- / HOME

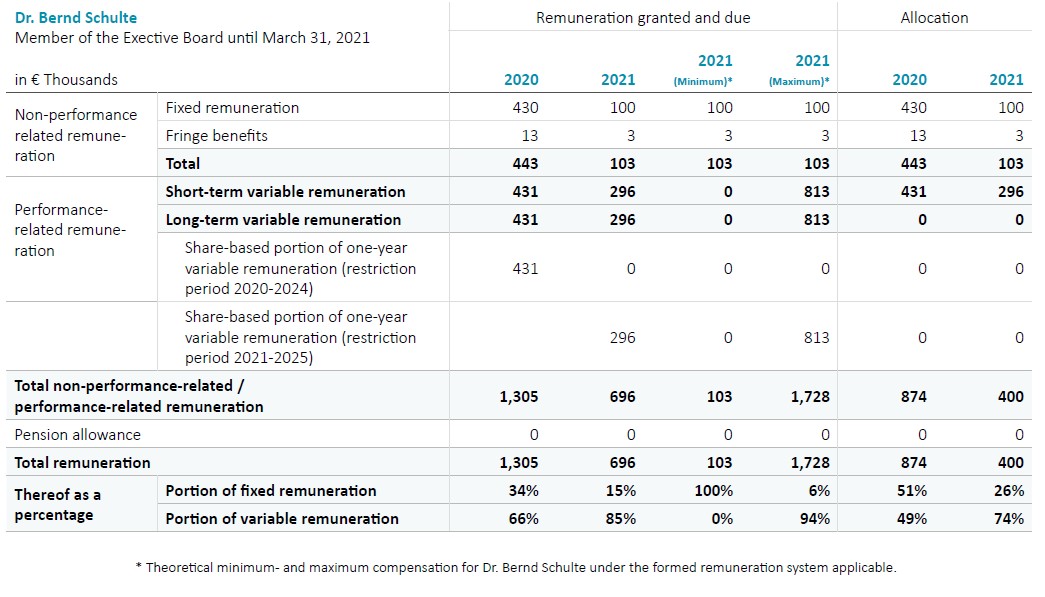

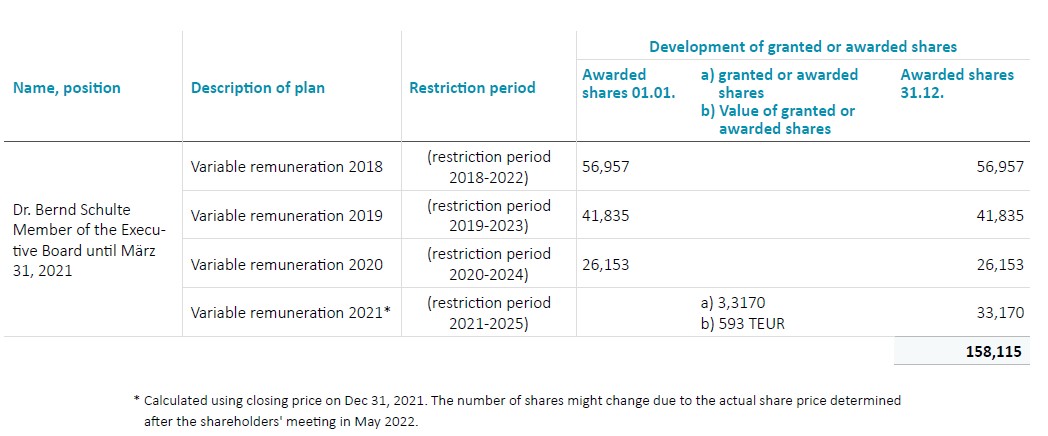

With the approval of the Annual General Meeting on May 20, 2020, a new compensation system ("new compensation system") for the Executive Board of AIXTRON SE was introduced. Since then, this has been applied to all new contracts of the Executive Board of the Company. For existing legacy contracts of the Executive Board, the previous compensation system approved by the regular general shareholders meeting on May 16, 2018 ("previous compensation system") continued to be applied. In the reporting year, the previous remuneration system was applied for the last time for Executive Board member Dr. Bernd Schulte until his resignation on March 31, 2021. A detailed description of the previous remuneration system is available in the Annual Report 2020.

The following remuneration report describes the main features of the new remuneration system and explains the amount and structure of the remuneration of the Executive Board as well as the remuneration of the Supervisory Board of AIXTRON SE for fiscal year 2021 in accordance with the articles of association. The remuneration of the individual members of the Executive Board and the Supervisory Board is disclosed individually in the remuneration report. The compensation report complies with the disclosure requirements under German stock corporation law pursuant to §162 AktG. In addition, the remuneration report is based in particular on the recommendations of the German Corporate Governance Code (DCGK) and the requirements of the German Stock Corporation Act (AktG).

The new remuneration system of the Executive Board of AIXTRON SE introduced in fiscal year 2020 is in line with the content requirements of ARUGII and is based on the recommendations of the new German Corporate Governance Code (DCGK 2020) which came into force on March 20, 2020.

The new remuneration system was applied to new Executive Board employment contracts in fiscal year 2021 as follows:

Executive Board remuneration at AIXTRON SE is structured in a way that creates incentives for the sustainable, long-term development of the Company and for the long-term commitment of Executive Board members.

The Supervisory Board sets the specific remuneration for each Executive Board member on the basis of the remuneration system. To the extent legally permissible, the Supervisory Board seeks to offer Executive Board members remuneration that is both in line with the market and competitive, also in order to be able to recruit outstanding individuals to AIXTRON SE and gain their long-term commitment.

Based on the remuneration system, the Supervisory Board sets target total remuneration for each individual Executive Board member for the forthcoming fiscal year. This consists of three components:

Fixed remuneration consists of fixed, non-performance-related base remuneration, which is paid out as a monthly salary. Other components of fixed remuneration include fringe benefits, such as the provision of a Company car, allowances for individual private pensions, and the assumption of costs for other insurance policies.

Variable remuneration is tied to the performance of the AIXTRON Group and consists of short-term variable remuneration (STI) and long-term variable remuneration (LTI). The amount of both components depends on the achievement of financial and non-financial performance indicators.

The short-term performance-related remuneration, also referred to as the short-term incentive (STI), is geared to the performance of the AIXTRON Group in the given fiscal year and is paid out in full in cash.

The STI is determined using the indicators consolidated net income for the year, the market position of the AIXTRON Group, as well as financial and operational targets. In this regard, the relative weighting amounts to 70% for consolidated net income for the year, 15% for market position, and 15% for financial and operational targets.

The targets are set prior to the start of a fiscal year: The Supervisory Board establishes the STI‘s target value and the targets based on the aforementioned indicators. In the event of 100% target achievement, the individual target STI of the Executive Board members varies from 1.1% to 1.75% of the consolidated net income for the year pursuant to the budget approved by the Supervisory Board for the fiscal year.

STI target achievement is determined after the expiry of the fiscal year. This is capped at a maximum of 250% target achievement. No STI is paid if the consolidated net income for the year is negative, i.e. in years in which the Company posts a loss. STI is paid out in cash after the Supervisory Board has approved the consolidated financial statements.

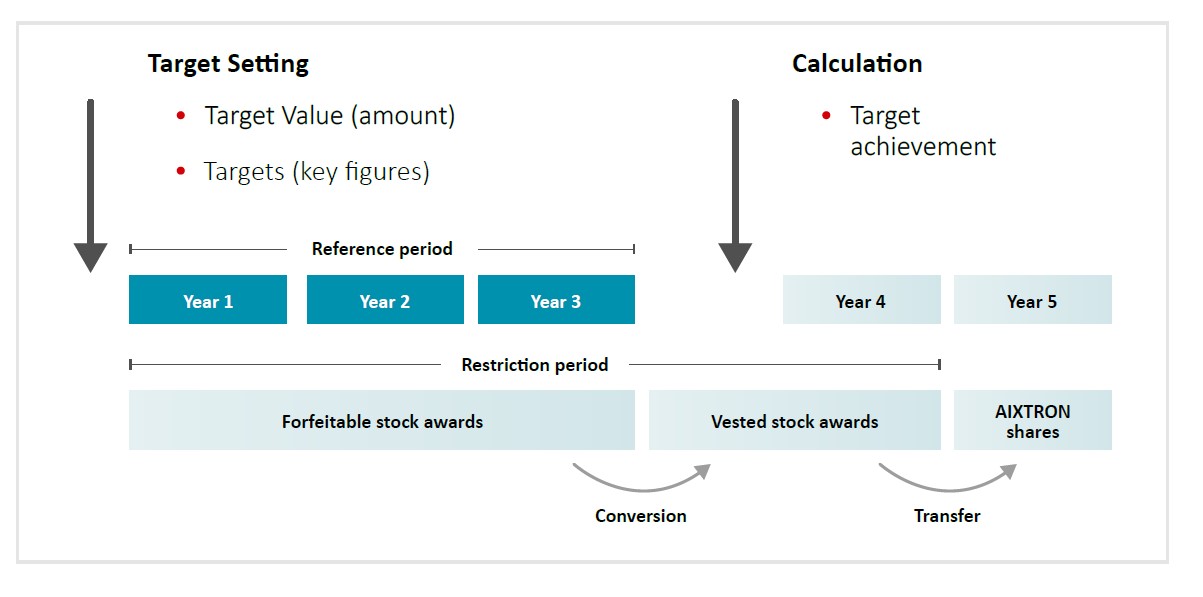

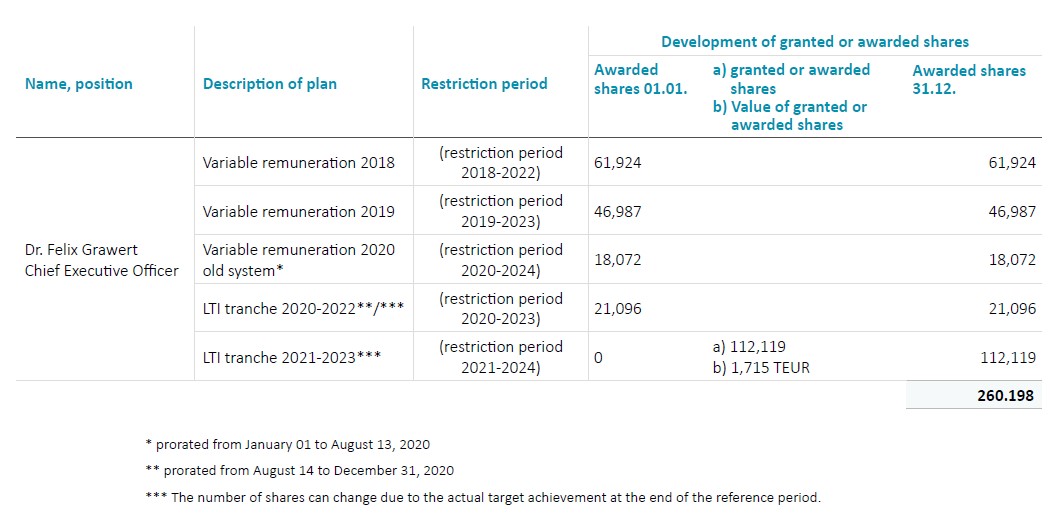

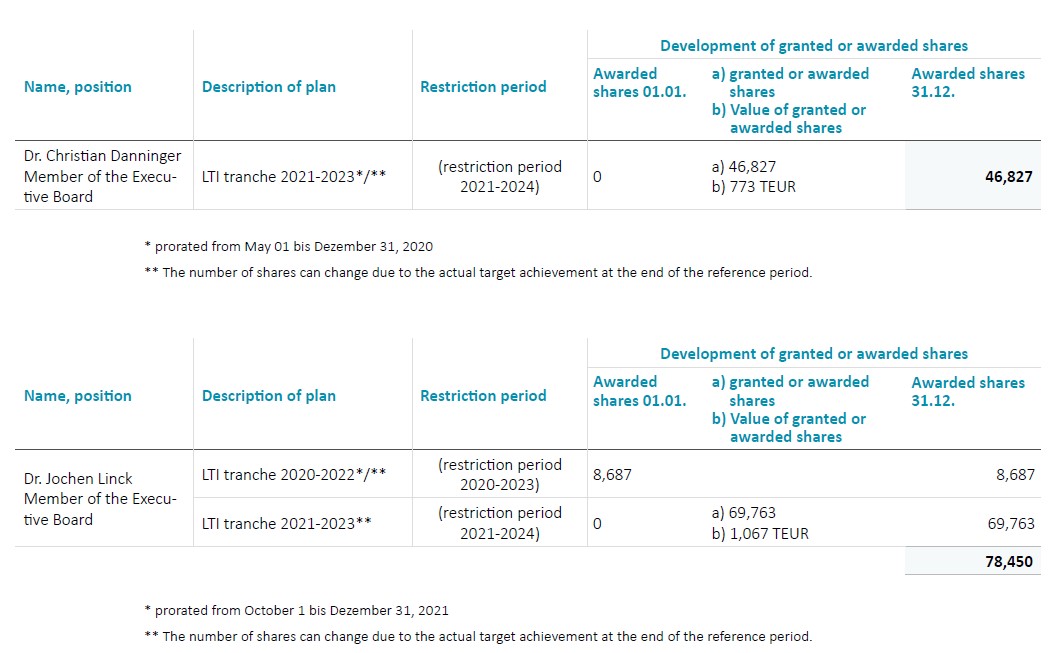

The amount of long-term performance-related remuneration, also referred to as the long-term incentive (LTI), is geared to the performance of the AIXTRON Group over a 3-year reference period and is granted entirely in AIXTRON shares. Executive Board members may first dispose of these shares following a four-year holding period calculated from the start of the reference period.

Before the start of a fiscal year, the Supervisory Board determines the long-term targets for each Executive Board member for the forthcoming reference period. Each Executive Board member receives forfeitable stock awards in the amount of the target LTI, which varies from 1.4% to 2.25% of the consolidated net income for the year pursuant to the budget adopted by the Supervisory Board for the fiscal year. The number of forfeitable stock awards is calculated based on the average of the closing prices on all stock market trading days in the final quarter of the previous year. If consolidated net income for the year is budgeted to be zero or negative, and if a return to profitability is expected during the reference period, the Supervisory Board may within reasonable limits specify a LTI value for the fiscal year.

LTI target achievement is determined using the indicators consolidated net income for the year and total shareholder return (TSR), as well as sustainability targets. In this regard, the relative weighting amounts to 50% for consolidated net income for the year, 40% for TSR, and 10% for sustainability targets.

For the first LTI key figure, the consolidated net income for the year, before the start of each fiscal year the Supervisory Board sets a target value that the aggregate consolidated net incomes for must achieve during the reference period. After the reference period ends, the ratio of the actual value to the target value is calculated. If the two values are identical, target achievement amounts to 100%. Target achievement is capped at a maximum of 250%. If the ratio is zero or negative, target achievement amounts to 0%. A linear interpolation takes place between the values of 0% and 250%.

The second LTI key figure, the TSR, denotes the total shareholder return over the reference period and is calculated as the ratio of the change in the stock price, plus paid dividends, at the end of the reference period to the value at the start of the reference period. The TSR for AIXTRON stock is determined by the weighted TSR for a comparative group, which consists of the shares of six semiconductor equipment manufacturers – Veeco Instruments, Applied Materials, Tokyo Electron, Lam Research, ASML, and ASMI – and is weighted in proportion to their market capitalization. Changes in the share prices are determined by reference to the difference between the average values of the closing prices on all stock market trading days in the final quarter before the start of the reference period and in the final quarter of the reference period. After the reference period ends, the ratio of the development in the TSR for AIXTRON shares to the development in the TSR for the comparative group is calculated. Target achievement is capped at a maximum of 250% and amounts to 0% if the ratio is less than 50%. A linear interpolation takes place between these values. If during the period under consideration the enterprises in the comparative group experience extraordinary changes (such as mergers, changes in business activities, etc.), the Supervisory Board may take this appropriately into consideration with regard to the composition of the comparative group. In such case, the Supervisory Board will report on this in the annual remuneration report.

The third LTI key figure is calculated by reference to sustainability targets set by the Supervisory Board at the start of each reference period. These targets refer to the areas of environment, social affairs, and good corporate governance. Target achievement corresponds to the ratio of the actual values to the target values and is capped at 250%. Before the start of each fiscal year, the Supervisory Board sets two to three sustainability targets that are to be achieved by the end of the reference period. The sustainability targets that the Supervisory Board may choose from before the start of a fiscal year when setting targets for the respective Executive Board member include, among others: efficient use of energy and raw materials, reduction of emissions, employee satisfaction and development, customer satisfaction, innovation achievements, successor planning, and compliance.

After the expiry of the three-year reference period, the degree of LTI target achievement is determined by the Supervisory Board. Depending on the degree of target achievement, the forfeitable stock awards are then converted into vested stock awards or otherwise lapse. The maximum number of vested stock awards that may be granted in connection with LTI is capped at 250% of the number of forfeitable stock awards granted at the start of the reference period.

Following expiry of the four-year restriction period, the shares are transferred to the Executive Board member, with due compliance with the maximum remuneration limits set out below. The Executive Board member is not entitled to receive dividends during the restriction period.

The remuneration system is intended to provide appropriate rewards for successful Executive Board work and to ensure that the Executive Board and shareholders all benefit from the Company‘s positive development. At the same time, to prevent the taking of inappropriate risks and ensure an appropriate relation to the situation of AIXTRON Group, Executive Board remuneration is limited by setting maximum remuneration and a remuneration cap.

Maximum remuneration (expenditure cap) is the total remuneration owed to the Executive Board for a fiscal year. It may not exceed EUR 6.5 million in the case of two Executive Board members or EUR 10.0 million in the case of three or more Executive Board members. This also represents the expenditure cap, i.e. the maximum expense for the Company.

There is also a remuneration cap (allocation cap) for the aggregate of fixed remuneration, STI, and LTI. The actual allocation for each Executive Board member for a fiscal year is capped at four times the Executive Board member’s target total remuneration. This is the allocation cap. If the remuneration cap is exceeded, a portion of the vested stock awards previously awarded is forfeited to ensure compliance.

Fixed remuneration will generally account for 20% to 40% of target total remuneration, while variable remuneration will make up 60% to 80%. Long-term remuneration will account for a greater share of remuneration in order to provide incentives for long-term and sustainable actions. No additional remuneration is paid for group-internal mandates, such as at subsidiaries.

To ensure that the interests of the Executive Board are aligned with those of shareholders, the Company has a stockholding policy. Following a four-year build-up phase, each Executive Board member is obliged to hold AIXTRON stock worth 100% of their base remuneration on a permanent basis throughout their term of office. The value of vested stock awards is set off against the respective target shareholding value. Executive Board members may sell shares only if they exceed the respective target value.

Furthermore, a sanctioning mechanism, i. e. claw-back provision, applies for breaches of duty or compliance. Based on this mechanism, in the event of such breaches the Supervisory Board may reduce variable remuneration components not yet paid out, allow stock awards to lapse, or even claw these back. These possibilities may be exercised even when the Executive Board member is no longer in office and is no longer employed by the Company.

In justified exceptional circumstances, such as severe economic crises, the effects of which render the original Company targets invalid, the Supervisory Board may resolve a temporary divergence from the remuneration system if such divergence is in the interests of AIXTRON SE. As a general rule, the targets and target values do not change during the periods relevant for the respective target achievement, even if developments in the overall market are unfavorable.

A detailed description of the new Executive Board remuneration system adopted by the Annual General Meeting on May 20, 2020 can be found on AIXTRON‘s website at https://www.aixtron.com/en/investors/corporate-governance/remuneration-policy.

The Supervisory Board reviews the appropriateness of the various components of remuneration on an annual basis. The remuneration system is presented to the Annual General Meeting for approval in the event of any material changes to the system and at least every four years.

For the purposes of external comparison, the Supervisory Board refers to remuneration data at the semiconductor equipment manufacturers Veeco Instruments, Applied Materials, Lam Research, ASML, and ASMI, as well as to those companies listed in the TecDAX that have market capitalizations between 50% and 200% of that at AIXTRON SE.

For the internal comparison, the Supervisory Board defines the senior management level as the ten senior managers whose remuneration is not tied to collective bargaining agreements and who have the greatest managerial responsibility and decision-making powers.

The Executive Board and the Supervisory Board prepare a remuneration report each year in accordance with statutory provisions. For the fiscal year 2021, a remuneration report in accordance with Section 162 of the German Stock Corporation Act (AktG) as amended by ARUG II is presented for the first time. This report explains which performance criteria were applied and how the respective amounts of the variable compensation components were calculated.

The remuneration report for the past fiscal year contains an outlook on the application of the remuneration system in the current fiscal year. This outlook reports in advance on the selection of the financial and non-financial performance criteria. However, the non-financial performance criteria, as well as the specific targets for the financial indicators, are not explained in detail until after the end of the relevant periods for STI and/or LTI in order not to disclose competition-relevant strategic plans in advance.

Should a contract with an Executive Board member be terminated, then the outstanding variable remuneration components attributable to the time through to termination of the contract will be paid out in accordance with the originally agreed targets and comparison parameters and with the due dates or holding periods specified in the contract. If an Executive Board contract ends during a fiscal year, STI and LTI are granted on a prorated basis relative to the length of service in this fiscal year.

The foregoing does not apply to cases in which the employment contract is terminated without notice for cause inherent in the Executive Board member for which he or she is responsible. In such case, variable remuneration will not be paid for the year in which termination becomes effective.

In the case of premature termination of the Executive Board mandate by reason of revocation of the appointment, the Executive Board member will be paid a severance equal to the remuneration expected to be owed by the Company for the remaining term of the employment contract, but not more than two years of remuneration (severance cap).

When agreeing employment contracts with Executive Board members, the Supervisory Board may stipulate that, in the event of the contract being terminated due to a “change-of-control” event, severance will be paid in the aforementioned maximum amount. A change-of-control event in the foregoing sense exists where a third party, or a group of third parties who combine their shareholding by contract in order to act as a single third party, directly or indirectly holds more than 50% of the Company’s share capital.

No benefits in excess of this severance payment are permitted.

In the event of premature termination of the Executive Board mandate based on mutual agreement to end the employment contract, the total value of benefits pledged by the Company to the Executive Board member in connection with such agreement may not exceed the amount of remuneration expected to be owed by the Company for the original remaining term of the employment contract and may not exceed a maximum of two annual remuneration packages.

In fiscal year 2021, exclusively the new remuneration system described above was applied for the members of the Executive Board of AIXTRON SE with the exception of Dr. Bernd Schulte, whose legacy contract expired on March 31, 2021. The following section specifies the concrete Executive Board remuneration for the reporting year and contains detailed information and background on the total Executive Board remuneration, the target setting and target achievement of the variable remuneration as well as individualized information on the remuneration of the individual Executive Board members for fiscal year 2021.

The total remuneration of the Executive Board for the financial year 2021 amounted to kEUR 8,437 (2020: kEUR 2,956). The non-performance-related fixed remuneration of the Executive Board for the fiscal year 2021, consisting of a basic remuneration, pension allowances and benefits in kind, totaled kEUR 1,106 (2020: kEUR 912).

Base remuneration comprised the following amounts in fiscal year 2021:

The Executive Board members in office in the year under report do not have individual pension commitments, as a result of which no provisions are stated for pensions. The Company rather pays pension allowances to Executive Board members together with their salaries or makes contributions to an insurance contract with a pension fund.

Pension allowances form a constituent component of the non-performance-related fixed remuneration of the Executive Board. They comprised the following amounts in fiscal year 2021:

The former remuneration system was applied in 2021 to determine the variable remuneration for Dr. Bernd Schulte from January 01, 2021, to March 31, 2021. The variable remuneration under the former remuneration system amounts to 2.5% of consolidated net income per Executive Board member on a pro rata basis and is paid half in cash and half in shares. This results in variable remuneration for 2021 under the previous remuneration system:

The new remuneration system was applied in 2021 to determine the short-term variable remuneration for Dr. Felix Grawert, Dr. Christian Danninger and Dr. Jochen Linck.

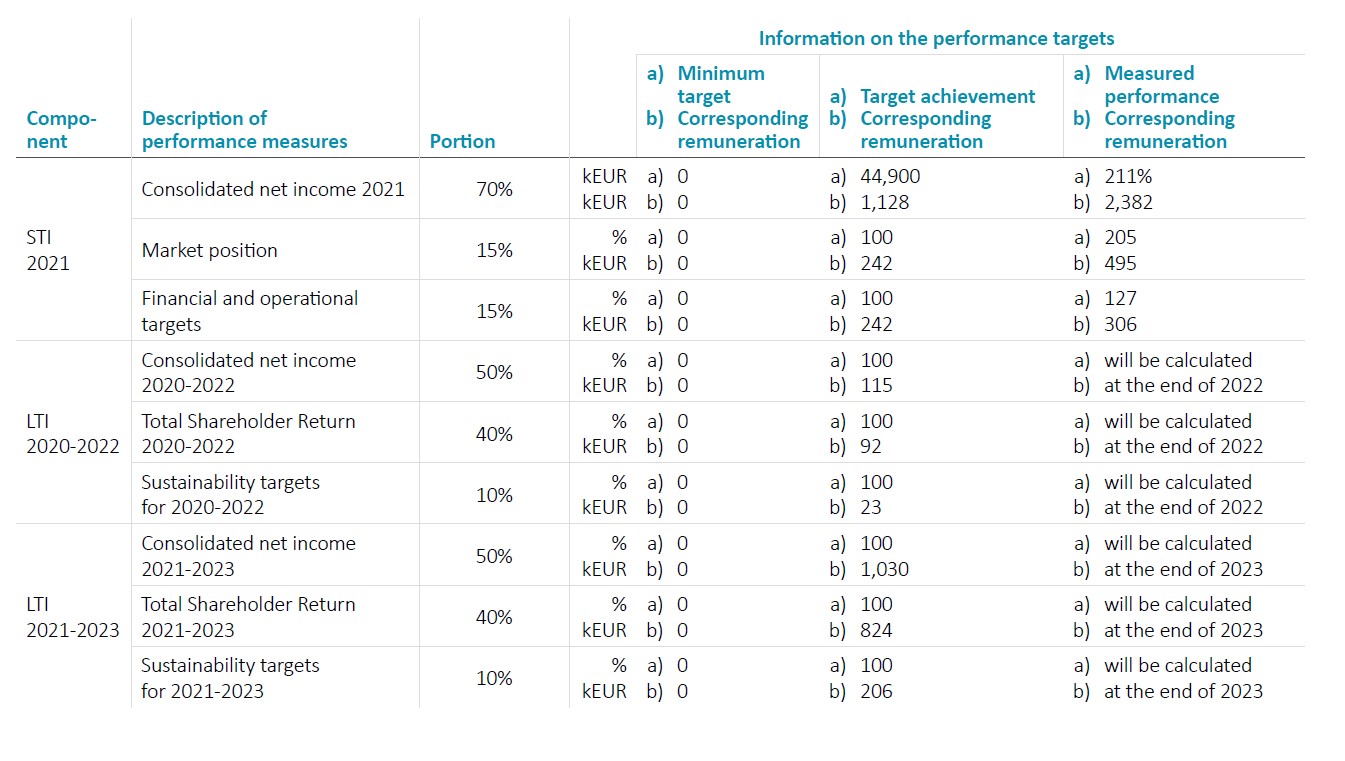

At its meeting on December 09, 2020, the Supervisory Board set a target of kEUR 44,900 for consolidated net income in 2021 (70% of total target). The actual figure of kEUR 94,839 results in a target achievement of 211%.

For the target dimension "market position" (15% of total target), the Supervisory Board set targets for individual market segments for 2021. Good sales performance in the existing markets and success in the growth markets led to a target achievement of 205%.

For the target dimension "Financial and operational targets" (15% of total target), performance criteria were defined in the area of operational performance, the market launch of new products, and for the OLED business unit. Here, target achievement in the past fiscal year was 127%.

Based on the achievement of these three target dimensions, short-term variable remuneration (STI) is calculated for fiscal year 2021 under the new remuneration system as follows:

In 2021, the new remuneration system was applied to the contracts with Dr. Felix Grawert, Dr. Christian Danninger (since May 1, 2021) and Dr. Jochen Linck. Target achievement for the 2021 LTI tranche is calculated by reference to the results achieved in the period from January 1, 2021, to December 31, 2023. It is determined by the following performance criteria:

The relevant AIXTRON SE share price for the TSR target remuneration 2021 is EUR 11.582. It corresponds to the average of the XETRA closing prices on all stock exchange trading days in Q4 2020. The degree of achievement of the performance criteria will be determined by the Supervisory Board after the end of fiscal year 2023. At that time, the vested share awards will be converted into non-forfeitable share awards depending on target achievement. After the expiry of a 4-year vesting period ending on December 31, 2024, for the fiscal year 2021, one share of the Company will be transferred for each vested share award. This is to take place in the week following the publication of the annual report.

For the long-term variable remuneration (LTI) for 2021, the Supervisory Board stipulated the values of target LTI as follows:

In 2021, there were no deviations from and no adjustments to the remuneration system compared with the AGM resolution on the remuneration system in May 2020.

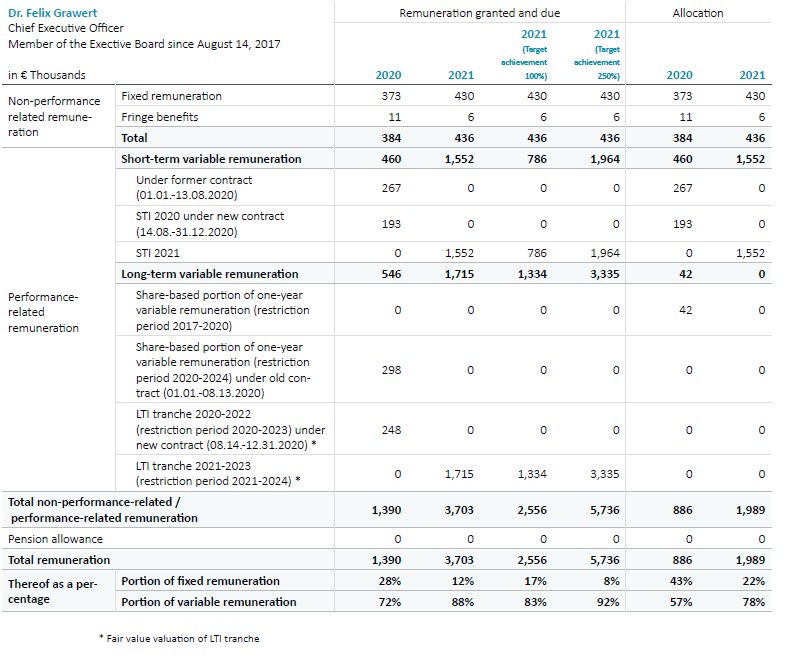

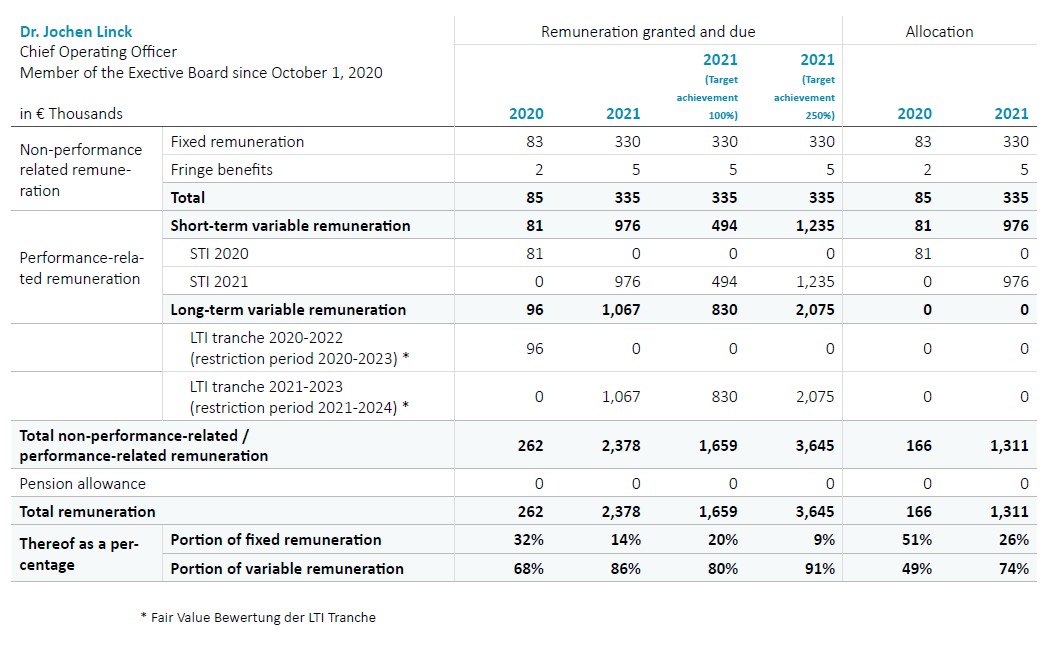

The following tables show the remuneration granted and due to the active members of the Executive Board in each of the fiscal years 2020 and 2021 in accordance with Section 162 (1) sentence 1 AktG. The "Remuneration granted and due" section of the tables thus contains all amounts actually received by the individual Executive Board members in the reporting period ("remuneration granted") and all remuneration legally due but not yet received in the reporting period ("remuneration due"). In addition, the individual possible minimum and maximum remuneration values for the 2021 fiscal year are shown here.

Furthermore, in line with the DCGK 2020, the tables show the fixed remuneration and the one-year variable remuneration as an inflow for the respective financial year. For subscription rights and other share-based remuneration, the time and value of the inflow is the relevant time and value under German tax law.

In addition to the remuneration amounts, Section 162 (1) sentence 2 no. 1 AktG also requires the disclosure of the relative share of all fixed and variable remuneration components in total remuneration. The relative proportions stated here at the end of each table relate to the remuneration components granted and due in the respective fiscal year in accordance with Section 162 (1) sentence 1 AktG.

In total, the remuneration of the Executive Board ("remuneration granted and due") for fiscal year 2021 amounted to kEUR 8,437 (fiscal year 2020: kEUR 2,956) and was thus below the maximum remuneration (expense cap) for three Executive Board members of kEUR 10,000.

Apart from the provisions regarding the termination of an Executive Board member's contract (page 50 ), there are no other contractually agreed benefits that would apply if an Executive Board member were to leave the Company, such as retirement benefits, the further use of a company car or office, or the continued payment of other benefits.

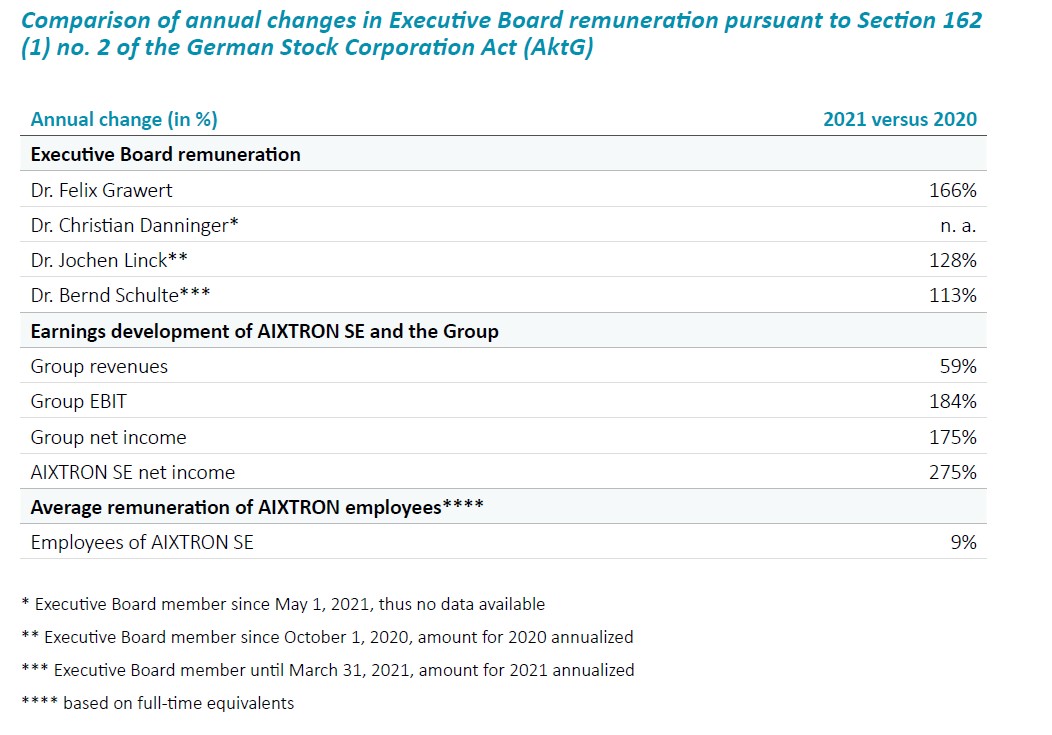

The following table shows a comparison of the percentage change in the remuneration of the members of the Executive Board with the earnings development of AIXTRON SE and the AIXTRON Group as well as with the average remuneration of the employees on a full-time equivalent basis compared to the previous year. The remuneration of the members of the Executive Board included in the table reflects the remuneration granted and due to the respective Executive Board members in the reporting year and thus corresponds to the value stated in the preceding remuneration tables in the column "Remuneration granted and due" for the fiscal years 2020 and 2021 within the meaning of Section 162 (1) sentence 1 AktG (on page 56 -58 of the Annual Report). Where members of the Executive Board were only remunerated on a pro rata basis in individual financial years, for example due to joining or leaving the company during the year, the remuneration for this fiscal year was extrapolated to a full year to ensure comparability.

The development of earnings is generally presented on the basis of the development of the annual result of AIXTRON SE in accordance with Section 275 (3) No. 16 HGB (German Commercial Code). Since the remuneration of the members of the Executive Board is also significantly dependent on the business success of the AIXTRON Group, the development of the revenues, the EBIT and the net income for the year is also stated for the Group.

The comparison with the development of the average remuneration of employees is based on the average remuneration of the workforce of the Group parent company AIXTRON SE in Germany. Since the employee and remuneration structures in the subsidiaries are manifold, in particular in the case of employees abroad, it is appropriate for the comparison of the development of the average remuneration to be based only on the total workforce of AIXTRON SE. This comparison group was also used in the examination of the appropriateness of the remuneration of the members of the Executive Board. In this context, the remuneration of all employees of AIXTRON SE, including executive employees and excluding student assistants, was taken into account. In order to ensure comparability, the remuneration of part-time employees was extrapolated to full-time equivalents.

Stock options are neither components of the "former remuneration system" nor of the "new remuneration system" described above. Therefore, Dr. Felix Grawert, Dr. Christian Danninger and Dr. Jochen Linck do not hold any stock options. Regarding periods prior to the applicability of the remuneration systems described herein, Dr. Bernd Schulte holds a stock position of 50,000 stock options as of December 31, 2021.

In fiscal year 2021, 50,000 option rights to purchase AIXTRON shares expired (2020: 52,000). The members of the Executive Board in office in the reporting year 2021 did not exercise any option rights in 2021 (2020: 0).

There was no claw-back of variable compensation components of the Executive Board members in fiscal year 2021 (claw-back clause).

Short-term variable remuneration (STI)

FFor the current fiscal year 2022, the Supervisory Board has defined the following target dimensions and performance criteria for the short-term variable remuneration (STI):

The Supervisory Board has defined the following performance criteria for the reference period for long-term variable remuneration (LTI) starting in fiscal year 2022:

The target achievement of the LTI remuneration 2022 is calculated on the basis of the results achieved in the period from January 1, 2022, to December 31, 2024. The relevant share price of AIXTRON SE for the LTI grant is EUR 19.64. It corresponds to the average of the XETRA closing prices on all stock exchange trading days in the 4th quarter of 2021. The degree of fulfillment of the performance criteria will be determined by the Supervisory Board after the end of fiscal year 2024. At that time, the vested share awards will be converted into non-forfeitable share awards depending on target achievement. After the expiry of a 4-year vesting period ending on December 31, 2025 for the fiscal year 2022, one share of the Company will be transferred for each vested share award. This is to take place in the week following the publication of the annual report.

Remuneration of the Supervisory Board is regulated in Article 17 of AIXTRON’s Articles of Association. The currently valid remuneration system was last approved by the Annual General Meeting on May 16, 2018. Accordingly, annual fixed remuneration for individual members of the Supervisory Board amounts to EUR 60,000, with the Chairman receiving three times and the Deputy Chairman one and a half times the remuneration of an ordinary Supervisory Board member.

The Chairman of the Audit Committee receives additional annual remuneration of EUR 20,000.

No attendance fees or other variable remuneration is granted.

The members of the Supervisory Board who are only members of the Supervisory Board for part of the fiscal year or who are the Chairman or Deputy Chairman of the Supervisory Board or Audit Committee receive one twelfth of the above mentioned remuneration on a prorated basis for each month or part thereof of the corresponding activity on the Supervisory Board.

The Company assumes insurance premiums paid for liability and legal expenses insurance to cover liability risks arising from Supervisory Board activities for the members of the Supervisory Board, as well as the insurance tax payable thereon.

The Supervisory Board members receive no loans from the Company.

The remuneration allocable to individual Supervisory Board members in fiscal years 2020 and 2021 is presented on an individualized basis in the table below. As in previous years, no remuneration was paid to Supervisory Board members for individual advisory services in fiscal year 2021.

In accordance with the requirements of Section 93 para. 2 AktG, AIXTRON SE has arranged a D&O insurance policy for all members of the Executive Board against risks from their professional activities for the Company, which in each case provides for a deductible of at least 10 percent of the damage up to at least the amount of one and a half times the fixed annual remuneration of the Executive Board member. For the members of the Supervisory Board of AIXTRON SE, the Company has arranged D&O insurance policies which also provide for a corresponding deductible.

Alan Tai

Taiwan/Singapore

Christof Sommerhalter

USA

Christian Geng

Europe

Hisatoshi Hagiwara

Japan

Nam Kyu Lee

South Korea

Wei (William) Song

China

AIXTRON SE (Headquarters)

AIXTRON 24/7 Technical Support Line

AIXTRON Europe

AIXTRON Ltd (UK)

AIXTRON K.K. (Japan)

AIXTRON Korea Co., Ltd.

AIXTRON Taiwan Co., Ltd. (Main Office)

AIXTRON Inc. (USA)

Christoph Pütz

Senior Manager ESG & Sustainability

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Ralf Penner

Senior IR Manager

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Prof. Dr. Michael Heuken

Vice President Advanced Technologies