- / HOME

The AIXTRON share is listed in the Prime Standard of the Frankfurt Stock Exchange as well as in the MDAX and TecDAX. In Deutsche Börse’s MDAX ranking, which includes a total of 50 stocks, it was ranked 9th in terms of market capitalization as of December 31, 2023 (2022: 15th place). Among the 30 TecDAX members, the share continued to mark an 8th place (2022: 8th place).

In addition to the traditional trading platforms such as XETRA and the German regional stock exchanges, trading in AIXTRON shares also takes place to a significant extent on alternative trading platforms such as Tradegate or Chi-X.

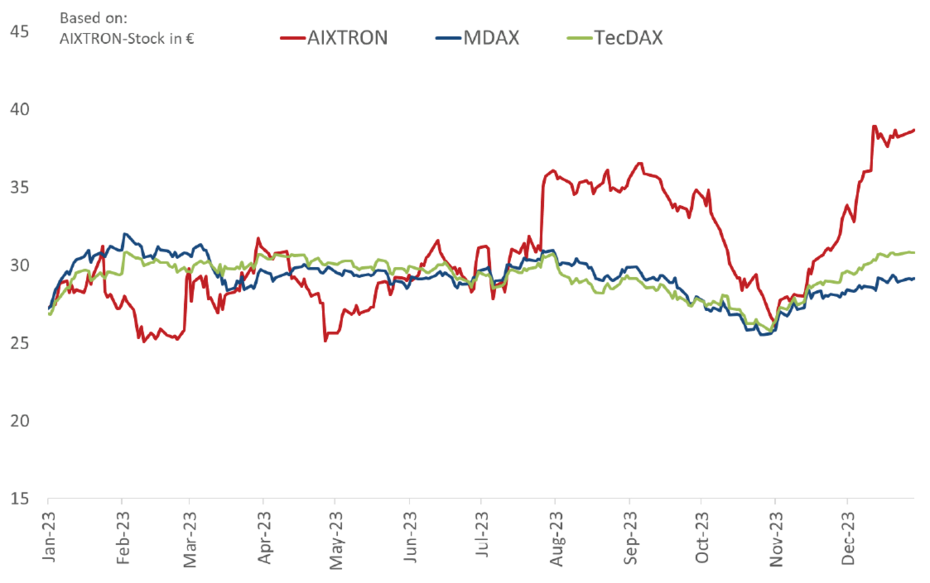

After a positive start to the 2023 stock market year, the upward movement of the AIXTRON share ended at the end of January and the subsequent downward movement was reinforced by interest rate increases by the central banks. The short-term profit- taking caused the share price to fall to an annual low of EUR 25.08. The publication of the 2022 annual results and the positive outlook for 2023 led to an upward movement in the share price until the end of March. Lower deliveries due to timing effects and the impact on the results of the first quarter led to an abrupt downward trend at the end of April. The share price then rose significantly again until the end of June.

The announcement of further operational successes, particularly with the new G10-SiC system in the market for SiC power electronics, the very good results for the second quarter of 2023, the increase in the outlook for 2023 and positive studies from renowned analyst firms supported this positive development. Doubts about the dynamics of demand from the SiC sector led to a brief price decline at the beginning of the fourth quarter. After the release of the third quarter results and the confirmation of the annual forecast for 2023, the stock showed a sharp increase. This was further reinforced by the extensive positive reporting from a renowned analyst firm in December with a focus on gallium nitride as a long-term business driver and resulted in a multi-year high of EUR 39.49.

Despite the slight sell-off at the end of the year, the AIXTRON share clearly outperformed the comparative indices in the 2023 stock market year with an increase of 39% at a XETRA closing price of EUR 38.60 as of December 29th. The market capitalization at the end of the year was EUR 4,384 million (year-end 2022: EUR 3,057 million). The comparative indices MDAX and TecDAX rose significantly more moderately over the course of 2023 by 6.5% to 27,137 points and 14.8% to 3,337 points, respectively.

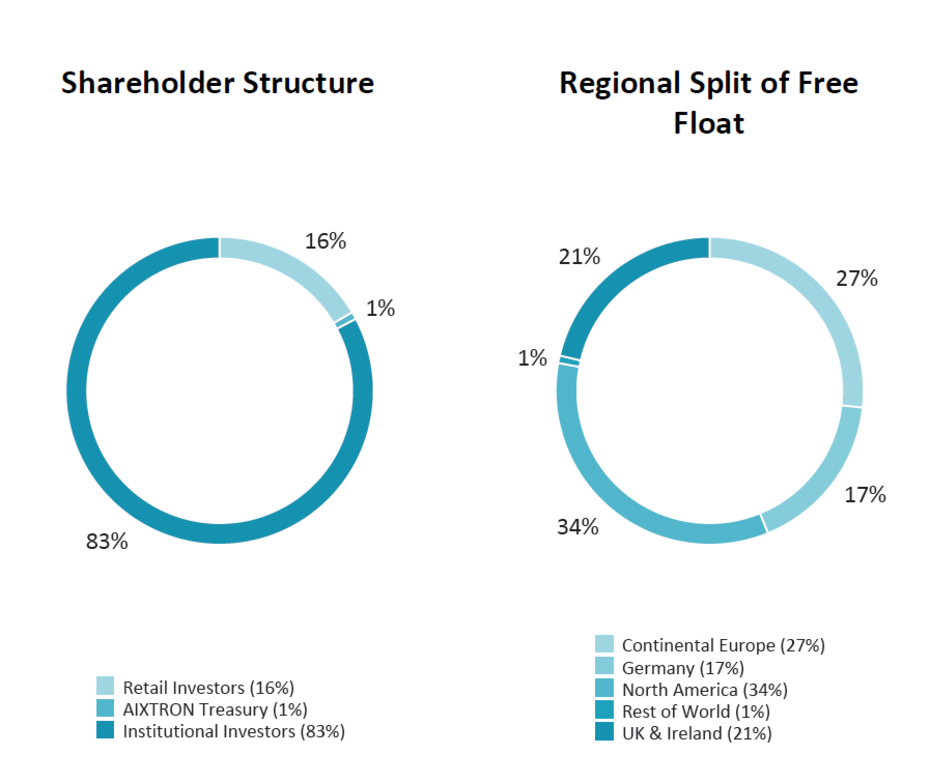

As of December 31, 2023, around 16% of AIXTRON shares were owned by private individuals (2022: 18%), most of whom are based in Germany. Around 83% of the outstanding AIXTRON shares were in the hands of institutional investors (2022: 82%). The majority of institutional investors are based in North America (34%), followed by Great Britain and Ireland (21%) and Germany (17%). The remaining investors come from other parts of Europe and the rest of the world.

At the end of 2023, the four largest shareholders each held more than 3% of AIXTRON shares in their portfolios. According to the most recently received voting rights notifications, Blackrock, Inc. was at 5.7%, Bank of America Corp. at 4.8%, Norges Bank at 4.3% and Perpetual Limited at 3.6%. According to the definition of the German stock exchange, 99% of the shares were in free float and around 1% of the AIXTRON shares were held by the company itself.

All voting rights notifications made in 2023 and thereafter in accordance with sections 33 et seq. of the German Securities Trading Act (WpHG) can be found on our website. Information on reportable holdings that currently exceed or fall below a certain threshold can be found in the appendix to this report.

During the fiscal year of 2023, a total of fifteen international banks and brokers (2022: eleven) published equity research reports about AIXTRON and the development of the semiconductor industry. Barclays, Citi, Equita and Morgan Stanley initiated coverage in 2023. Of the fifteen financial analysts who monitored our shares at the end of 2023, eleven issued a buy recommendation and four recommended holding the AIXTRON share. The average price target at the end of December 2023 was EUR 38.77 (2022: EUR 25.00). At the end of the year, the AIXTRON share was monitored by the following financial analysts (the current status can be found on our website):

| Broker | Analyst | Location |

| Alster Research | Oliver Wojahn | Hamburg |

| Bank of America | Didier Scemama | London |

| Barclays | Simon Coles | London |

| Berenberg | Gustav Froberg | London |

| Citi | Andrew Gardiner | London |

| Deutsche Bank | Michael Kuhn | Frankfurt |

| DZ Bank | Armin Kremser | Frankfurt |

| Equita | Gianmarco Bonacina | Milan |

| Exane BNP Paribas | David O'Connor | San Francisco |

| Jefferies | Olivia Honychurch | London |

| Morgan Stanley | Lee Simpson | London |

| Nomura | Donnie Teng | Hong Kong |

| Oddo BHF | Martin Marandon-Carlhian | Paris |

| Stifel (MainFirst) | Jürgen Wagner | Frankfurt |

| Warburg Research | Malte Schaumann | Hamburg |

Our aim is transparency and openness in a continuous dialogue with our shareholders and participants in the capital market. Our investor relations work is aimed at strengthening trust in AIXTRON in the long term and achieving a fair valuation on the capital market. To this end, we provide our shareholders and the capital market with accurate, timely and relevant information about both the AIXTRON Group's business and our market environment. In addition, AIXTRON is committed to adhering to the principles of good corporate governance.

In individual or group discussions at investor roadshows and conferences, our management and investor relations team answered investors and financial analysts' questions about the AIXTRON Group's business strategy and development as well as industry and market trends. With almost 440 meetings (2022: 400) with 520 financial market participants, the exchange was significantly intensified in 2023.

The virtual Annual General Meeting of AIXTRON SE took place on May 17, 2023. Around 67% of the share capital was represented. The Executive Board explained the results of the 2022 fiscal year and the first quarter of 2023 as well as the operational highlights and technologies of the AIXTRON Group. Together with the Chairman of the Supervisory Board, the Executive Board answered the shareholders’ questions in detail. For the 2022 fiscal year, AIXTRON increased the dividend payment to shareholders to EUR 0.31 per share (2021: EUR 0.30 per share). This corresponded to a payout of EUR 34.8 million.

In the light of the strong operational and financial development in 2023, the company's strong financial position and the management's confidence in the long-term growth prospects, the Executive Board and Supervisory Board of AIXTRON SE will propose a dividend of EUR 0.40 per dividend-entitled share to the Annual General Meeting on May 15, 2024 (2023: EUR 0.31 per share). The total payout of EUR 45.0 million (2023: EUR 34.8 million) corresponds to a payout ratio of around 31% of AIXTRON's consolidated net income for the year (2022: around 35%), based on the number of shares outstanding as of December 31, 2023.

Alan Tai

Taiwan/Singapore

Christof Sommerhalter

USA

Christian Geng

Europe

Hisatoshi Hagiwara

Japan

Nam Kyu Lee

South Korea

Wei (William) Song

China

AIXTRON SE (Headquarters)

AIXTRON 24/7 Technical Support Line

AIXTRON Europe

AIXTRON Ltd (UK)

AIXTRON K.K. (Japan)

AIXTRON Korea Co., Ltd.

AIXTRON Taiwan Co., Ltd. (Main Office)

AIXTRON Inc. (USA)

Christoph Pütz

Senior Manager ESG & Sustainability

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Ralf Penner

Senior IR Manager

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Prof. Dr. Michael Heuken

Vice President Advanced Technologies