financial statements incorporate the financial statements of the Company and entities controlled by the Company (its subsidiaries) made up to 31 December each year. Control is achieved when the Company:

The Company reassesses whether or not it controls an investee if facts and circumstances indicate that there are changes to one or more of the three elements of control listed above.

Entities over which AIXTRON SE has control are treated as subsidiaries (see note 31). The results of subsidiaries are included in the consolidated financial statements from the date that control commences until the date that control ceases.

(II) Transactions Eliminated on Consolidation

All intercompany income and expenses, transactions and balances have been eliminated in the consolidation.

The consolidated financial statements have been prepared in Euro (EUR). In the translation of financial statements of subsidiaries outside the Eurozone the local currencies are also the functional currencies of those companies. Assets and liabilities of those companies are translated to EUR at the exchange rate as of the balance sheet date. Income and expenses are translated to EUR at average exchange rates for the year or at average exchange rates for the period between their inclusion in the consolidated financial statements and the balance sheet date. Net equity is translated at historical rates. The differences arising on translation are disclosed in the consolidated statement of changes in equity.

Exchange gains and losses resulting from fluctuations in exchange rates in the case of foreign currency transactions are recognized in the income statement in other operating income or other operating expenses.

(I) Acquisition or Manufacturing Cost

Items of property, plant and equipment are stated at cost, plus ancillary charges such as installation and delivery costs, less accumulated depreciation (see below) and impairment losses (see accounting policy (J)).

Costs of internally generated assets include not only costs of material and personnel, but also a share of directly attributable overhead costs, such as employee benefits, delivery costs, installation, and professional fees.

Where parts of an item of property, plant and equipment have different useful lives, they are depreciated as separate items of property, plant and equipment.

(II) Subsequent Recognition of Costs

AIXTRON recognizes in the carrying amount of an item of property, plant and equipment the cost of replacing components or enhancement of such an item when that cost is incurred if it is probable that the future economic benefits embodied in the item will flow to the Group and the cost of the item can be measured reliably. All other costs such as repairs and maintenance are expensed as incurred.

(III) Government Grants

Government grants related to the acquisition or manufacture of owned assets are deducted from original cost at the date of capitalization.

(IV) Depreciation

Depreciation is charged on a straight-line basis over the estimated useful lives of each part of an item of property, plant and equipment. Useful lives, depreciation method and residual values of property, plant and equipment are reviewed at the year-end date or more frequently if circumstances arise which are indicative of a change. The estimated useful lives are as follows:

• Buildings 25 - 45 years

• Machinery and equipment 3 - 19 years

• Other plant, factory and office equipment 2 - 20 years

The useful lives of leased assets do not exceed the expected lease periods.

(V) Leased Assets

The Group only has contracts in which it is the lessee.

AIXTRON assesses whether a contract is, or contains, a lease, at inception of the contract. The Group recognizes a lease asset and a corresponding lease liability with respect to all lease arrangements in which it is the lessee, except for short-term leases (defined as leases with a lease term of 12 months or less) and leases of low value assets (such as tablets and personal computers, small items of office furniture and telephones). For these leases, the Group recognizes the lease payments as an operating expense on a straight- line basis over the term of the lease unless another systematic basis is more representative of the time pattern in which economic benefits from the leased assets are consumed.

AIXTRON recognizes a leased asset and a lease liability at the lease commencement date. The leased asset is initially measured at cost, which comprises the initial amount of the lease liability adjusted for any lease payments made at or before the commencement date, plus any initial direct costs incurred and an estimate of costs to dismantle and remove the underlying asset or to restore the underlying asset or the site on which it is located, less any lease incentives received.

The leased asset is subsequently depreciated using the straight-line method from the commencement date to the earlier of the end of the useful life of the asset or the expected end of the lease term. The estimated useful lives of leased assets are determined on the same bases as those of property, plant and equipment. In addition, the leased asset is periodically tested and reduced by impairment losses, if any, and adjusted for certain remeasurements of the lease liability.

The right-of-use assets are presented in property, plant and equipment, and leased assets in the consolidated statement of financial position.

The lease liability is initially measured at the present value of the lease payments that are not paid at the commencement date, discounted using the interest rate implicit in the lease or, if that rate cannot be readily determined, the company’s incremental borrowing rate.

Lease payments included in the measurement of the lease liability comprise fixed payments, less any lease incentives and variable lease payments that depend on an index or rate, initially measured using the index or rate at the commencement date.

The lease liabilities are included in other non-current payables and other current liabilities in the consolidated statement of financial position.

The lease liability is measured at amortized cost using the effective interest method. It is remeasured when there is a change in future lease payments arising from a change in index or rate, or if the company changes its assessment of whether it will exercise a purchase, extension or termination option. When the lease liability is remeasured in this way, a corresponding adjustment is made to the carrying amount of the leased asset, or is recorded in profit or loss if the carrying amount of the leased asset has been reduced to zero.

The Group did not make any such adjustments during the periods presented.

(I) Goodwill

Business combinations are accounted for by applying the purchase method.

Goodwill is stated at cost less any accumulated impairment loss. Goodwill is allocated to cash-generating units and is tested at least once per year for impairment, regardless there are any indications of impairment. For the purposes of the impairment test, goodwill is allocated to the cash-generating unit. An impairment loss is recognized if the carrying amount exceeds the higher of the fair value less costs to sell and the value in use of the cash-generating unit. Details of the impairment test are presented in Note 12 (see accounting policy (J)). Impairment losses on goodwill are not reversed.

(II) Research and Development

Expenditure on research activities, undertaken with the prospect of gaining new technical knowledge and understanding using scientific methods, is recognized as an expense as incurred.

Expenditure on development comprises costs incurred with the purpose of using scientific knowledge technically and commercially. As not all criteria of IAS 38 are met AIXTRON does not capitalize such costs.

(III) Other Intangible Assets

Other intangible assets that are acquired are stated at cost less accumulated amortization (see below) and impairment losses (see accounting policy (J)).

Intangible assets acquired through business combinations are stated at their fair value at the date of purchase.

Expenditure on internally generated goodwill, trademarks and patents is expensed as incurred.

(IV) Amortization

Amortization is charged on a straight-line basis over the estimated useful lives of intangible assets, except for goodwill. Goodwill has a useful life which is indefinite and is tested annually in respect of its recoverable amount. Other intangible assets are amortized from the date they are available for use. Useful lives and residual values of intangible assets are reviewed at the year-end date or more frequently if circumstances arise which are indicative of a change.

The estimated useful lives are as follows:

(I) Financial Assets

Financial assets are classified into the following specific categories:

The classification depends on the nature and purpose of the financial assets and is determined at the time of initial recognition.

(II) Financial Assets at Amortized Cost

Financial assets are measured at amortized cost as they are held within a business model to collect contractual cash flows and these cash flows consist solely of payments of principal and interest on the principal amount outstanding.

(III) Financial Assets at FVTPL

All financial assets not classified as measured at amortized cost or at fair value through other comprehensive income under IFRS 9 are measured at fair value through profit and loss (FVTPL).

Financial assets at FVTPL are measured at fair value at the end of each reporting period, with any fair value gains or losses recognized in profit or loss. The gain or loss including dividends earned on financial asset and is included in profit and loss account and in note 5 or 6 respectively. Fair value is determined in accordance with IFRS 13.

(IV) Trade Receivables

Trade receivables and other receivables are measured at amortized cost as they are held within a business model to collect contractual cash flows and these cash flows consist solely of payments of principal and interest on the principal amount outstanding.

(V) Impairment of Financial Assets

The Group recognizes a loss allowance for expected credit losses (ECL) on trade receivables and contract assets. The amount of expected credit losses is updated at each reporting date to reflect changes in credit risk since initial recognition of the respective financial instrument. The Group always recognizes lifetime ECL for trade receivables, and contract assets. The expected credit losses on these financial assets are estimated using a provision analysis based on the Group’s historical credit loss experience, adjusted for factors that are specific to the debtors, general economic conditions and an assessment of both the current as well as the forecast direction of conditions at the reporting date.

For all other financial instruments, the Group recognizes lifetime ECL when there has been a significant increase in credit risk since initial recognition. However, if the credit risk on the financial instrument has not increased significantly since initial recognition, the Group measures the loss allowance for that financial instrument at an amount equal to 12-month ECL. Lifetime ECL represents the expected credit losses that will result from all possible default events over the expected life of a financial instrument. In contrast, 12- month ECL represents the portion of lifetime ECL that is expected to result from default events on a financial instrument that are possible within 12 months after the reporting date.

(VI) Cash and Cash Equivalents

Cash and cash equivalents comprise cash on hand and deposits with banks with a maturity of less than three months at inception.

(VII) Equity Instruments

Equity instruments, including share capital, issued by the Group are recorded at the proceeds received, net of direct issue costs.

(VIII) Financial Liabilities

Other financial liabilities, including trade payables, are measured at amortized cost.

Inventories are stated at the lower of cost and net realizable value. Net realizable value is the estimated selling price in the ordinary course of business, less the estimated cost of completion and selling expenses. Cost is determined using weighted average cost.

The cost includes expenditures incurred in acquiring the inventories and bringing them to their existing location and condition. In the case of work in progress and finished goods, cost includes direct material and production cost, as well as an appropriate share of overheads based on normal operating capacity. Scrap and other wasted costs are expensed on a periodic basis either as cost of sales or, in the case of beta tools as research and development expense.

Allowance for slow moving, excess and obsolete, and otherwise unsaleable inventory is recorded based primarily on either the estimated forecast of product demand and production requirement or historical usage. When the estimated future demand is less than the inventory, AIXTRON writes down such inventories.

Operating result is stated before finance income, finance expense and tax.

Property, plant and equipment as well as other intangible assets are tested for impairment, where there is any indication that the asset may be impaired. The Group assesses at the end of each period whether there is an indication that an asset may be impaired. Impairment losses on such assets are recognized, to the extent that the carrying amount exceeds both the fair value that would be obtainable from a disposal in an arm’s length transaction, and the value in use.

In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments and the risks associated with the asset.

Impairment losses are reversed if there has been a change in the estimates used to determine the recoverable amount. Reversals are made only to the extent that the carrying amount of the asset does not exceed the carrying amount that would have been determined if no impairment loss had been recognized.

Basic earnings per share are computed by dividing net income (loss) by the weighted average number of issued common shares for the year. Diluted earnings per share reflect the potential dilution that could occur if options issued under the Company’s stock option plans were exercised unless such exercises had an anti-dilutive effect.

(I) Defined Contribution Plans

Obligations for contributions to defined contribution pension plans are recognized as an expense in the income statement as incurred.

(II) Share-based Payment Transactions Stock Option Programs

As part of the share option programs from 2007 and 2012, share options were issued to members of the Executive Board, managers and employees of the Group. The contractual terms of these share programs are presented in note 22. These stock option programs are accounted for according to IFRS 2 for equity-settled share-based payment transactions. The fair value of options granted were recognized as personnel expense with a corresponding increase in additional paid-in capital.

Executive Board remuneration system at AIXTRON SE consists long-term variable remuneration incentives (LTI) granted in shares of AIXTRON SE. These equity-settled share-based payments are measured at fair value of the equity instruments at the grant date. The fair value of the shares granted is measured using a mathematical model, taking into account the terms and conditions upon which the shares were granted. Further details regarding the equity-settled share-based transactions are set out in note 22 and 31.

The fair value determined at the grant date of the equity-settled share-based payments is expensed on a straight-line basis over the performance period, based on the Group’s estimate of the number of equity instruments expected to vest. For non-market-based vesting conditions, the Group reviews its estimate of number of equity instruments at each reporting date during vesting period. The impact of the revision of the original estimates, if any, is recognized in profit or loss and a corresponding adjustment is recognized to equity.

A provision is recognized when the Group has a present legal or constructive obligation as a result of a past event, and it is probable that an outflow of economic benefits will be required to settle this obligation. If the effect is material, provisions are determined by discounting the expected future cash flows at a pre-tax interest rate that reflects current market assessments of the time value of money and, where appropriate, the risks associated with the liability.

(I) Warranties

The Group normally offers one- or two-year warranties on all of its products. Warranty expenses generally include cost of labor, material and related overhead necessary to repair a product free of charge during the warranty period. The specific terms and conditions of those warranties may vary depending on the equipment sold, the terms of the contract and the locations from which they are sold. The Group establishes the costs that may be incurred under its warranty obligations and records a liability in the amount of such costs at the time revenue is recognized.

Factors affecting the warranty obligation include the historical and expected number of warranty claims and the estimated cost per warranty claim.

The Group accrues warranty cost for systems shipped based upon historical experience. The Group periodically assesses the adequacy of its recorded warranty provisions and adjusts the amounts as necessary.

Extended warranties, beyond the normal warranty periods, are treated as maintenance services in accordance with note 2(N) below.

AIXTRON enters contracts with customers for goods and services, including combinations of goods and services. Contracts are usually for fixed prices and do not offer any unilateral right of return to the customer.

Revenue is generated from the following major sources:

Revenue is recognized when the Group satisfies a performance obligation in contracts with its customers by transferring control of promised goods or services to the customer and it is probable that the economic benefits associated with the transaction will flow to the entity.

The sale of equipment involves acceptance tests at AIXTRON ́s production facility. After successful completion of this test, the equipment is dismantled and packaged for shipment.

Revenues from the sale of products that have been demonstrated to meet product specification requirements are recognized at a point in time upon shipment to the customer if full acceptance tests have been successfully completed at the AIXTRON production facility and control has passed to the customer and the customer can benefit from the product either on its own or with other resources that are readily available.

Upon arrival at the customer site the equipment is reassembled and installed, which is a service generally performed by AIXTRON engineers. Revenue relating to the installation of the equipment is recognized at the point in time when AIXTRON has fulfilled its performance obligations under the contract and control of the goods has passed to the customer.

Revenue related to equipment where meeting the product specification requirements has not yet been demonstrated or the customer cannot benefit from the product either on its own or with other resources that are readily available, or where specific rights of return have been negotiated, is recognized only at the point in time when the customer finally accepts the equipment and has control.

Revenue related to spares is recognized at the point in time at which the customer obtains control of the goods, generally at the point of delivery.

Revenue related to services such as repair works is recognized at the point in time as the customers accepts the equipment at this point.

As part of the payment terms, AIXTRON does not grant any general right of return, cash discount, credit notes or other sales incentives. Generally, payment terms for advance payments and customer invoices are short-term and contracts do not include a financing component.

The consideration from contracts which include combinations of different performance obligations such as equipment, spares and services is allocated to each performance obligation in an amount that depicts the amount of consideration to which the Group expects to be entitled in exchange for transferring the goods or services to the customer. Discounts from list price are proportionately allocated to each performance obligation. The transaction price is allocated to each performance obligation based on a relative stand-alone selling price basis. As the stand-alone selling prices are usually not directly observable, AIXTRON uses the expected cost plus a margin approach to estimate the stand-alone selling price.

The portion of equipment revenue related to installation services is determined based on either the method described above or, if the Group determines that there may be a risk that the economic benefits of installation services may not flow to the Group, the portion of the contract amount that is due and payable upon completion of the installation.

Contract assets may arise for contracts with different performance obligations if the revenue recognized exceed the amounts for received advance payments and customer invoices (see note 16).

(I) Cost of Sales

Cost of sales includes such direct costs as materials, labor, and related production overheads.

(II) Research and Development

Research and development costs are expensed as incurred. Costs of beta tools which do not qualify to be recognized as an asset are expensed as research and development costs.

Project funding received from governments (e.g. state funding) is recorded in other operating income, if the research and development costs are incurred and provided that the conditions for the funding have been met.

(III) Lease Payments

Payments made under leases for assets which have not been capitalized are recognized as expense on a straight-line basis over the term of the lease.

Government grants awarded for project funding are recorded in other operating income if the research and development costs are incurred and provided that the conditions for the funding have been met. Government grants awarded to support continued employment where work is not allowed are recorded as a reduction in the related expense, as this presents the underlying reason for the grant better.

The tax expense represents the sum of the current and deferred tax.

A deferred tax asset is recognized only to the extent that it is probable that future taxable profits can be set off against timing differences and tax losses carried forward or taxable temporary differences exist. Deferred tax assets are reduced to the extent that it is no longer probable that the related tax benefit can be realized. The recoverability of deferred tax assets is reviewed at least annually.

Deferred tax assets and liabilities are recorded for temporary differences between tax and commercial balance sheets and for losses brought forward for tax purposes as well as for tax credits of the companies included in consolidation. Deferred tax assets and liabilities shall be measured at the tax rates that are expected to apply to the period when the asset is realized or the liability is settled, based on tax rates (and tax laws) that have been enacted or substantively enacted by the end of the reporting period.

Current income taxes for the current and prior periods are recognized as a liability to the extent that they have not yet been paid. If the amount attributable to the current and prior periods and already paid exceeds the amount due for those periods, the difference is recognized as an asset. The amount of the expected tax liability or tax receivable reflects the best estimate of the amount, considering tax uncertainties, when applicable.

The Group evaluates income tax uncertain treatments on a regular basis. In making this assessment, the Group assumes that a tax authority will review the matter in question and that it has all the relevant information to do so. If it is probable that an uncertain tax treatment will not be accepted by the tax authorities, the best estimate (expected value or most likely value of the tax uncertainty) is used to determine the impact and a tax liability is recognized or, in the case of existing loss carryforwards, the deferred tax attributable to them is reduced accordingly.

An operating segment is a component of the Group that is engaged in business activities and whose operating results are reviewed regularly by the Chief Operating Decision Maker, which AIXTRON considers to be its Executive Board, to make decisions about resources to be allocated to the segment and assess its performance and for which discrete financial information is available. AIXTRON has only one reportable segment.

Accounting standards applied in segment reporting are in accordance with the general accounting policies as explained in this section.

Cash flows from operating activities are determined using the indirect method. Cash flows from taxes are allocated to operating activities.

Cash flows from other financial assets (fund investments) are presented in cash flow from investing activities as the assets are not traded for trading purposes.

New and Amended IFRS Standards Effective for the Current Year

In the current year, the Group has applied the below amendments to IFRS standards and interpretations issued by the International Accounting Standards Board (IASB) that are effective for an annual period that begins on or after 1 January 2023. Their adoption has not had any material impact on the disclosures or on the amounts reported in these consolidated financial statements.

IFRS 17 Insurance contracts

| Amendments to IAS 1 and IFRS Practice Statement 2 | Disclosure of Accounting Policies |

| Amendments to IAS 8 | Definition of Accounting Estimates |

| Amendments to IAS 12 | Deferred Tax related to assets and liabilities arising from a single transaction1) |

| Amendments to IAS 12 | International Tax reform - pillar two model rules1) |

1) The amendment has been effective immediately since the publication on May 23, 2023.

At the date of authorization of these consolidated financial statements, the Group has not applied following new and revised standards and interpretations which have been issued but are not yet effective. AIXTRON does not expect that the adoption of these standards will have a material impact on the financial statements of the Group in future periods.

Long-term debt with additional conditions - Amendments to IAS 1 Classification of liabilities as current or non-current1)

| Amendments to IFRS 16 | Lease liability in a Sale and Leaseback transaction1) |

| Amendment to IAS 7 and IFRS 7 Supplier arrangements4) | |

| Amendments to IAS 21 | Lack of exchangeability2) |

| Amendment to IFRS 10 and IAS 28 | Sale or contribution of assets between an investor and an associate or joint venture3) |

1) Initial application to annual reporting periods beginning on or after 1 January 2024.

2) Initial application to annual reporting periods beginning on or after 1 January 2025.

3) The effective date of the amendments has yet to be set by the Board.

4) EU endorsement is still pending.

IFRS 8 requires operating segments to be identified on the basis of internal reports about components of the Group that are regularly reviewed by the Executive Board, as chief operating decision maker, in order to allocate resources to the segments and to assess their performance.

In the period 2022 to 2023 the Executive Board regularly reviewed financial information to allocate resources and assess performance only on a consolidated Group basis since the various activities of the Group are largely integrated from an operational perspective. In accordance with IFRS, AIXTRON has only one reportable segment.

The Group’s reportable segment is based around the category of goods and services provided to the semiconductor industry

Revenues are recognized as disclosed in note 2 (N).

Reversals of impairment allowances are included in other operating income as described in note 5.

The accounting policies of the reportable segment are identical to the Group’s accounting policies as described in note 2. Segment profit represents the profit earned by the segment without the allocation of investment revenue, finance costs and income tax expense. This is the measure reported to the Executive Board for the purpose of resource allocation and assessment of performance.

The transaction price allocated to (partially) unsatisfied performance obligations at 31 December 2023 is EUR 353.7 million (31 December 2022: EUR 351.8 million). Management expects that approximately 91% of the transaction price allocated to the unsatisfied contracts as of the year ended 2023 will be recognized as revenue during 2024. The remaining amount will be recognized during the next fiscal year.

For the purpose of monitoring segment performance and allocating resources all assets other than tax assets, deferred tax assets, cash and cash equivalents and other financial assets are treated as allocated to the reportable segment. All liabilities are allocated to the reportable segment apart from tax liabilities and post-employment benefit liabilities.

Additions and changes to property, plant and equipment, to goodwill and to intangible as- sets, and the depreciation and amortization expenses are given in notes 11 and 12. Other non-current financial assets were essentially unchanged during 2023 compared to previous year (2022: unchanged).

Information concerning other material items of income and expense for personnel expenses and R&D expenses can be found in notes 7 and 4.

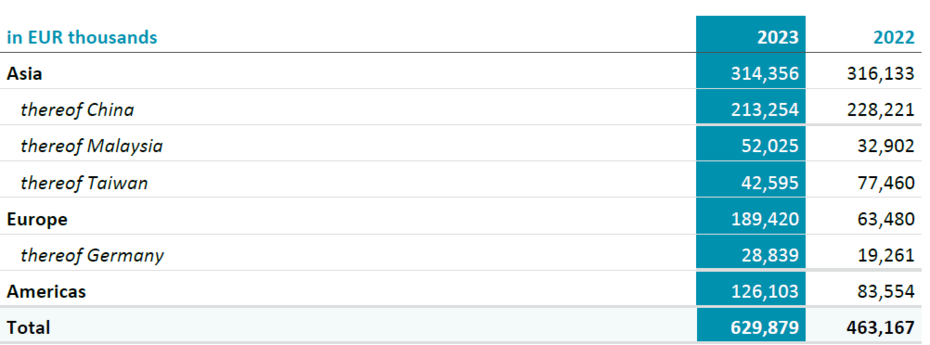

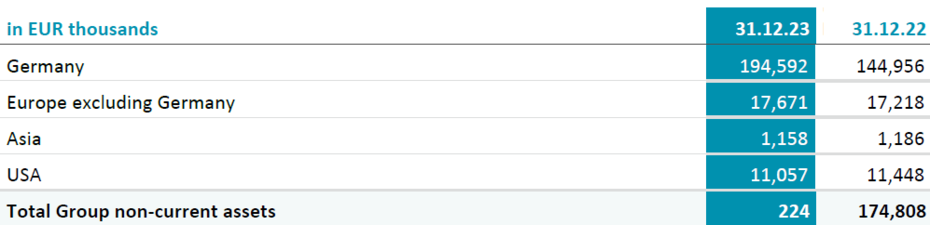

The Group’s revenue from continuing operations from external customers and information about its non-current assets by geographical location are detailed below. Revenues from external customers are attributed to individual countries based on the country in which it is expected that the products will be used.

Revenues from all countries outside Germany were EUR 601,040 thousand and EUR 443,906 thousand for the years 2023 and 2022 respectively.

In 2023 one customer accounted 15% and one customer for 10% of Group revenue. During 2022 sales of Group revenue with no customer exceeding 10%.

Non-current assets exclude deferred tax assets, financial instruments, post-employment benefit assets and rights arising under insurance contracts.

Research and development costs, before deducting project funding received which is included in other operating income, were EUR 87,681 thousand and EUR 57,726 thousand for the years ended December 31, 2023 and 2022 respectively.

After deducting project funding received and not repayable, net expenses for research and development were EUR 80,923 thousand and EUR 52,424 thousand for the years ended December 31, 2023 and 2022 respectively.

The project funding received amounting to EUR 6,758 thousand (2022: EUR 5,303 thousand) are government grants.

In addition, EUR 15 thousand (2022: EUR 15 thousand) government grants were deducted from the carrying amount of an asset in property, plant and equipment. The reduced depreciation is attributable to research and development.

The amounts for research and development funding are government grants.

In 2023 total net exchange gains of EUR 759 thousand were recognized in profit or loss (2022: gain EUR 2,794 thousand) (see also note 6).

Financial assets measured at fair value through profit or loss resulted in net income of EUR 4,846 thousand in 2023 (2022: net loss of EUR 1,047 thousand).

The item “Losses from financial assets at FVTPL” includes unrealized losses of EUR 0 thousand (2022: EUR 770 thousand) and realized losses of EUR 0 thousand (2022: EUR 277 thousand).

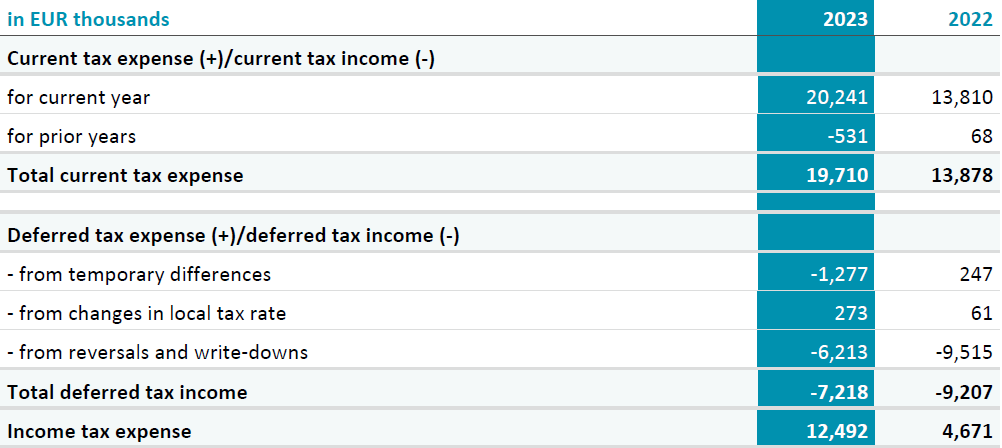

The following table shows income tax expenses and income recognized in the consolidated income statement:

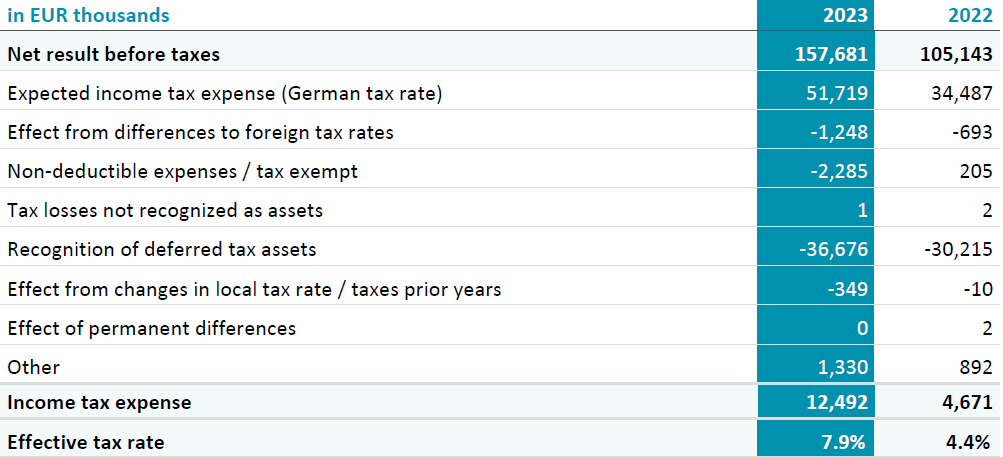

The Group’s effective tax rate is different from the German statutory tax rate of 32.80% (2022: 32.80%) which is based on the German corporate income tax rate (incl. solidarity surcharge) and trade tax.

The following table shows the reconciliation from the expected to the reported tax expense:

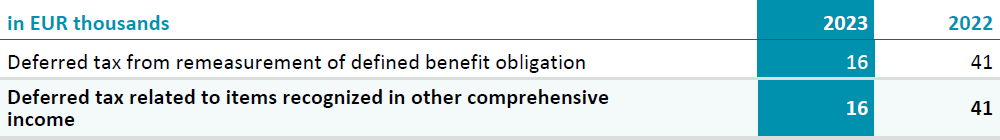

In addition to the amount charged to profit or loss, the following amounts relating to tax have been recognized in other comprehensive income (OCI):

The law implementing Council Directive (EU) 2022/2523 to ensure a global minimum level of taxation for groups of companies (Minimum Tax Act) and other accompanying

measures was promulgated in the Federal Law Gazette on December 27, 2023 and came into force on December 28, 2023. AIXTRON SE is not subject to the application of these regulations in fiscal year 2023.

Therefore, the corresponding IAS 12 Tax Amendments do not apply either.

As of December 31, 2023 the current tax receivable and payable, arising because the amount of tax paid in the current or in prior periods was either too high or too low, are EUR 2,115 thousand (2022: EUR 2,804 thousand) and EUR 6,447 thousand (2022: EUR  2,439 thousand) respectively.

2,439 thousand) respectively.

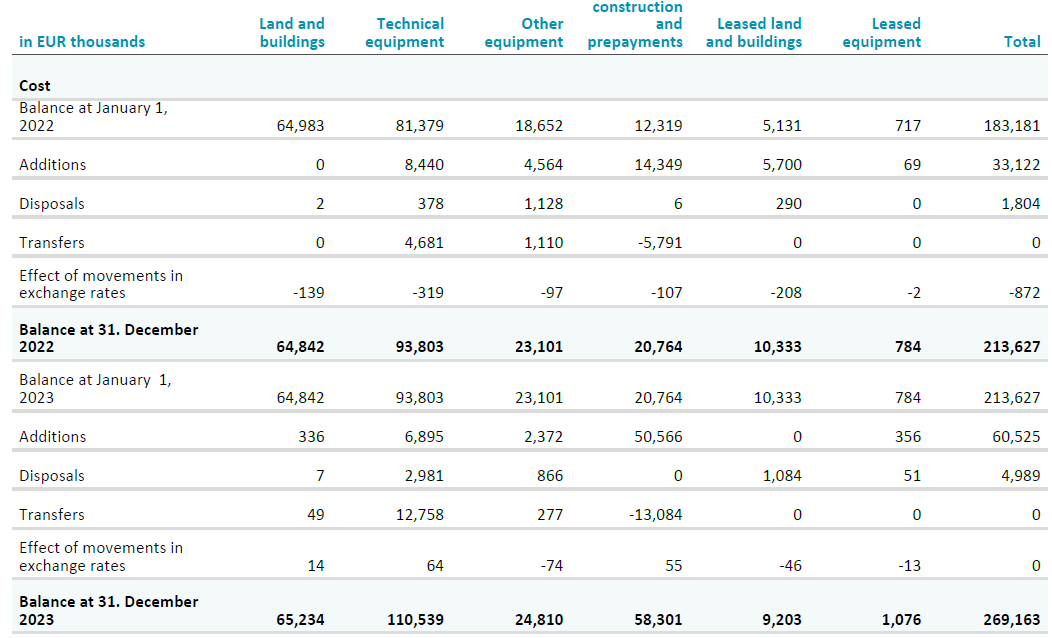

Depreciation expense amounted to EUR 10,303 thousand for 2023 and EUR 7,674 thousand for 2022 respectively.

The useful lives and residual values of assets are reviewed at least at the end of each financial year. If the expected useful lives and residual values differ from previous estimates, the effects of the changes are recognized in the current financial year.

In 2023 there were no adjustments to the remaining useful lives and residual values that would have to led to lower depreciation than if the useful lives and residual values had not been adjusted.

In 2022 the audit revealed that depreciation was EUR 933 thousand lower than if the useful lives and residual values had not been adjusted.

No impairment expense was incurred in the fiscal year 2023 or for the previous year.

Assets under construction amounted to EUR 58,292 thousand in 2023 (2022: EUR 20,755 thousand) and mainly relate to the building of the new innovation center and internally generated laboratory facilities under construction. In 2022, the item mainly included internally generated laboratory facilities under construction and advance payments for the expansion of the production and development areas.

Disclosures in respect of the underlying leases are shown in note 27.

Other intangible assets include patents, other rights and software.

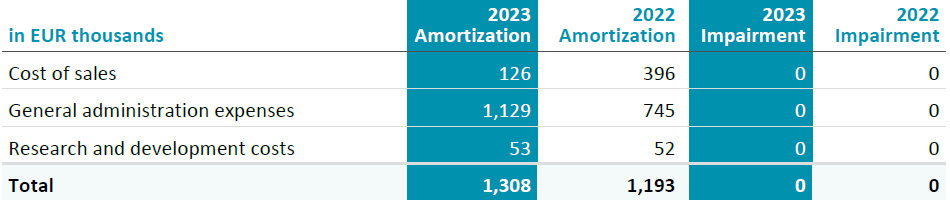

Amortization and impairment expenses for other intangible assets are recognized in the income statement as follows:

As in the previous year no impairment expense was incurred in 2023. No reversal of impairment were recognized in fiscal years 2023 and 2022.

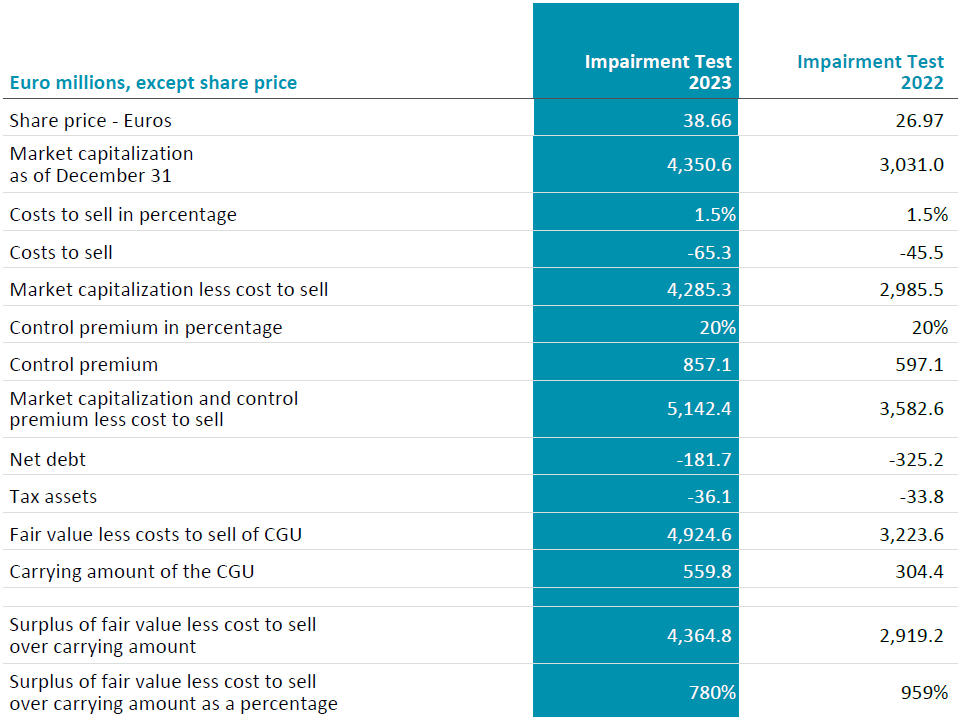

At the end of 2023 the Group assessed the recoverable amount of goodwill and determined that as in 2022 no impairment loss had to be recognized.

As at the end of 2023 the cash generating unit, to which the goodwill has been allocated, is the AIXTRON Group Semiconductor Equipment segment.

The recoverable amount of the cash-generating unit is determined through a fair value less cost to sell calculation. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. As AIXTRON has only one cash generating unit (CGU), market capitalization of AIXTRON, adjusted for a control premium, has been used to determine the fair value less cost to sell of the cash generating unit. This is level 2 in the hierarchy of fair value measures set out in IFRS 13.

As at December 31, 2023 the market capitalization of AIXTRON was EUR 4,351 million, based on a share price of EUR 38.66 and issued shares (excluding Treasury Shares) of 112,534,618.

In an orderly selling process costs are incurred. AIXTRON has used 1.5% to account for the costs to sell.

A control premium typically in the range 20% - 40% is incurred in the acquisition of a company. A 20% premium has been applied in this test to adjust the market capitalization to the fair value. Market capitalization was also adjusted for net debt and tax assets prior to comparing it to the carrying amount of the CGU. The analysis shows that the fair value less costs to sell of the CGU AIXTRON exceeds its carrying amount and that Goodwill is not impaired.

The fair value less costs to sell, which is the recoverable amount, exceeds the carrying amount of the CGU by 780% (2022: 959%).

Other non-current financial assets amounting to EUR 707 thousand (2022: EUR 705 thousand) mainly relate to security deposits for buildings.

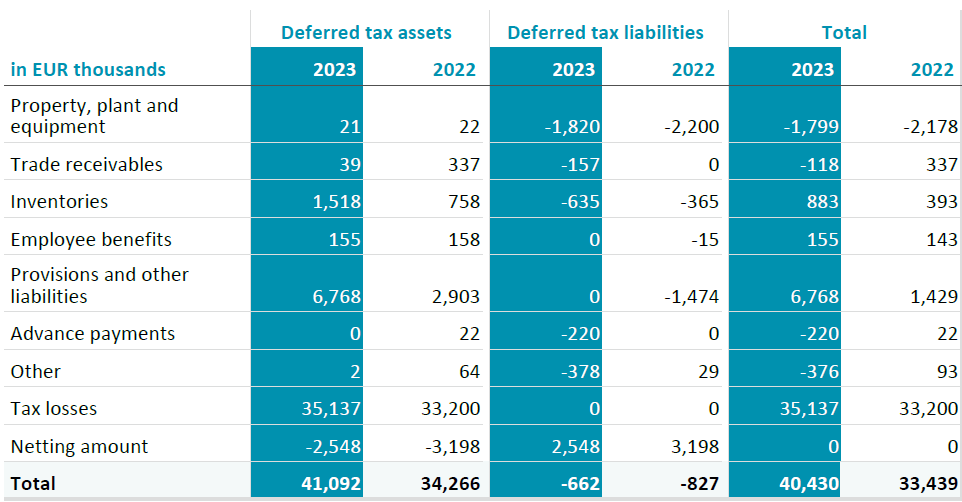

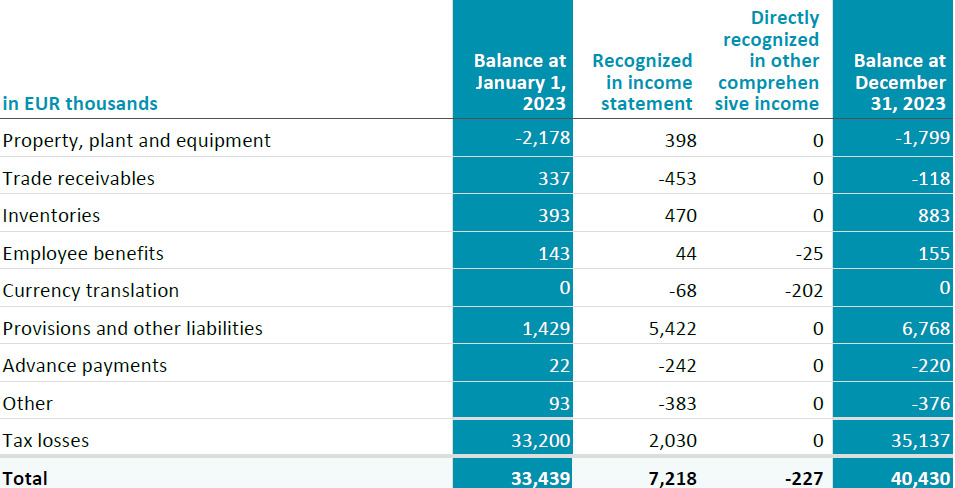

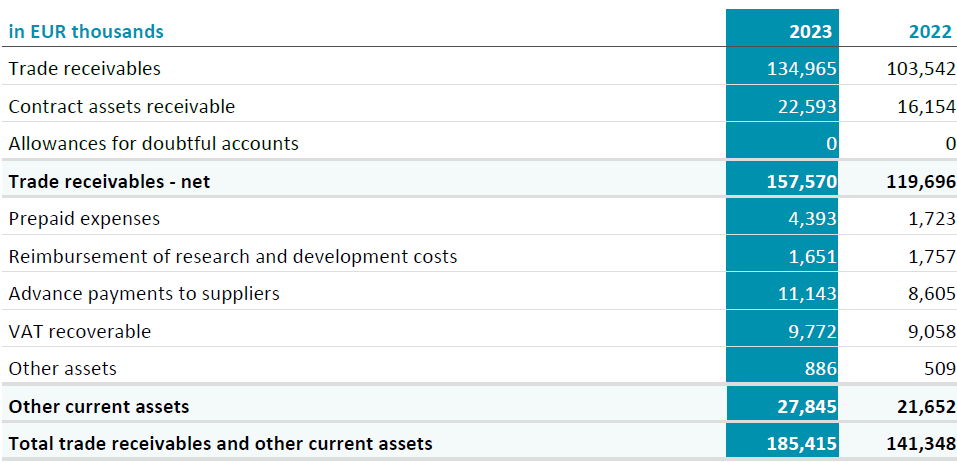

Deferred tax assets and liabilities are attributable to the following items:

Deferred tax assets are recognized at the level of individual consolidated companies in which a loss was realized in the current or preceding fiscal year, only to the extent that there is convincing evidence that sufficient taxable profit will be available against which the deferred tax assets can be used. The nature of the evidence used in assessing the probability of realization includes forecasts, budgets and the recent profitability of the relevant entity. In fiscal year 2023, deferred tax assets in the amount of EUR 652 thousand (2022: EUR 255 thousand) were recognized, which were attributable to companies that reported a loss in fiscal year 2023 or in the previous fiscal year. Of this amount, EUR 641 thousand was attributable to a Group company that had suffered a loss in the financial year due to a timing effect. It is expected that the reversal of the effect will lead to corresponding taxable profits.

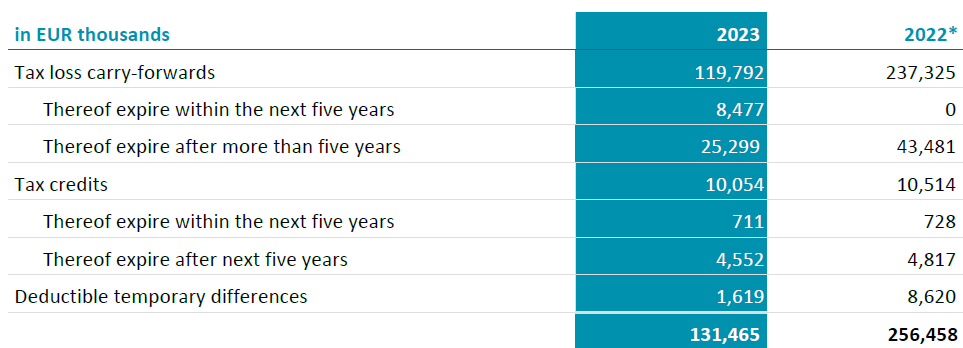

No deferred tax assets were recognized for the following items (gross values):

No deferred tax liabilities were recognized on temporary differences in relation to investments in subsidiaries amounting to EUR 859 thousand (2022: EUR 774 thousand*).

The following table shows the development of deferred tax assets and liabilities during the fiscal year:

*For reasons of comparability and on the basis of better insights, the previous year's figures have been adjusted without affecting the amounts recognized in the balance sheet.

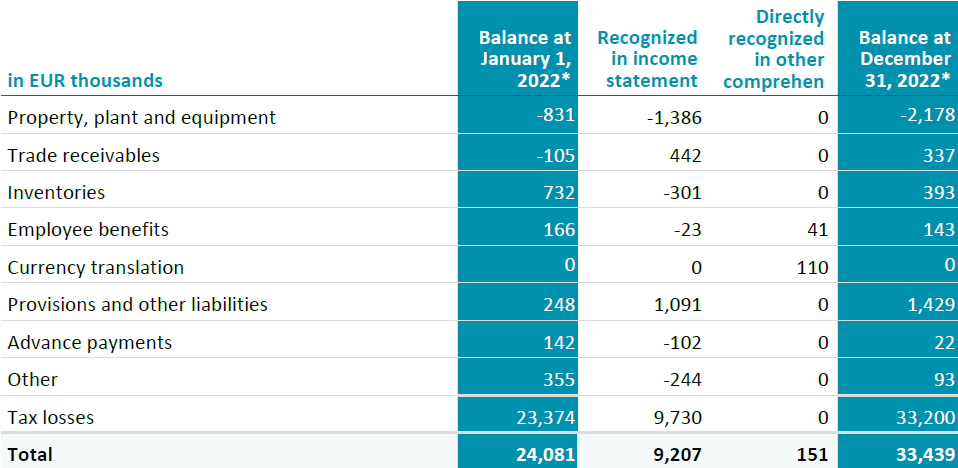

The reversal of write-downs recognized during the year in both 2023 and 2022 mainly relates to inventories which had been written down to their net realizable value and subsequently were sold.

Customer-specific work in process relates to work performed at the customers’ site, typically to install equipment or to upgrade customers’ existing equipment. Completion of installation is the final contractual deliverable in most customer contracts which typically allows any remaining payments to be received from the customer.

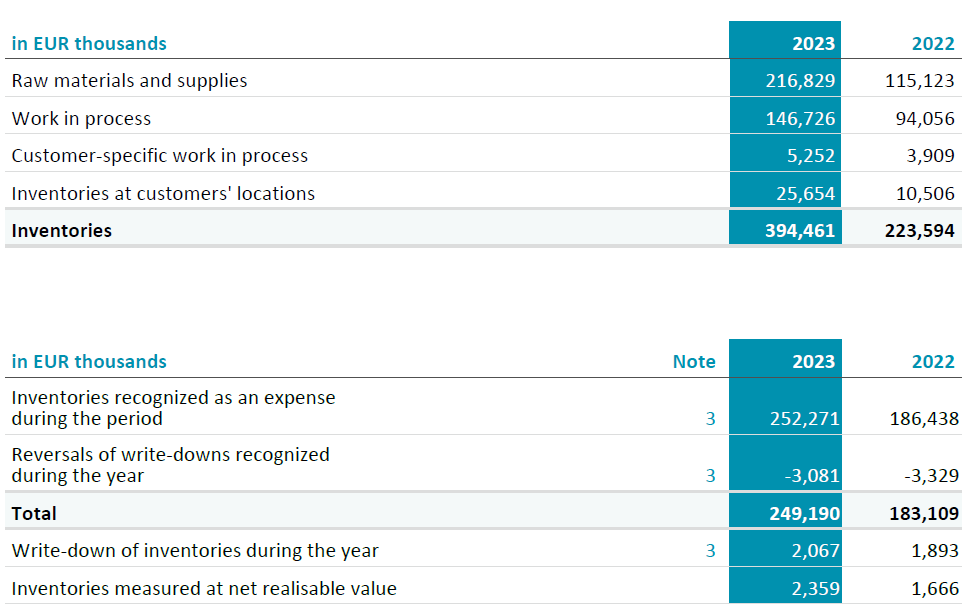

Additions to allowances against trade receivables are included in other operating expenses, releases of allowances are included in other operating income. Neither in the 2023 financial year nor in the previous year were any impairment losses on receivables or reversals of impairment losses to be recognized.

Ageing of past due but not impaired receivables:

Due to the worldwide spread of risks, there is a diversification of the credit risk for trade receivables. Generally, the Group demands no securities for financial assets. In accordance with usual business practice for capital equipment however, the Group mitigates its exposure to credit risk by requiring payment by irrevocable letters of credit and substantial payments in advance from most customers as conditions of contracts for sale of major items of equipment.

In 2023 one customer accounted for 13% of net trade receivables respectively. In 2022 two customers accounted for 11% and 10% of net trade receivables respectively. In determining concentrations of credit risk, the Group defines counterparties as having similar characteristics if they are part of the same external group of entities.

Included in the Group’s trade receivable balance are debtors with a carrying amount of EUR 4,662 thousand (2022: EUR 17,937 thousand) which are past due at the reporting date for which the Group has not provided. As there has not been a significant change in credit quality, and although the Group has no collateral, the amounts are considered recoverable.

The Group measures the loss allowance for trade receivables at an amount equal to the lifetime expected credit loss. Based on its experience, the Group uses a negligible risk of default for lifetime, adjusted for factors which are specific to the debtors, general economic conditions, and an assessment of both the current as well as the forecast direction of conditions at the reporting date.

In determining receivables which may be individually impaired the Group has taken into account the likelihood of recoverability based on the past due nature of certain receivables, and our assessment of the ability of all counterparties to perform their obligations.

In 2023 other financial assets comprise fund investments.

The composition of the other financial assets and the maturities at inception of the deposits were as below:

The fair value of fund investments is determined using the quoted prices in active markets at reporting date which is level one of the fair value hierarchy.

Cash and cash equivalents comprise short-term bank deposits with an original maturity of 3 months or less and financial assets that are convertible to cash at any time and are subject to only minor fluctuations in value. The carrying amount and fair value are the same.

No bank balances were given as security either as of the balance sheet date of the fiscal year or in the previous year.

The share capital of AIXTRON SE consists of no-par value shares and was fully paid-up during 2023 and 2022. Each share represents a portion of the share capital in the amount of EUR 1.00.

Authorized share capital, including issued capital, amounted to EUR 169,927,020 (2022: EUR 169,927,020).

Additional paid-in capital mainly includes the premium on increases of subscribed capital as well as cumulative expenses from stock option plans and for share-based payments.

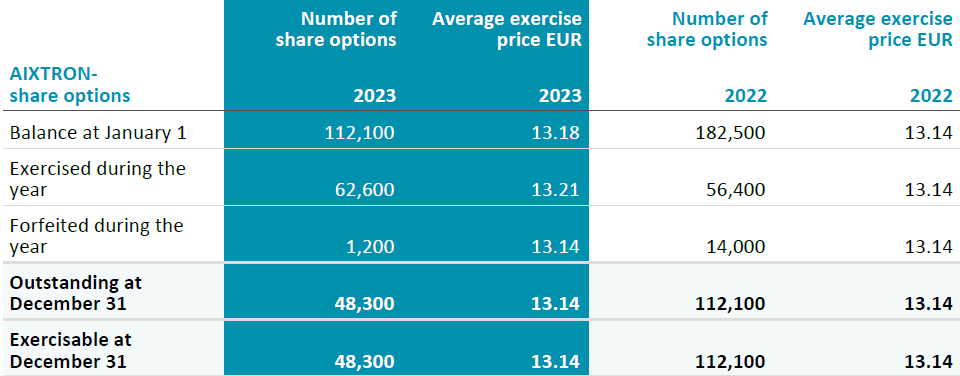

In 2023 62,600 new shares were issued within the scope of AIXTRON stock option plans (2022: 56,400 shares). 88,822 treasury shares were transferred in 2023 as part of the share-based payments scheme (2022: 118,881 shares).

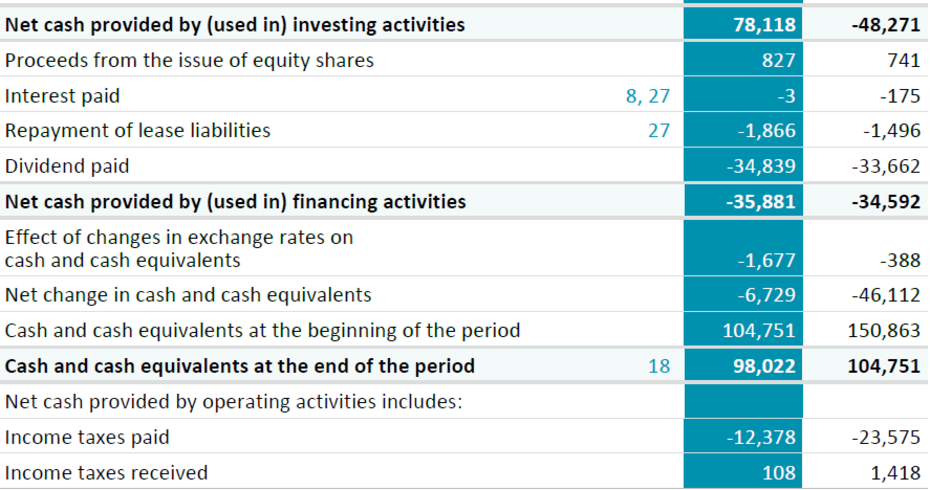

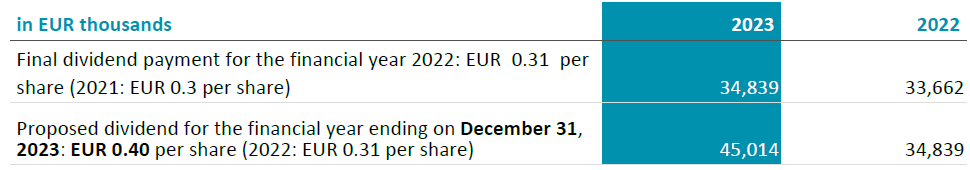

A dividend of EUR 0.31 per share was paid in May 2023. Total dividend amount of EUR 34,839 thousand was paid to shareholders of AIXTRON SE (2022: EUR 33,662 thousand).

The Group regards its shareholders’ equity as capital for the purpose of managing capital. In order to ensure the sustainable development of the AIXTRON Group and to maintain the confidence of investors and stake holders, AIXTRON’s capital management aims to maintain a strong capital base. This is also taken into account when determining dividend distributions. The Group considers its capital resources to be adequate.

Income and expenses recognized in other comprehensive income are shown in the statement of other comprehensive income.

The foreign currency translation adjustment comprises all foreign exchange differences arising from the translation of the financial statements of foreign subsidiaries whose functional currency is not the Euro.

During 2023 an expense of EUR 46 thousand (2022: income EUR 85 thousand) was recorded from the remeasurement of defined benefit obligations in other comprehensive income.

The calculation of the basic earnings per share is based on the weighted-average number of common shares outstanding during the reporting period.

The calculation of the diluted earnings per share is based on the weighted-average number of outstanding common shares and of common shares with a possible dilutive effect resulting from share options being exercised under the share option plan.

In 2023 and 2022 no share options existed that would be anti-dilutive.

Amounts recognized as distributions to shareholders during the fiscal year and the proposed dividend for the year ended December 31, 2023 are set out in the table below:

The Group grants retirement benefits to qualified employees through various defined contribution pension plans. In 2023 the expense recognized for defined contribution plans amounted to EUR 1,625 thousand (2022: EUR 1,253 thousand).

In addition to the Group’s retirement benefit plans, the Group is required to make contributions to state retirement benefit schemes in the countries in which it operates. AIXTRON is required to contribute a specified percentage of payroll costs to the retirement schemes in order to fund the benefits. The only obligation of the Group is to make the required contributions.

Provisions for defined benefit pension plans in the amount of EUR 123 thousand (2022: EUR 115 thousand) are reported under other non-current provisions.

The Company has different fixed option plans which reserve shares of common stock for issuance to members of the Executive Board, management, and employees of the Group. The Executive Board remuneration system at AIXTRON SE also consists long-term variable remuneration components (long-term incentive, LTI) that are granted in shares of AIXTRON SE.

The fair value of services received in return for shares or stock options granted is measured by reference to the fair value of the equity instruments or stock options granted which are determined using mathematical valuation models.

The fair value of the shares and stock options is determined on the basis of a mathematical model.

In the fiscal years 2023 and 2022, no new stock option programs were initiated. There were no expenses recognized for the existing program in 2023 and 2022.

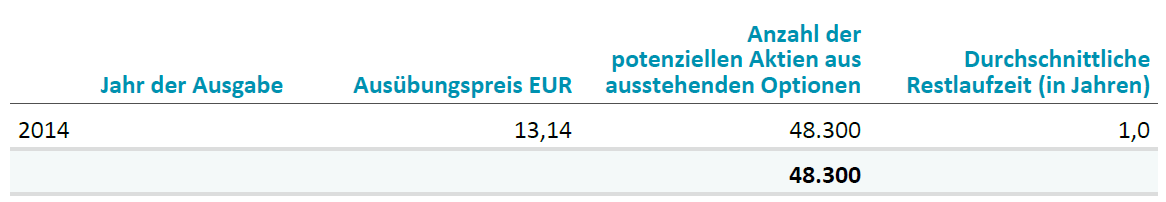

In May 2012, options were authorized to purchase shares of common stock. The granted options may be exercised after a waiting period of not less than four years. The options expire 10 years after they have been granted. Under the terms of the 2012 plan, options are granted at prices equal to the average closing price over the last 20 trading days on the Frankfurt Stock Exchange before the grant date, plus 30%. Options to purchase 48,300 common shares were outstanding under this plan as of December 31, 2023.

The amount of long-term performance-related remuneration (LTI) is geared to the performance of the Group over a 3-year reference period and is granted entirely in AIXTRON shares. Executive Board members may first dispose of these shares following a four-year holding period calculated from the start of the reference period. Before the start of a fiscal year, the Supervisory Board determines the long-term targets for each Executive Board member for the forthcoming reference period. Each Executive Board member receives forfeitable stock awards in the amount of the target LTI as a percentage of the consolidated net income for the year pursuant to the budget adopted for the fiscal year. The number of forfeitable stock awards is calculated based on the average of the closing prices on all stock market trading days in the final quarter of the previous year.

LTI target achievement is determined using the indicators consolidated net income for the year and total shareholder return (TSR), as well as sustainability targets. The TSR is defined as the total shareholder return over the reference period and is calculated as the ratio of the share price development including dividends paid at the end of the reference period to the value at the beginning of the reference period.

In this regard, the relative weighting of the targets amounts to 50% for consolidated net income for the year, 40% for TSR, and 10% for sustainability targets. After the expiry of the three-year reference period, the degree of LTI target achievement is determined by the Supervisory Board. Depending on the degree of target achievement, the forfeitable stock awards are then converted into vested stock awards or otherwise lapse. The maximum number of vested stock awards that may be granted in connection with LTI is capped at 250% of the number of forfeitable stock awards granted at the start of the reference period.

The shares are transferred to the Executive Board member after the four-year restriction period.

The fair value of equity-settled share-based payment transactions is recognized as an expense over the vesting period and a corresponding adjustment is made to equity. The fair value of the shares granted is measured based on a valuation model taking into account the vesting conditions at which the shares are granted. The calculation takes into account estimates for future dividends. The TSR ratio is used as a market condition in estimating the fair value at the valuation date. For the other non-market-based vesting conditions, the Group reviews its estimate of the number of equity instruments during the vesting period. Adjustments in the original estimates, if any, are recognized in profit or loss and a corresponding adjustment is made to equity.

The following table shows the main parameters of the valuation model (Monte Carlo simulation) for the long-term variable remuneration of the Executive Board (LTI) for the LTI Tranche 2023 and 2022:

Assumptions regarding volatility and correlation between the AIXTRON share and the Peer Group were determined based on historical share price developments.

Within the scope of the LTI Tranche 2023 236,101 forfeitable share awards were granted with the weighted average fair value of EUR 34.47 per award on grant date (LTI Tranche 2022: 224,941 forfeitable share awards with the weighted average fair value of EUR 17,35 per award). At the end of the reference period, the forfeitable share awards of LTI Tranche 2023 or 2022 are converted into vested stock awards or partially forfeited.

In 2023, the personnel expenses from share-based payments, all of which were equity settled share-based payments, were EUR 4,762 thousand (2022: EUR 4,441 thousand). Share-based payments include the expense of long-term incentive of the Executive Board which is paid in shares (see note 30).

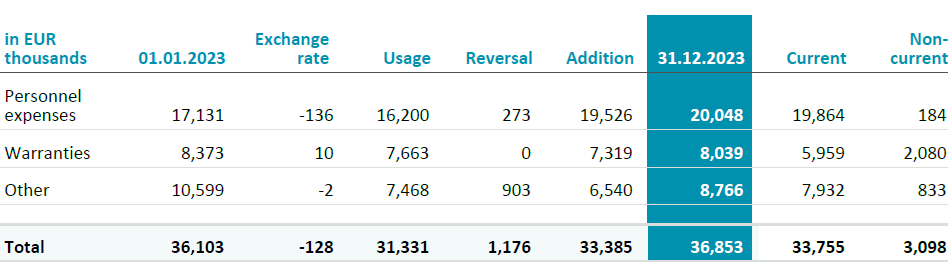

Development and breakdown of provisions:

These include mainly provisions for holiday pay, payroll, severance payments and other variable element of pay, which are financial liabilities.

Warranty provisions are the estimated unavoidable costs of providing parts and service to customers during the normal warranty periods.

Other provisions consist mainly of the estimated cost of services received and also include pension provisions.

For provisions existing at both December 31, 2023 and December 31, 2022, the economic outflows resulting from the obligations that are provided for are expected to be settled within one year of the respective balance sheet date for current provisions and within two years of the respective balance sheet date, but more than one year, for the main non-current provisions (excluding pension provisions).

The liabilities consist of the following:

The carrying amount of trade payables and other current liabilities approximates their fair value. Trade payables, grant liabilities, taxes and other liabilities fall due for payment within 34 days of receipt of the relevant goods or services.

Short-term lease liabilities are explained in note 25.

Details of the significant accounting policies and methods, the basis of measurement that are used in preparing the financial statements and the other accounting policies that are relevant to an understanding of the financial statement are disclosed in note 2 to the financial statements.

The Group seeks to minimize the effects of any risk that may occur from any financial transaction. Key aspects are the exposures to liquidity risk, credit risk, interest rate risk and currency risk arising in the normal course of the Group’s business.

The AIXTRON Group’s central management coordinates access to domestic and international financial institutions and monitors and manages the financial risks relating to the operations of the Group through internal risk reports which analyze exposure to risk by likelihood and magnitude. These risks cover all aspects of the business, including financial risks.

Liquidity risk is the risk that the Group is unable to meet its existing or future obligations due to insufficient availability of cash or cash equivalents. Managing liquidity risk is one of

the central tasks of AIXTRON SE. In order to be able to ensure the Group’s solvency and flexibility at all times cash and cash equivalents are projected on the basis of regular financial and liquidity planning.

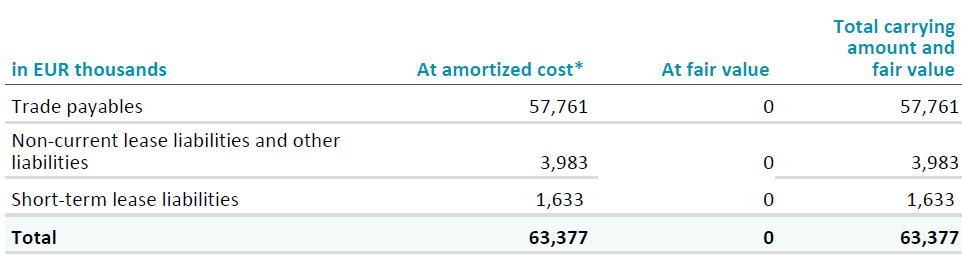

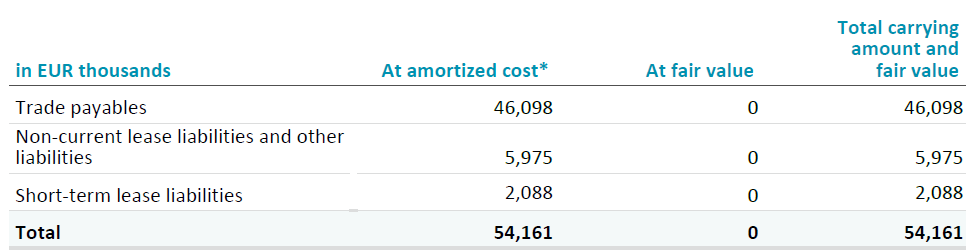

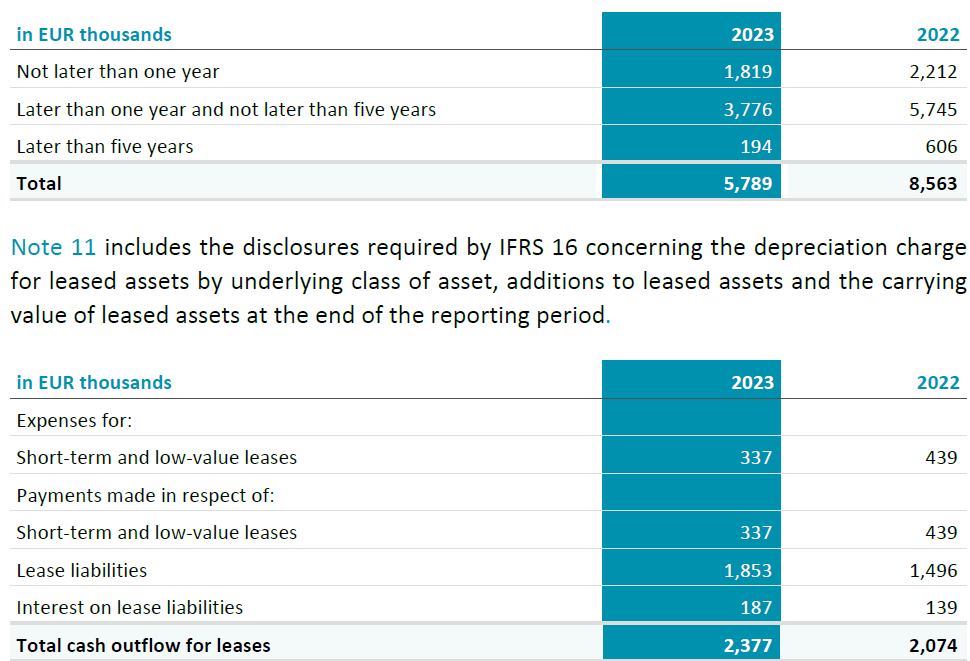

As of December 31, 2023 the Group did not have any borrowings (2022: nil). Financial liabilities, all due within one year, of EUR 63,136 thousand (2022: EUR 52,679 thousand) consisting of trade payables and other liabilities and are shown in note 24, together with an analysis of their maturity. Non-current payables consist of lease liabilities and other payables. Long term lease liabilities of EUR 3,803 thousand (2022: EUR 5,874 thousand) are shown with an analysis of their maturity in note 27. Other non-current payables of EUR 181 thousand (2022: EUR 101 thousand) are due after more than one year.

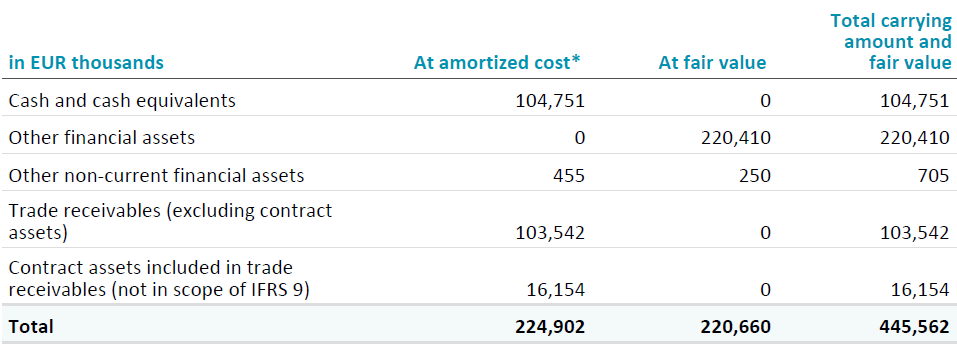

As of December 31, 2023 the Group had EUR 181,928 thousand (2022: EUR 325,411 thousand) of bank deposits and investments as described in notes 13, 17 and 18.

Financial assets generally exposed to a credit risk are trade receivables, financial investments, and cash and cash equivalents.

The Group’s cash and cash equivalents and financial investments are kept with financial institutions that have a good credit standing. Central management of the Group assesses the counter-party risk of each financial institution dealt with and sets limits to the Group’s exposure to those institutions. These credit limits are reviewed from time to time so as to minimize the default risk as far as possible and to ensure that concentrations of risk are managed.

The maximum exposure of the Group to credit risk is the total amount of receivables, financial assets and bank deposits as described in notes 13, 16, 17 and 18.

For contract assets measured at fair value, the maximum amount of the exposure to credit risk is the amount of contract assets measured at fair value as disclosed in note 25. There are no credit derivatives or similar instruments which mitigate the maximum exposure to credit risk and there has been no change during the period or cumulatively in the fair value of such receivables that is attributable to changes in the credit risk.

The Group’s activities expose it to the financial risks of changes in foreign currency exchange rates and interest rate risks. Interest rate risks are not material as the Group only receives a minor amount of interest income. The Group does not use derivative financial instruments to manage its exposure to interest rate risk. Cash deposits are made with the Group’s bankers at the market rates prevailing at inception of the deposit for the period and currency concerned. The Group’s financial investments are made into funds bases in the European Union and are exposed to changes in the market value of those funds. There has been no change to the Group’s exposure to market risk or the manner in which it manages and measures the risk.

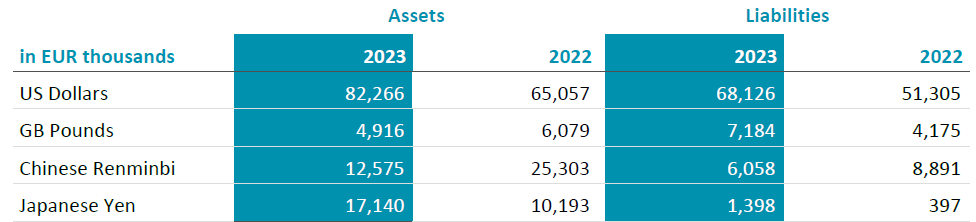

The Group can enter into a variety of derivative financial instruments to manage its exposure to foreign currency risk, including forward exchange contracts to hedge the exchange rate risk arising on the export of equipment. The main exchange rates giving rise to the risk are those between the US Dollar, GB Pound, Chinese Renminbi, Japanese Yen and Euro. No forward exchange contracts were entered into in the fiscal year or in the previous year.

The carrying amounts of the Group’s foreign currency denominated monetary assets and monetary liabilities at the reporting date are as follows:

Exposures are reviewed on a regular basis and are managed by the Group through sensitivity analysis.

The Group's global operations expose it primarily to foreign exchange risks by the US Dollar, GB Pound, Japanese Yen and Chinese Renminbi.

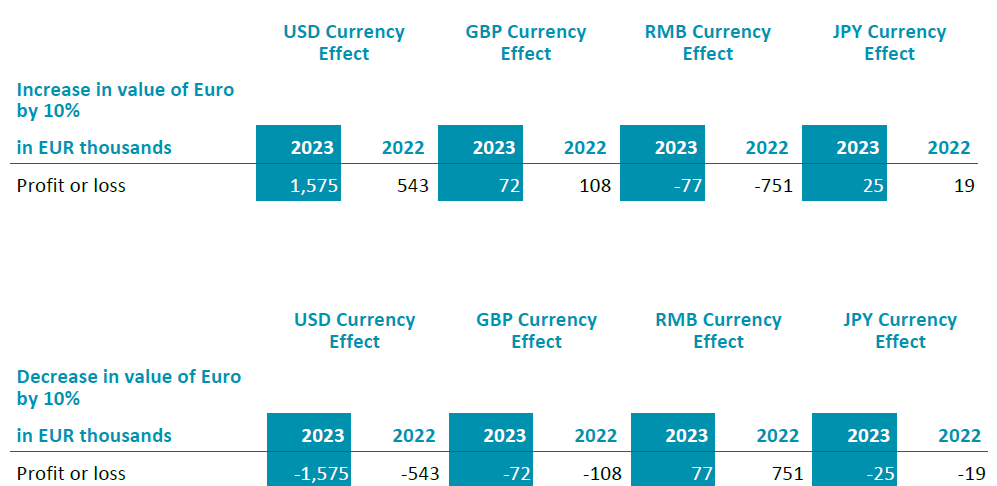

The following table details the Group’s sensitivity to a 10% change in the value of the Euro against the US Dollar, GB Pound, Japanese Yen and Chinese Renminbi. A positive number indicates an increase in profit, a negative number indicates a reduction in profit.

The sensitivity analysis represents the foreign exchange risk at the year-end date only. It is calculated by revaluing the Group's financial assets and liabilities, existing at 31 December, denominated in US Dollars, GB Pounds or Chinese Renminbi by 10%. It does not represent the effect of a 10% change in exchange rates sustained over the whole of the fiscal year, only the effect of a different rate occurring on the last day of the year.

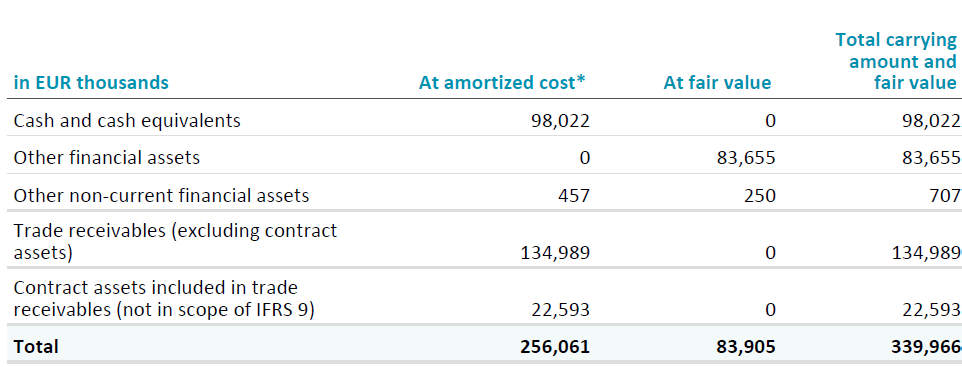

Cash and cash equivalents, receivables are stated at amortized cost. Other financial assets in 2023 and 2022 comprise financial assets measured at FVTPL. Contract assets are outside the scope of IFRS 9.

For trade receivables/payables due within less than one year, measured at amortized cost, the fair value is equivalent to the carrying amount.

*For the financial assets and financial liabilities at amortized cost the carrying amount is a reasonable approximation of fair value.

Contract liabilities for advance payments from customers occur when a contract requires the customer to pay a deposit to the Group and the deposit has actually been paid, typically near the commencement of the contract, or if it reflects an unconditional payment claim. Usually, advance payments are up to 50% of the total contract price.

The Group records the liability as the advance payment is received and eliminates the liability at the same time and up to the same amount as it records revenue until the liability is fully extinguished. Changes in contract liabilities for advance payments in the year reflect the changing level of outstanding customer orders.

Revenues of EUR 93,079 thousand were realized in 2023 from the EUR 141,237 thousand of contract liabilities for advance payments outstanding at the end of 2022. Revenues of EUR 60,821 thousand were realized in 2022 from the EUR 77,041 thousand of contract liabilities for advance payments outstanding at the end of 2021. In 2023 no revenue was recognized from performance obligations that were settled in prior years.

The undiscounted lease liabilities are payable as follows:

The Group has applied paragraph 6 of IFRS 16 when accounting for short-term leases and low-value leases and has expensed these on a straight-line basis. A similar portfolio of short-term leases exists at the reporting date.

The Group leases certain buildings, equipment and vehicles under various leases. Under most of the lease commitments for buildings the Group has options to renew the leasing contracts. The leases typically run for a period between one and ten years. None of the leases include contingent rentals.

AIXTRON is occasionally involved in legal proceedings or can be exposed to a threat of legal proceedings in the normal course of business. The Executive Board regularly analyses these matters, considering any possibilities of avoiding legal proceedings or of covering potential damages under insurance contracts and has recognized, where required, appropriate provisions. It is not expected that such matters will have a material effect on the Group’s net assets, results of operations and financial position.

The related parties of AIXTRON SE are the fully consolidated subsidiaries according to note 31.

Related parties of the Group are members of the Executive Board and members of the Supervisory Board and their close relatives.

SBG Beteiligung GmbH is also a related party because the company is controlled by a related person of AIXTRON SE. There were no transactions with AIXTRON in the fiscal year or in the previous year.

The disclosures of key management personnel compensation are as follows:

Share-based payments refer to the fair value of share options at grant date and includes that portion of bonus agreements which is settled in shares. The number of shares granted and their fair value at the time they were granted can be found in Note 22.

Individual amounts and further details regarding the remuneration of the members of the Executive Board and Supervisory Board are disclosed in the Remuneration Report.

AIXTRON SE controls the following subsidiaries:

There are no events which have occurred after the balance sheet date, of which the directors have knowledge, which would result in a different assessment of the Group’s net assets, results of operation and financial position.

Fees expensed in the income statement for the services of the Group auditor, KPMG AG Wirtschaftsprüfungsgesellschaft are as follows:

The fees for other confirmation services in the current and previous year include fees for audits of the non-financial Group report. In the current financial year, the fees for other confirmation services include EUR 107 thousand relating to the previous financial year.

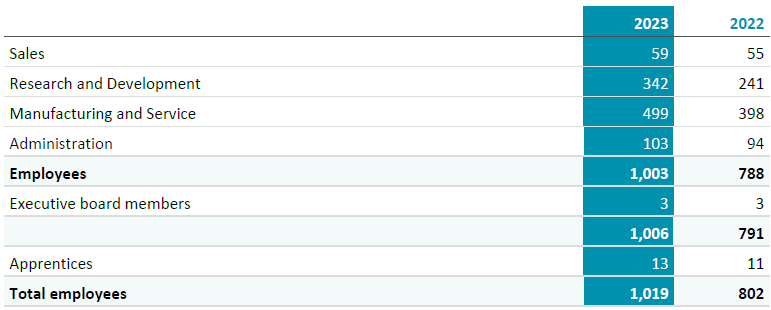

Compared to last year, the average number of employees during the current year was as follows:

Chairman of the Supervisory Board since 2002 until February 28, 2017 and since September 1, 2017

Entrepreneur

Vice Chairman of the Supervisory Board since 2019 Entrepreneur

Member of the Supervisory Board since 2013 Entrepreneur

Membership of Supervisory Boards and Controlling Bodies:

Member of the Supervisory Board since 2011

Professor of Energy Economics

Membership of Supervisory Boards and Controlling Bodies:

Member of the Supervisory Board since 2019

Professor for Economics esp. External Financial Accounting

German Public Auditor (Wirtschaftsprueferin), German Tax Advisor (Steuerberaterin)

Membership of Supervisory Boards and Controlling Bodies:

Member of the Supervisory Board since May 25, 2022 Chairman of Executive Board, JENOPTIK AG

Membership of Supervisory Boards and Controlling Bodies:

The composition of the Company’s Executive Board in 2023 is:

Aachen, Chairman of the Executive Board and Chief Executive Officer (CEO), member of the Executive Board since 2017

Cologne, member of the Executive Board and Chief Financial Officer (CFO), member of the Executive Board since 2021

Aachen, member of the Executive Board and Chief Operating Officer (COO), member of the Executive Board until September 30, 2023

The preparation of AIXTRON’s Consolidated Financial Statements requires management to make certain estimates, judgments, and assumptions that the Group believes are reasonable based upon the information available. These estimates and assumptions affect the reported amounts and related disclosures and are made in order to fairly present the Group’s financial position and results of operations. The following accounting policies are significantly impacted by these estimates and judgments that AIXTRON believes are the most critical to aid in fully understanding and evaluating its reported financial results:

Revenue for the supply of most equipment to customers is generally recognized in two stages, partly on delivery and partly on final installation and acceptance (see note 2 (N)). When allocating the transaction price to the two performance obligations, delivery of the tool and installation of the tool, assumptions are made regarding individual margins as part of the cost-plus method. The Group believes, based on past experience, that this method of recognizing revenue fairly states the revenues of the Group. For the reporting periods 2023 and 2022, 10% of the installation revenue was allocated to installation performance.

The judgements made by management include an assessment of the point at which control has passed to the customer.

Inventories are stated at the lower of cost and net realizable value. This requires the Group to make judgments concerning obsolescence of materials. This evaluation requires estimates, including both forecasted product demand and pricing environment, both of which may be susceptible to significant change. The carrying amount of inventories and details on impairment losses and reversals of impairment losses in the fiscal year are disclosed in notes 3 and 15. In future periods, impairment losses may be necessary due to various factors such as decreasing product demand or technological obsolescence. These factors could result in adjustment to the valuation of inventory in future periods, and significantly impact the Group’s future operating results.

At each balance sheet date, the Group assesses whether the realization of future tax benefits is sufficiently probable to recognize deferred tax assets. This assessment requires the exercise of judgement on the part of management with respect to future taxable income. The parent company AIXTRON SE does generally not exceed a planning horizon of twelve months. The recorded amount of total deferred tax assets could be reduced or increased if estimates of projected future taxable income are lowered or increased, or if changes in current tax regulations are enacted that impose restrictions on the timing or extent of the Group’s ability to utilize future tax benefits. The carrying amount of deferred tax assets is disclosed in note 14.

Provisions are liabilities of uncertain timing or amount. At each balance sheet date, the Group assesses the valuation of the liabilities which have been recorded as provisions and adjusts them if necessary. Because of the uncertain nature of the timing or amounts of provisions, judgement has to be exercised by the Group with respect to their valuation. Actual liabilities may differ from the estimated amounts. Details of provisions are shown in note 23.

In the normal course of business, the Group is subject to various legal proceedings and claims. The Company, based upon advice from legal counsel, believes that the matters the Group is aware of are not likely to have a material adverse effect on its financial condition or results of operations. The Group is not aware of any unasserted claims that may have a material adverse effect on its financial condition or results of operation.

The global impact of the Russia/Ukraine conflict on business operations is explained in the combined management report. The impact on the 2023 consolidated financial statements is immaterial and it is also expected that the impact on fiscal year 2024 will be immaterial. Climate risks also did not have a material impact on the business operations of AIXTRON.

The current Declaration of Conformity according to section 161 German Stock Corporation Act (“Aktiengesetz”), which was adopted by the Executive Board and the Supervisory Board in February 2024, is permanently available on AIXTRON's website under Investors/Corporate Governance.

Herzogenrath, February 26, 2024

AIXTRON SE

Executive Board

Dr. Felix Grawert Dr. Christian Danninger

Chairman Member

Alan Tai

Taiwan/Singapore

Christof Sommerhalter

USA

Christian Geng

Europe

Hisatoshi Hagiwara

Japan

Nam Kyu Lee

South Korea

Wei (William) Song

China

AIXTRON SE (Headquarters)

AIXTRON 24/7 Technical Support Line

AIXTRON Europe

AIXTRON Ltd (UK)

AIXTRON K.K. (Japan)

AIXTRON Korea Co., Ltd.

AIXTRON Taiwan Co., Ltd. (Main Office)

AIXTRON Inc. (USA)

Christoph Pütz

Senior Manager ESG & Sustainability

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Ralf Penner

Senior IR Manager

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Prof. Dr. Michael Heuken

Vice President Advanced Technologies